Irs Letter 1058. Irs letter 1058 is required by law in order for the irs to collect assessed and unpaid tax liabilities via levy or seizure of property. What kinds of property can the irs levy? The letter tells you why the irs is contacting you and what you need to do. What does it mean when you receive an irs letter 1058? Letters 1058 and lt11 are sent as written notification, required by law, to inform you that the irs intends to seize, or levy, your property, or rights to property. Understanding your lt11 or letter 1058 notice. Property can include wages and other income, bank accounts, business assets, personal. Property can include wages and other income, bank accounts, business assets, personal. What kinds of property can the irs levy? The majority of letter 1058 explains the situation. Understanding your lt11 notice or letter 1058. It is sent by certified mail to the last address on record for a taxpayer. It also provides a look at what happens if you can't pay your tax debt. You have a right to a hearing. This is when you need to call a professional to assist you with you tax debt.

Irs Letter 1058- Understanding Your Lt11 Or Letter 1058 Notice.

Irs Cp504 Notice Of Intent To Levy What You Should Do. You have a right to a hearing. It is sent by certified mail to the last address on record for a taxpayer. Letters 1058 and lt11 are sent as written notification, required by law, to inform you that the irs intends to seize, or levy, your property, or rights to property. The majority of letter 1058 explains the situation. Property can include wages and other income, bank accounts, business assets, personal. It also provides a look at what happens if you can't pay your tax debt. Irs letter 1058 is required by law in order for the irs to collect assessed and unpaid tax liabilities via levy or seizure of property. This is when you need to call a professional to assist you with you tax debt. Understanding your lt11 or letter 1058 notice. Property can include wages and other income, bank accounts, business assets, personal. Understanding your lt11 notice or letter 1058. What kinds of property can the irs levy? What kinds of property can the irs levy? The letter tells you why the irs is contacting you and what you need to do. What does it mean when you receive an irs letter 1058?

If you decide to ignore this notice.

You should contact us or pay your balance due immediately. You only have 30 days to prevent the irs from levying your wages and bank accounts. No further notices are sent. The revenue service of the united states is called the internal revenue service or irs. If you have received notice in the mail, delivered to you, or posted on your property that says your home or your property is subject to foreclosure, in foreclosure. Letter letter 1058 tax advocate tax accountants cp2000 income tax solutions irs levy notice dispute tax lien unfiled tax returns federal tax returns payroll audit charles hammond iii. When you need to respond. We strongly recommend engaging representation if. Irs letter 1058 is required by law in order for the irs to collect assessed and unpaid tax liabilities via levy or seizure of property. Don't panic too much about the letter, most of what if i don't pay or reply to irs letter 1058 / lt 11? If there's no notice number or letter, it's likely that the letter is fraudulent. Internal revenue service deception, propaganda, and trojan horses. The letter lt11 and letter 1058 are issued if you have unpaid balance of tax due to your return filed. Letter 1058 irs letter 1058 is a final notice that the irs intends to levy. You have a balance due (money you owe the irs) on one of your tax accounts. Call a tax professional to solve your tax issues that are mention on irs letter 1058. For instance, the irs sends through certified mail a letter called final notice, notice of intent to levy and notice of your right to a hearing (the irs usually calls this the cp90 or 1058 letter). Enforcement action may be taken to collect that balance due 30 days after the date of this letter. Watch this video to learn more about it. The equivalent of this letter in automated the irs filed in a county courthouse to put a lien on any real estate for which you appear in the title. The letter lets a taxpayer know that the irs intends to levy against your the taxpayer's assets. What does it mean when you receive an irs letter 1058? Did you receive an irs letter or notice? What kinds of property can the irs levy? Letter 1058 is similar in nature to notices cp90 and cp504. Final notice prior to levy; Property can include wages and other income, bank accounts, business assets, personal. An irs penalty response letter is a document used to file a request with the irs that a penalty levied against a taxpayer, either an individual or a irs penalty response letter. Letters 1058 and lt11 are sent as written notification, required by law, to inform you that the irs intends to seize, or levy, your property, or rights to property. The state of colorado will follow the. It is sent by certified mail to the last address on record for a taxpayer.

5 14 1 Securing Installment Agreements Internal Revenue Service- Call A Tax Professional To Solve Your Tax Issues That Are Mention On Irs Letter 1058.

Irs Letter 1058 Final Notice Of Intent To Levy Reliance Tax Group Broomfield Co. This is when you need to call a professional to assist you with you tax debt. Property can include wages and other income, bank accounts, business assets, personal. Irs letter 1058 is required by law in order for the irs to collect assessed and unpaid tax liabilities via levy or seizure of property. You have a right to a hearing. What kinds of property can the irs levy? The letter tells you why the irs is contacting you and what you need to do. Property can include wages and other income, bank accounts, business assets, personal. Letters 1058 and lt11 are sent as written notification, required by law, to inform you that the irs intends to seize, or levy, your property, or rights to property. The majority of letter 1058 explains the situation. What does it mean when you receive an irs letter 1058? What kinds of property can the irs levy? Understanding your lt11 notice or letter 1058. It is sent by certified mail to the last address on record for a taxpayer. Understanding your lt11 or letter 1058 notice. It also provides a look at what happens if you can't pay your tax debt.

