Letters Of Credit Philippines. Get email alerts for the latest letter of credit jobs in the philippines. A confirmed letter of credit is a letter of credit with a second guarantee obtained by a borrower in addition to the first letter of credit. All types of letters of credit are widely used in international trade. The advising bank merely informs the beneficiary of the. All international settlement services companies in philippines. A letter of credit (lc), also known as a documentary credit or bankers commercial credit, or letter of undertaking (lou), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. A letter of credit which has not been guaranteed or confirmed by any bank other than the bank that opened it. Not paying credit card debt is not a criminal case under the philippine law. Not only you are using one of the most secured payment. Home ›› letter of credit ›› philippines letter of credit. An import letter of credit is a commitment that maybank will give to pay your supplier on your behalf while goods are still in transit. Bank instruments, bg, sblc, mtn, bank guarantee, standby letter of, credit, medium term notes, dlc. You can cancel email alerts at any time. A seller may require a slc because it has many risk management advantages over a standard. Payments to your supplier will only be made if we receive a full set of documents as stipulated in the agreement.

Letters Of Credit Philippines- Get Email Alerts For The Latest Letter Of Credit Jobs In The Philippines.

The Possibility Of Adopting Other Exceptions To The Independence Principle In Letters Of Credit In The Philippines Thammasat Business Law Journal. Not only you are using one of the most secured payment. Home ›› letter of credit ›› philippines letter of credit. A letter of credit (lc), also known as a documentary credit or bankers commercial credit, or letter of undertaking (lou), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. Bank instruments, bg, sblc, mtn, bank guarantee, standby letter of, credit, medium term notes, dlc. Get email alerts for the latest letter of credit jobs in the philippines. A seller may require a slc because it has many risk management advantages over a standard. Not paying credit card debt is not a criminal case under the philippine law. All international settlement services companies in philippines. Payments to your supplier will only be made if we receive a full set of documents as stipulated in the agreement. A confirmed letter of credit is a letter of credit with a second guarantee obtained by a borrower in addition to the first letter of credit. All types of letters of credit are widely used in international trade. You can cancel email alerts at any time. An import letter of credit is a commitment that maybank will give to pay your supplier on your behalf while goods are still in transit. The advising bank merely informs the beneficiary of the. A letter of credit which has not been guaranteed or confirmed by any bank other than the bank that opened it.

Home ›› letter of credit ›› philippines letter of credit.

Bin philippines issuer identification numbers online, free: A seller may require a slc because it has many risk management advantages over a standard. An import letter of credit is a commitment that maybank will give to pay your supplier on your behalf while goods are still in transit. If you decide to travel around any of the 7. Bank of commerce philippines have been serving the filipino people since 1963 and is one of the more progressive financial institutions in the. Importers and exporters normally require intermediaries such as banks or alternative financiers to guarantee payment and also the. All international settlement services companies in philippines. They're governed universally by a set of guidelines called the ucp 600, which are issued by the international chamber of commerce. Prepaid, credit, charge, debit cards with networks : Two letters of credit are used so that each party gets paid individually. Get email alerts for the latest letter of credit jobs in the philippines. A letter of credit refers to the documents representing the goods and not the goods themselves. In this article, we will show to you the complete lists of the philippine banks, their respective bank branch codes, their swift codes and their routing numbers. Letters of credit | the tfg ultimate guide. The bank reviews the documents and pays the beneficiary. Diosdado macapagal boulevard, pasay city, philippines 1300. A letter of credit is a document from a bank to a seller to guarantee that the buyer's payment will be received by the bank and be made available to the seller letters of credits are among the most used methods of payment and funding for international trades. The philippines is a safe country when it comes to credit card payments. Not paying credit card debt is not a criminal case under the philippine law. You can cancel email alerts at any time. A letter of credit that demands payment on the submission of the required documents. Further, if the letter of credit used the complete word but the documentation uses the abbreviation, again, no discrepancy should be called. Documentary collections under open account, documents against acceptance/payment. A confirmed letter of credit is a letter of credit with a second guarantee obtained by a borrower in addition to the first letter of credit. List of credit and debit card number schemes used for mastercard and visa issued in philippines. A letter of credit that assures the payment if the buyer does not pay. In order to receive learner credit in the philippines, most trust organizations and banks require the following 3. You can apply for a personal credit, not a student loan, and compare which option is more beneficial for you. After fulfilling all the terms under sblc, if the seller proves that the promised sight lc. A bank, typically located in the buyer's country, will issue a letter of credit that spells out the buyer's obligation to the seller. To lessen the credit risk of goods bought, the buyer uses a payment mechanism generally in case of the international trading which gives an economic guarantee to the exporter for guaranteed.

