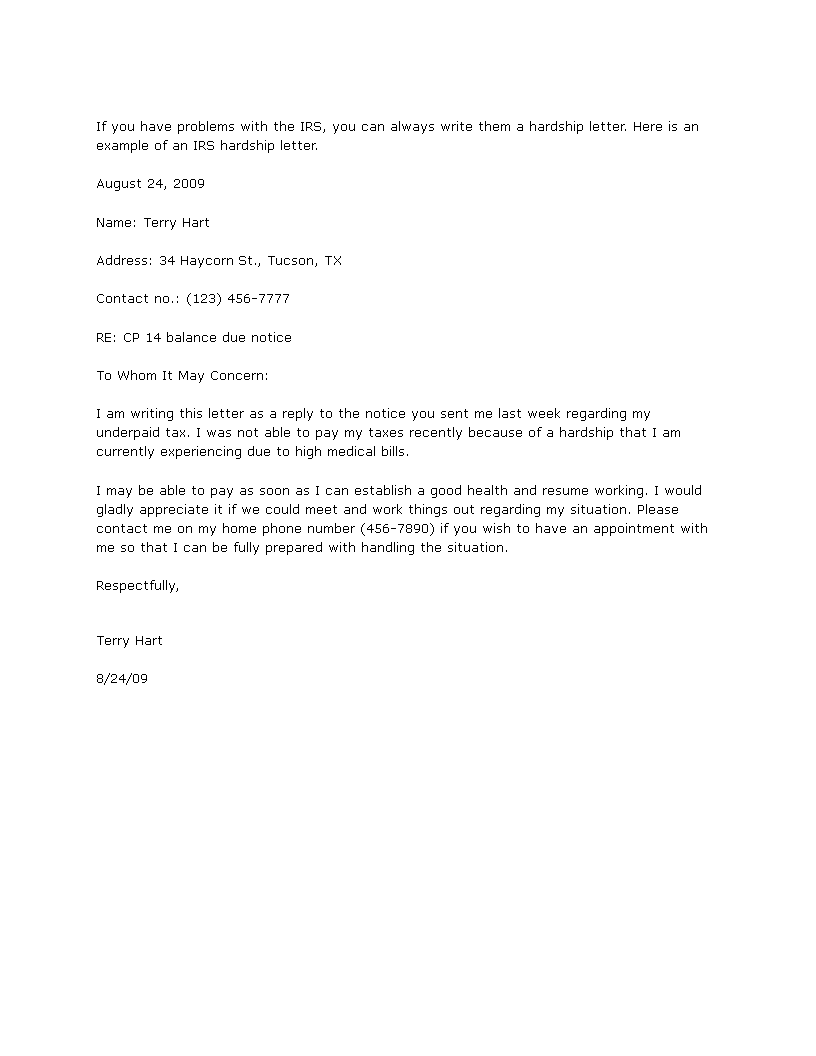

Irs Hardship Letter. If you have problems with the irs, you can always write them a hardship letter. Each notice or letter contains a lot of valuable information, so it's very important that you read it carefully. The irs sends notices and letters for the following reasons: If they deem it necessary, they may delay account collection for checklist for writing a hardship letter to the irs. The internal revenue service (irs) may, at times, look at a taxpayer's debt ratio. We have tips on writing hardship letters as well as example letters, including hardship letter templates. agent name or collection compliance unit irs location address. Every year the irs will mail you a reminder letter regarding taxes owed. Irs hardship letter example, format, template and writing guide. You have a balance due. Get hardship letter examples for your situation. 285 hardship letter templates you can download and print for free. Irs hardship is for taxpayers not able to pay their back taxes. The internal revenue service sometimes assesses a taxpayer's debt ratio and affords him or her so what should you include in this hardship letter to the irs? The following tips will help you draft.

Irs Hardship Letter: We Support You And Your Company By Providing This Irs Hardship Letter Template, Which Will Save Your Time, Cost And Efforts And Help You To Reach.

Sample Hardship Letter Short Sale Download Printable Pdf Templateroller. Get hardship letter examples for your situation. Every year the irs will mail you a reminder letter regarding taxes owed. The internal revenue service sometimes assesses a taxpayer's debt ratio and affords him or her so what should you include in this hardship letter to the irs? You have a balance due. We have tips on writing hardship letters as well as example letters, including hardship letter templates. Irs hardship is for taxpayers not able to pay their back taxes. 285 hardship letter templates you can download and print for free. If you have problems with the irs, you can always write them a hardship letter. The irs sends notices and letters for the following reasons: agent name or collection compliance unit irs location address. Irs hardship letter example, format, template and writing guide. The internal revenue service (irs) may, at times, look at a taxpayer's debt ratio. Each notice or letter contains a lot of valuable information, so it's very important that you read it carefully. If they deem it necessary, they may delay account collection for checklist for writing a hardship letter to the irs. The following tips will help you draft.