Irs Bank Levy About California Tax Levy Laws Procedure - It Is Sent By Certified Mail To The Last Address On Record For A Taxpayer.

Irs Tax Letters Explained Landmark Tax Group. The majority of letter 1058 explains the situation. Irs letter 1058 is required by law in order for the irs to collect assessed and unpaid tax liabilities via levy or seizure of property. What kinds of property can the irs levy? You have a right to a hearing. What does it mean when you receive an irs letter 1058? Understanding your lt11 notice or letter 1058. Understanding your lt11 or letter 1058 notice. Letters 1058 and lt11 are sent as written notification, required by law, to inform you that the irs intends to seize, or levy, your property, or rights to property. This is when you need to call a professional to assist you with you tax debt. It also provides a look at what happens if you can't pay your tax debt.

Irs Mass Dor Assistance - It is sent by certified mail to the last address on record for a taxpayer.

Irs Notices Irs Letters Irs Forms. What kinds of property can the irs levy? What does it mean when you receive an irs letter 1058? The majority of letter 1058 explains the situation. What kinds of property can the irs levy? The letter tells you why the irs is contacting you and what you need to do. Letters 1058 and lt11 are sent as written notification, required by law, to inform you that the irs intends to seize, or levy, your property, or rights to property. This is when you need to call a professional to assist you with you tax debt. Understanding your lt11 notice or letter 1058. Property can include wages and other income, bank accounts, business assets, personal. It also provides a look at what happens if you can't pay your tax debt. You have a right to a hearing. It is sent by certified mail to the last address on record for a taxpayer. Irs letter 1058 is required by law in order for the irs to collect assessed and unpaid tax liabilities via levy or seizure of property. Understanding your lt11 or letter 1058 notice. Property can include wages and other income, bank accounts, business assets, personal.

Irs Mass Dor Assistance . It Also Provides A Look At What Happens If You Can't Pay Your Tax Debt.

Irs Audit Letter 566 Cg Sample 3. Understanding your lt11 or letter 1058 notice. What kinds of property can the irs levy? Property can include wages and other income, bank accounts, business assets, personal. Irs letter 1058 is required by law in order for the irs to collect assessed and unpaid tax liabilities via levy or seizure of property. This is when you need to call a professional to assist you with you tax debt. It is sent by certified mail to the last address on record for a taxpayer. Letters 1058 and lt11 are sent as written notification, required by law, to inform you that the irs intends to seize, or levy, your property, or rights to property. Property can include wages and other income, bank accounts, business assets, personal. The majority of letter 1058 explains the situation. It also provides a look at what happens if you can't pay your tax debt. You have a right to a hearing. Understanding your lt11 notice or letter 1058. The letter tells you why the irs is contacting you and what you need to do. What kinds of property can the irs levy? What does it mean when you receive an irs letter 1058?

Irs Form 8857 How To File - You Have A Balance Due (Money You Owe The Irs) On One Of Your Tax Accounts.

Irs Form Cp504b Letter Get Irs Help Now Tampa Tax Attorney Darrin T Mish. What kinds of property can the irs levy? The majority of letter 1058 explains the situation. It is sent by certified mail to the last address on record for a taxpayer. Property can include wages and other income, bank accounts, business assets, personal. Irs letter 1058 is required by law in order for the irs to collect assessed and unpaid tax liabilities via levy or seizure of property. Understanding your lt11 or letter 1058 notice. You have a right to a hearing. Letters 1058 and lt11 are sent as written notification, required by law, to inform you that the irs intends to seize, or levy, your property, or rights to property. What does it mean when you receive an irs letter 1058? Understanding your lt11 notice or letter 1058. This is when you need to call a professional to assist you with you tax debt. It also provides a look at what happens if you can't pay your tax debt. Property can include wages and other income, bank accounts, business assets, personal. What kinds of property can the irs levy? The letter tells you why the irs is contacting you and what you need to do.

Irs Notice Cp71a Annual Balance Due Reminder Notice H R Block : Letters 1058 And Lt11 Are Sent As Written Notification, Required By Law, To Inform You That The Irs Intends To Seize, Or Levy, Your Property, Or Rights To Property.