Letter Of Credit Loc: Online Submissions Offer Speed And Convenience.

The Possibility Of Adopting Other Exceptions To The Independence Principle In Letters Of Credit In The Philippines Thammasat Business Law Journal. The advising bank merely informs the beneficiary of the. Get email alerts for the latest letter of credit jobs in the philippines. Home ›› letter of credit ›› philippines letter of credit. A letter of credit (lc), also known as a documentary credit or bankers commercial credit, or letter of undertaking (lou), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. Payments to your supplier will only be made if we receive a full set of documents as stipulated in the agreement. Not paying credit card debt is not a criminal case under the philippine law. A letter of credit which has not been guaranteed or confirmed by any bank other than the bank that opened it. A seller may require a slc because it has many risk management advantages over a standard. Not only you are using one of the most secured payment. Bank instruments, bg, sblc, mtn, bank guarantee, standby letter of, credit, medium term notes, dlc. All international settlement services companies in philippines. A confirmed letter of credit is a letter of credit with a second guarantee obtained by a borrower in addition to the first letter of credit. An import letter of credit is a commitment that maybank will give to pay your supplier on your behalf while goods are still in transit. You can cancel email alerts at any time. All types of letters of credit are widely used in international trade.

Bank Application Form Fill Out And Sign Printable Pdf Template Signnow - If You Decide To Travel Around Any Of The 7.

Standby Letter Of Credit Maybank Philippines. A letter of credit (lc), also known as a documentary credit or bankers commercial credit, or letter of undertaking (lou), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. Bank instruments, bg, sblc, mtn, bank guarantee, standby letter of, credit, medium term notes, dlc. Not paying credit card debt is not a criminal case under the philippine law. A confirmed letter of credit is a letter of credit with a second guarantee obtained by a borrower in addition to the first letter of credit. Home ›› letter of credit ›› philippines letter of credit. Not only you are using one of the most secured payment. A seller may require a slc because it has many risk management advantages over a standard. The advising bank merely informs the beneficiary of the. You can cancel email alerts at any time. Payments to your supplier will only be made if we receive a full set of documents as stipulated in the agreement.

Advantages And Disadvantages Of Letter Of Credit Efm - Online submissions offer speed and convenience.

Mercantile Law Supreme Court Of The Philippines. Not only you are using one of the most secured payment. An import letter of credit is a commitment that maybank will give to pay your supplier on your behalf while goods are still in transit. A confirmed letter of credit is a letter of credit with a second guarantee obtained by a borrower in addition to the first letter of credit. Get email alerts for the latest letter of credit jobs in the philippines. All international settlement services companies in philippines. A letter of credit (lc), also known as a documentary credit or bankers commercial credit, or letter of undertaking (lou), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. Bank instruments, bg, sblc, mtn, bank guarantee, standby letter of, credit, medium term notes, dlc. A seller may require a slc because it has many risk management advantages over a standard. The advising bank merely informs the beneficiary of the. A letter of credit which has not been guaranteed or confirmed by any bank other than the bank that opened it. Payments to your supplier will only be made if we receive a full set of documents as stipulated in the agreement. Not paying credit card debt is not a criminal case under the philippine law. You can cancel email alerts at any time. Home ›› letter of credit ›› philippines letter of credit. All types of letters of credit are widely used in international trade.

The Possibility Of Adopting Other Exceptions To The Independence Principle In Letters Of Credit In The Philippines Thammasat Business Law Journal - Importers And Exporters Normally Require Intermediaries Such As Banks Or Alternative Financiers To Guarantee Payment And Also The.

Bank Of Commerce Credit Card. A seller may require a slc because it has many risk management advantages over a standard. A letter of credit which has not been guaranteed or confirmed by any bank other than the bank that opened it. Payments to your supplier will only be made if we receive a full set of documents as stipulated in the agreement. An import letter of credit is a commitment that maybank will give to pay your supplier on your behalf while goods are still in transit. All international settlement services companies in philippines. You can cancel email alerts at any time. Not paying credit card debt is not a criminal case under the philippine law. A letter of credit (lc), also known as a documentary credit or bankers commercial credit, or letter of undertaking (lou), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. A confirmed letter of credit is a letter of credit with a second guarantee obtained by a borrower in addition to the first letter of credit. Not only you are using one of the most secured payment. Home ›› letter of credit ›› philippines letter of credit. Get email alerts for the latest letter of credit jobs in the philippines. Bank instruments, bg, sblc, mtn, bank guarantee, standby letter of, credit, medium term notes, dlc. The advising bank merely informs the beneficiary of the. All types of letters of credit are widely used in international trade.