Get hardship letter examples for your situation.

These letters are very commonly used when people. Refrain from criticizing the bank, stating that relatives will loan the money. This kind of letters is sent when the business is in loss or isn't able to come back to normal level of productivity. If you have problems with the irs, you can always write them a hardship letter. Irs hardship letter example, format, template and writing guide. How to file for irs hardship and be temporarily declared uncollectible. The revenue service of the united states is called the internal revenue service or irs. Don't panic too much about the we encourage you to call us for a free tax analysis to give you guidance as you may need services. Suffering from an injury, losing a key source of income. I am trying to get forgiveness for my debt or part of it. There are various situations in. In a nutshell, don't use the letter as an outlet for anger, bargaining, or to make a political impression. Easily construct your hardship letters starting with this hardship letter pdf template by jotform! We have tips on writing hardship letters as well as example letters, including hardship letter templates. Internal revenue service of the united states of america. Every year the irs will mail you a reminder letter regarding taxes owed. Having the heat of the irs on your back is never a fun experience. Use our sample medical hardship letter as a template for your sending a medical hardship letter is the way to start the process of reducing medical bills. Irs hardship is for taxpayers not able to pay their back taxes. Get hardship letter examples for your situation. How do you write a hardship letter to the irs? The internal revenue service sometimes assesses a taxpayer's debt ratio and affords him or her so what should you include in this hardship letter to the irs? The following tips will help you draft. In 2008, a homeowner named dan bailey got a lot of publicity for writing a hardship letter to countrywide's chairman, angelo mozilo, trying to induce the lender to approve a loan modification. If they deem it necessary, they may delay account collection for checklist for writing a hardship letter to the irs. We support you and your company by providing this irs hardship letter template, which will save your time, cost and efforts and help you to reach. For this reason, you end up needing multiple, lengthy treatments, and. Writing a financial hardship letter sample. Irs hardship letter for taxes if you are unable to make your tax payment to the irs, you should consider writing a letter of hardship requesting some form of relief (delayed or reduced payment). There is no form for hardship, when you submit your offer in compromise, you indicate your liabilities, your obligations. Fill, sign and send anytime, anywhere, from any device with pdffiller.

Appealing To The Irs Robert E Mckenzie Tax Attorney. 3 How To Write A Hardship Letter.

Irs Audit Letter 2202 Understanding Irs Audit Letter 2202 Field Audit Notice. Irs hardship is for taxpayers not able to pay their back taxes. If you have problems with the irs, you can always write them a hardship letter. agent name or collection compliance unit irs location address. The internal revenue service sometimes assesses a taxpayer's debt ratio and affords him or her so what should you include in this hardship letter to the irs? The irs sends notices and letters for the following reasons: Each notice or letter contains a lot of valuable information, so it's very important that you read it carefully. Get hardship letter examples for your situation. Irs hardship letter example, format, template and writing guide. If they deem it necessary, they may delay account collection for checklist for writing a hardship letter to the irs. You have a balance due. Every year the irs will mail you a reminder letter regarding taxes owed. We have tips on writing hardship letters as well as example letters, including hardship letter templates. The internal revenue service (irs) may, at times, look at a taxpayer's debt ratio. 285 hardship letter templates you can download and print for free. The following tips will help you draft.

Hardship Letter Template Final Docx Sample Hardship Letter - We Have Tips On Writing Hardship Letters As Well As Example Letters, Including Hardship Letter Templates.

Writing A Letter Of Appeal To The Irs. The internal revenue service sometimes assesses a taxpayer's debt ratio and affords him or her so what should you include in this hardship letter to the irs? Irs hardship letter example, format, template and writing guide. The irs sends notices and letters for the following reasons: Irs hardship is for taxpayers not able to pay their back taxes. If they deem it necessary, they may delay account collection for checklist for writing a hardship letter to the irs. The following tips will help you draft. The internal revenue service (irs) may, at times, look at a taxpayer's debt ratio. 285 hardship letter templates you can download and print for free. If you have problems with the irs, you can always write them a hardship letter. agent name or collection compliance unit irs location address.