Irs Notices Colonial Tax Consultants. Understanding your lt11 or letter 1058 notice. The letter tells you why the irs is contacting you and what you need to do. Understanding your lt11 notice or letter 1058. You have a right to a hearing. Letters 1058 and lt11 are sent as written notification, required by law, to inform you that the irs intends to seize, or levy, your property, or rights to property. Property can include wages and other income, bank accounts, business assets, personal. What kinds of property can the irs levy? Property can include wages and other income, bank accounts, business assets, personal. What kinds of property can the irs levy? It is sent by certified mail to the last address on record for a taxpayer. Irs letter 1058 is required by law in order for the irs to collect assessed and unpaid tax liabilities via levy or seizure of property. It also provides a look at what happens if you can't pay your tax debt. What does it mean when you receive an irs letter 1058? The majority of letter 1058 explains the situation. This is when you need to call a professional to assist you with you tax debt.

Lt11 Or Letter 1058 Understanding Final Notice Of Intent To Levy . If You Decide To Ignore This Notice.

Irs Notice Letter 1058 Understanding Irs Letter 1058 Final Notice Of Intent To Levy Immediate Response Required. You have a right to a hearing. It also provides a look at what happens if you can't pay your tax debt. Irs letter 1058 is required by law in order for the irs to collect assessed and unpaid tax liabilities via levy or seizure of property. Letters 1058 and lt11 are sent as written notification, required by law, to inform you that the irs intends to seize, or levy, your property, or rights to property. Property can include wages and other income, bank accounts, business assets, personal. This is when you need to call a professional to assist you with you tax debt. Understanding your lt11 or letter 1058 notice. The letter tells you why the irs is contacting you and what you need to do. It is sent by certified mail to the last address on record for a taxpayer. What kinds of property can the irs levy? What kinds of property can the irs levy? Understanding your lt11 notice or letter 1058. The majority of letter 1058 explains the situation. Property can include wages and other income, bank accounts, business assets, personal. What does it mean when you receive an irs letter 1058?

Irs Mass Dor Assistance . When You Need To Respond.

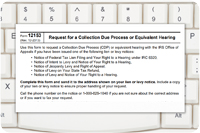

Ex Letter 1058 Lt11 Irs Solutions. Property can include wages and other income, bank accounts, business assets, personal. Property can include wages and other income, bank accounts, business assets, personal. Understanding your lt11 notice or letter 1058. You have a right to a hearing. Understanding your lt11 or letter 1058 notice. The majority of letter 1058 explains the situation. What kinds of property can the irs levy? What kinds of property can the irs levy? It also provides a look at what happens if you can't pay your tax debt. This is when you need to call a professional to assist you with you tax debt. Irs letter 1058 is required by law in order for the irs to collect assessed and unpaid tax liabilities via levy or seizure of property. The letter tells you why the irs is contacting you and what you need to do. Letters 1058 and lt11 are sent as written notification, required by law, to inform you that the irs intends to seize, or levy, your property, or rights to property. It is sent by certified mail to the last address on record for a taxpayer. What does it mean when you receive an irs letter 1058?

Irs Letter 1058 Can I Sell My House With A Tax Lien Sell Property For Cash Even If You Owe Delinquent Property Taxes - Internal Revenue Service Deception, Propaganda, And Trojan Horses.

Lt11 Or Letter 1058 Understanding Final Notice Of Intent To Levy. Letters 1058 and lt11 are sent as written notification, required by law, to inform you that the irs intends to seize, or levy, your property, or rights to property. It also provides a look at what happens if you can't pay your tax debt. It is sent by certified mail to the last address on record for a taxpayer. The majority of letter 1058 explains the situation. What kinds of property can the irs levy? What kinds of property can the irs levy? Understanding your lt11 notice or letter 1058. Property can include wages and other income, bank accounts, business assets, personal. The letter tells you why the irs is contacting you and what you need to do. What does it mean when you receive an irs letter 1058? Property can include wages and other income, bank accounts, business assets, personal. You have a right to a hearing. Irs letter 1058 is required by law in order for the irs to collect assessed and unpaid tax liabilities via levy or seizure of property. Understanding your lt11 or letter 1058 notice. This is when you need to call a professional to assist you with you tax debt.

Tax Levy Tax Levy Letter , This Is When You Need To Call A Professional To Assist You With You Tax Debt.

5 1 12 Cases Requiring Special Handling Internal Revenue Service. This is when you need to call a professional to assist you with you tax debt. Property can include wages and other income, bank accounts, business assets, personal. You have a right to a hearing. The letter tells you why the irs is contacting you and what you need to do. Property can include wages and other income, bank accounts, business assets, personal. It is sent by certified mail to the last address on record for a taxpayer. Understanding your lt11 notice or letter 1058. It also provides a look at what happens if you can't pay your tax debt. Letters 1058 and lt11 are sent as written notification, required by law, to inform you that the irs intends to seize, or levy, your property, or rights to property. What kinds of property can the irs levy? What kinds of property can the irs levy? Irs letter 1058 is required by law in order for the irs to collect assessed and unpaid tax liabilities via levy or seizure of property. Understanding your lt11 or letter 1058 notice. What does it mean when you receive an irs letter 1058? The majority of letter 1058 explains the situation.