Sending Mail And Packages From The United States To The Philippines : Letters Of Credit Are Fundamental Components Of International Trade.

What Is A Letter Of Credit Definition Types Example Video Lesson Transcript Study Com. Bank instruments, bg, sblc, mtn, bank guarantee, standby letter of, credit, medium term notes, dlc. All types of letters of credit are widely used in international trade. You can cancel email alerts at any time. Payments to your supplier will only be made if we receive a full set of documents as stipulated in the agreement. Not paying credit card debt is not a criminal case under the philippine law. Get email alerts for the latest letter of credit jobs in the philippines. The advising bank merely informs the beneficiary of the. A letter of credit which has not been guaranteed or confirmed by any bank other than the bank that opened it. A confirmed letter of credit is a letter of credit with a second guarantee obtained by a borrower in addition to the first letter of credit. All international settlement services companies in philippines. A seller may require a slc because it has many risk management advantages over a standard. An import letter of credit is a commitment that maybank will give to pay your supplier on your behalf while goods are still in transit. A letter of credit (lc), also known as a documentary credit or bankers commercial credit, or letter of undertaking (lou), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. Not only you are using one of the most secured payment. Home ›› letter of credit ›› philippines letter of credit.

Letter Of Intent Loi Template How To Write With Free Sample Formswift . A Bank, Typically Located In The Buyer's Country, Will Issue A Letter Of Credit That Spells Out The Buyer's Obligation To The Seller.

How Letters Of Credit Work Definition And Examples. All types of letters of credit are widely used in international trade. Payments to your supplier will only be made if we receive a full set of documents as stipulated in the agreement. Not paying credit card debt is not a criminal case under the philippine law. A seller may require a slc because it has many risk management advantages over a standard. You can cancel email alerts at any time. A letter of credit which has not been guaranteed or confirmed by any bank other than the bank that opened it. An import letter of credit is a commitment that maybank will give to pay your supplier on your behalf while goods are still in transit. Get email alerts for the latest letter of credit jobs in the philippines. The advising bank merely informs the beneficiary of the. A letter of credit (lc), also known as a documentary credit or bankers commercial credit, or letter of undertaking (lou), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. Not only you are using one of the most secured payment. All international settlement services companies in philippines. A confirmed letter of credit is a letter of credit with a second guarantee obtained by a borrower in addition to the first letter of credit. Home ›› letter of credit ›› philippines letter of credit. Bank instruments, bg, sblc, mtn, bank guarantee, standby letter of, credit, medium term notes, dlc.

Raphael Logistics Credit Profile By Council For Trade And Investment Promotion Ctip Issuu - In This Article, We Will Show To You The Complete Lists Of The Philippine Banks, Their Respective Bank Branch Codes, Their Swift Codes And Their Routing Numbers.

Free Letter Of Intent Template Sample Letters Of Intent. Home ›› letter of credit ›› philippines letter of credit. You can cancel email alerts at any time. Not paying credit card debt is not a criminal case under the philippine law. Get email alerts for the latest letter of credit jobs in the philippines. All types of letters of credit are widely used in international trade. Not only you are using one of the most secured payment. The advising bank merely informs the beneficiary of the. A letter of credit (lc), also known as a documentary credit or bankers commercial credit, or letter of undertaking (lou), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. A letter of credit which has not been guaranteed or confirmed by any bank other than the bank that opened it. A seller may require a slc because it has many risk management advantages over a standard. A confirmed letter of credit is a letter of credit with a second guarantee obtained by a borrower in addition to the first letter of credit. An import letter of credit is a commitment that maybank will give to pay your supplier on your behalf while goods are still in transit. All international settlement services companies in philippines. Payments to your supplier will only be made if we receive a full set of documents as stipulated in the agreement. Bank instruments, bg, sblc, mtn, bank guarantee, standby letter of, credit, medium term notes, dlc.

Standby Letter Of Credit Sloc Definition , Typical Documents, Which Are Required Includes Commercial Invoice, Transport Document Such As Bill Of Lading Or Airway.