Stop Tax Refund Garnishment Over Defaulted Student Loan Debt By Pleasantbarrel567 Issuu - Fillable and printable hardship letter 2020.

Expert Writing A Hardship Letter To The Irs On Pantone Canvas Gallery. We have tips on writing hardship letters as well as example letters, including hardship letter templates. You have a balance due. If you have problems with the irs, you can always write them a hardship letter. If they deem it necessary, they may delay account collection for checklist for writing a hardship letter to the irs. The following tips will help you draft. Irs hardship is for taxpayers not able to pay their back taxes. The internal revenue service (irs) may, at times, look at a taxpayer's debt ratio. Every year the irs will mail you a reminder letter regarding taxes owed. The internal revenue service sometimes assesses a taxpayer's debt ratio and affords him or her so what should you include in this hardship letter to the irs? The irs sends notices and letters for the following reasons: Irs hardship letter example, format, template and writing guide. 285 hardship letter templates you can download and print for free. Each notice or letter contains a lot of valuable information, so it's very important that you read it carefully. agent name or collection compliance unit irs location address. Get hardship letter examples for your situation.

3 17 80 Working And Monitoring Category D Erroneous Refund Cases In Accounting Operations Internal Revenue Service - Did You Receive An Irs Letter Or Notice?

Irs Changes To Your Tax Return Cp21 Notice And Cp22 Notice. If they deem it necessary, they may delay account collection for checklist for writing a hardship letter to the irs. Irs hardship letter example, format, template and writing guide. You have a balance due. The irs sends notices and letters for the following reasons: Irs hardship is for taxpayers not able to pay their back taxes. agent name or collection compliance unit irs location address. Each notice or letter contains a lot of valuable information, so it's very important that you read it carefully. The internal revenue service sometimes assesses a taxpayer's debt ratio and affords him or her so what should you include in this hardship letter to the irs? We have tips on writing hardship letters as well as example letters, including hardship letter templates. If you have problems with the irs, you can always write them a hardship letter. Get hardship letter examples for your situation. 285 hardship letter templates you can download and print for free. The following tips will help you draft. Every year the irs will mail you a reminder letter regarding taxes owed. The internal revenue service (irs) may, at times, look at a taxpayer's debt ratio.

Irs Hardship Letter For Taxes Sample Hardship Letters Induced Info - These Letters Are Very Commonly Used When People.

June Is The Time Of Reckoning For Taxpayers Who Cannot Pay Their Tax Bill Irs Mind. Every year the irs will mail you a reminder letter regarding taxes owed. You have a balance due. Irs hardship letter example, format, template and writing guide. The internal revenue service sometimes assesses a taxpayer's debt ratio and affords him or her so what should you include in this hardship letter to the irs? Get hardship letter examples for your situation. Each notice or letter contains a lot of valuable information, so it's very important that you read it carefully. The irs sends notices and letters for the following reasons: If you have problems with the irs, you can always write them a hardship letter. We have tips on writing hardship letters as well as example letters, including hardship letter templates. Irs hardship is for taxpayers not able to pay their back taxes. The internal revenue service (irs) may, at times, look at a taxpayer's debt ratio. 285 hardship letter templates you can download and print for free. agent name or collection compliance unit irs location address. The following tips will help you draft. If they deem it necessary, they may delay account collection for checklist for writing a hardship letter to the irs.

Hardship Letter Templates Pdf Download Fill And Print For Free Templateroller , Despite Your Best Efforts, You Might Face Obstacles That Prevent You From Fulfilling Financial Obligations And Other Promises.

Getting In Touch With The Irs During Covid 19 Pandemic Irs Mind. The following tips will help you draft. The internal revenue service (irs) may, at times, look at a taxpayer's debt ratio. 285 hardship letter templates you can download and print for free. We have tips on writing hardship letters as well as example letters, including hardship letter templates. Get hardship letter examples for your situation. If they deem it necessary, they may delay account collection for checklist for writing a hardship letter to the irs. Each notice or letter contains a lot of valuable information, so it's very important that you read it carefully. You have a balance due. The irs sends notices and letters for the following reasons: If you have problems with the irs, you can always write them a hardship letter. agent name or collection compliance unit irs location address. Irs hardship letter example, format, template and writing guide. Every year the irs will mail you a reminder letter regarding taxes owed. Irs hardship is for taxpayers not able to pay their back taxes. The internal revenue service sometimes assesses a taxpayer's debt ratio and affords him or her so what should you include in this hardship letter to the irs?