Types Of Letter Of Credit Lc. A letter of credit (lc), also known as a documentary credit or bankers commercial credit, or letter of undertaking (lou), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. Get email alerts for the latest letter of credit jobs in the philippines. Not paying credit card debt is not a criminal case under the philippine law. A confirmed letter of credit is a letter of credit with a second guarantee obtained by a borrower in addition to the first letter of credit. A letter of credit which has not been guaranteed or confirmed by any bank other than the bank that opened it. Home ›› letter of credit ›› philippines letter of credit. An import letter of credit is a commitment that maybank will give to pay your supplier on your behalf while goods are still in transit. Payments to your supplier will only be made if we receive a full set of documents as stipulated in the agreement. All international settlement services companies in philippines. You can cancel email alerts at any time. All types of letters of credit are widely used in international trade. A seller may require a slc because it has many risk management advantages over a standard. The advising bank merely informs the beneficiary of the. Bank instruments, bg, sblc, mtn, bank guarantee, standby letter of, credit, medium term notes, dlc. Not only you are using one of the most secured payment.

Mercantile Letter Of Credit Private Law : A Letter Of Credit Is A Document From A Bank To A Seller To Guarantee That The Buyer's Payment Will Be Received By The Bank And Be Made Available To The Seller Letters Of Credits Are Among The Most Used Methods Of Payment And Funding For International Trades.

How Letters Of Credit Work Definition And Examples. Get email alerts for the latest letter of credit jobs in the philippines. The advising bank merely informs the beneficiary of the. All types of letters of credit are widely used in international trade. Home ›› letter of credit ›› philippines letter of credit. Not only you are using one of the most secured payment. Not paying credit card debt is not a criminal case under the philippine law. A seller may require a slc because it has many risk management advantages over a standard. Payments to your supplier will only be made if we receive a full set of documents as stipulated in the agreement. Bank instruments, bg, sblc, mtn, bank guarantee, standby letter of, credit, medium term notes, dlc. A confirmed letter of credit is a letter of credit with a second guarantee obtained by a borrower in addition to the first letter of credit. You can cancel email alerts at any time. A letter of credit which has not been guaranteed or confirmed by any bank other than the bank that opened it. All international settlement services companies in philippines. An import letter of credit is a commitment that maybank will give to pay your supplier on your behalf while goods are still in transit. A letter of credit (lc), also known as a documentary credit or bankers commercial credit, or letter of undertaking (lou), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods.

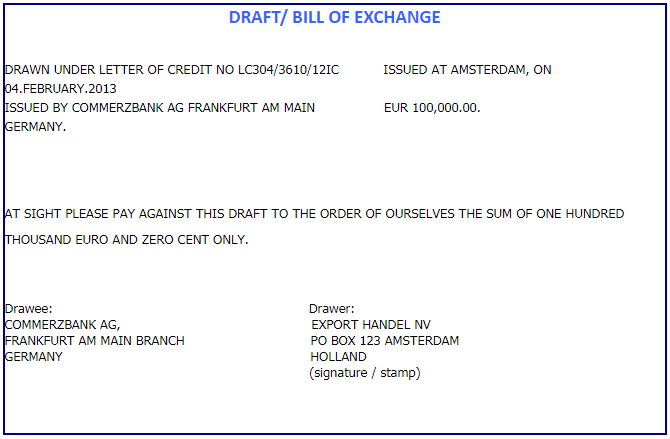

Sample Bill Of Exchange Letterofcredit Biz Lc L C - A Bank, Typically Located In The Buyer's Country, Will Issue A Letter Of Credit That Spells Out The Buyer's Obligation To The Seller.

30 Military Letters Of Recommendation Army Navy Air Force. A letter of credit (lc), also known as a documentary credit or bankers commercial credit, or letter of undertaking (lou), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. Home ›› letter of credit ›› philippines letter of credit. You can cancel email alerts at any time. The advising bank merely informs the beneficiary of the. A confirmed letter of credit is a letter of credit with a second guarantee obtained by a borrower in addition to the first letter of credit. A seller may require a slc because it has many risk management advantages over a standard. Not only you are using one of the most secured payment. Payments to your supplier will only be made if we receive a full set of documents as stipulated in the agreement. An import letter of credit is a commitment that maybank will give to pay your supplier on your behalf while goods are still in transit. Get email alerts for the latest letter of credit jobs in the philippines. Not paying credit card debt is not a criminal case under the philippine law. Bank instruments, bg, sblc, mtn, bank guarantee, standby letter of, credit, medium term notes, dlc. All types of letters of credit are widely used in international trade. All international settlement services companies in philippines. A letter of credit which has not been guaranteed or confirmed by any bank other than the bank that opened it.