Irs Form 12277 Tips And Guidelines For When To Use This Form , Did You Receive An Irs Letter Or Notice?

Irs Letter 4883c Tax Attorney Explains Options To Respond. The internal revenue service (irs) may, at times, look at a taxpayer's debt ratio. agent name or collection compliance unit irs location address. The irs sends notices and letters for the following reasons: If they deem it necessary, they may delay account collection for checklist for writing a hardship letter to the irs. 285 hardship letter templates you can download and print for free. Each notice or letter contains a lot of valuable information, so it's very important that you read it carefully. Get hardship letter examples for your situation. Every year the irs will mail you a reminder letter regarding taxes owed. We have tips on writing hardship letters as well as example letters, including hardship letter templates. Irs hardship is for taxpayers not able to pay their back taxes. The internal revenue service sometimes assesses a taxpayer's debt ratio and affords him or her so what should you include in this hardship letter to the irs? Irs hardship letter example, format, template and writing guide. You have a balance due. If you have problems with the irs, you can always write them a hardship letter. The following tips will help you draft.

Irs Notice Letter 2273c Understanding Irs Letter 2273c Explains The Details Of The Payment Agreement , We Support You And Your Company By Providing This Irs Hardship Letter Template, Which Will Save Your Time, Cost And Efforts And Help You To Reach.

Financial Hardship Letter Court Fill Online Printable Fillable Blank Pdffiller. Get hardship letter examples for your situation. Every year the irs will mail you a reminder letter regarding taxes owed. Each notice or letter contains a lot of valuable information, so it's very important that you read it carefully. If you have problems with the irs, you can always write them a hardship letter. You have a balance due. We have tips on writing hardship letters as well as example letters, including hardship letter templates. The irs sends notices and letters for the following reasons: The internal revenue service sometimes assesses a taxpayer's debt ratio and affords him or her so what should you include in this hardship letter to the irs? agent name or collection compliance unit irs location address. The following tips will help you draft. 285 hardship letter templates you can download and print for free. Irs hardship letter example, format, template and writing guide. The internal revenue service (irs) may, at times, look at a taxpayer's debt ratio. Irs hardship is for taxpayers not able to pay their back taxes. If they deem it necessary, they may delay account collection for checklist for writing a hardship letter to the irs.

Writing A Letter Of Appeal To The Irs , 2 Downloadable Financial Hardship Letter Templates.

Sample Penalty Abatement Letter To Irs To Waive Tax Penalties In Bank Charges Refund Letter Template 10 In 2020 Letter Templates Lettering Printable Letter Templates. The following tips will help you draft. If they deem it necessary, they may delay account collection for checklist for writing a hardship letter to the irs. If you have problems with the irs, you can always write them a hardship letter. The irs sends notices and letters for the following reasons: Each notice or letter contains a lot of valuable information, so it's very important that you read it carefully. The internal revenue service (irs) may, at times, look at a taxpayer's debt ratio. We have tips on writing hardship letters as well as example letters, including hardship letter templates. Get hardship letter examples for your situation. 285 hardship letter templates you can download and print for free. The internal revenue service sometimes assesses a taxpayer's debt ratio and affords him or her so what should you include in this hardship letter to the irs? Every year the irs will mail you a reminder letter regarding taxes owed. Irs hardship is for taxpayers not able to pay their back taxes. agent name or collection compliance unit irs location address. You have a balance due. Irs hardship letter example, format, template and writing guide.

Irs Letter 105c Understanding Irs Letter 105c Denial Of Your Claim For A Refund : The Internal Revenue Service (Irs) May, At Times, Look At A Taxpayer's Debt Ratio.

9 7 7 Claims And Petitions Internal Revenue Service. agent name or collection compliance unit irs location address. Every year the irs will mail you a reminder letter regarding taxes owed. We have tips on writing hardship letters as well as example letters, including hardship letter templates. The internal revenue service sometimes assesses a taxpayer's debt ratio and affords him or her so what should you include in this hardship letter to the irs? The internal revenue service (irs) may, at times, look at a taxpayer's debt ratio. The following tips will help you draft. If they deem it necessary, they may delay account collection for checklist for writing a hardship letter to the irs. The irs sends notices and letters for the following reasons: If you have problems with the irs, you can always write them a hardship letter. 285 hardship letter templates you can download and print for free. You have a balance due. Irs hardship letter example, format, template and writing guide. Each notice or letter contains a lot of valuable information, so it's very important that you read it carefully. Get hardship letter examples for your situation. Irs hardship is for taxpayers not able to pay their back taxes.