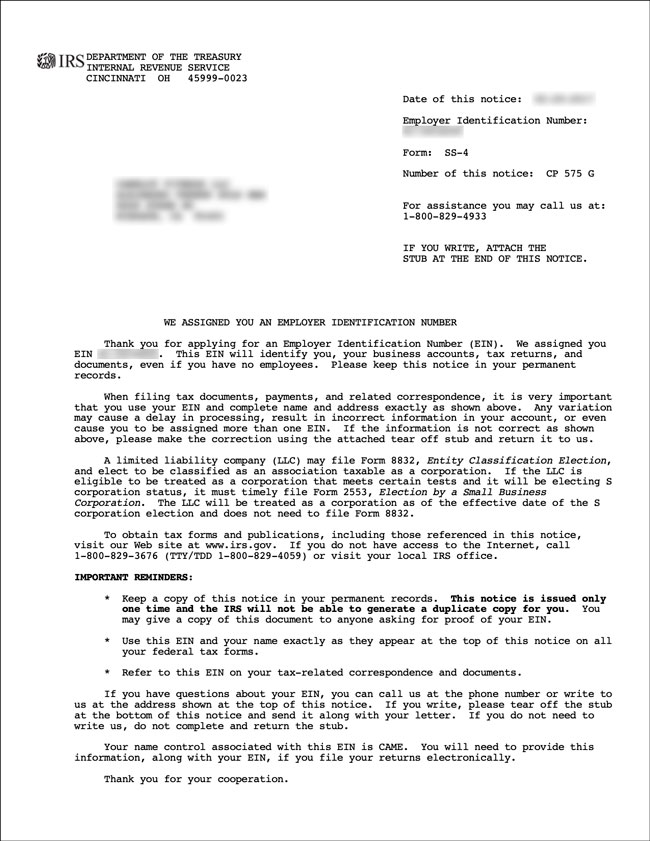

Irs Ein Letter. Instead, submit a letter to the irs, preferably on your company letterhead. You can't get this letter again. The letter will confirm the employer name and ein connected with the personal security information that you will provide to the irs. If you obtained the ein through harvard business services, our team will be happy to assist you. The irs only issues the ein confirmation letter (cp 575) one time. You may need a copy of ein letter from irs on various occasions to confirm your tax id to your bankers, financers, and vendors.3 min read. You can close your business account with the irs by writing to internal revenue service, cincinnati, ohio 45999. The irs will mail your 147c letter to the mailing address they have on file for your llc. The irs sends out a confirmation letter for every ein application it processes. It contains the required information needed by the irs in order to process your request. If you remember your ein the irs can't just give out ein information to anyone. Please complete the application below. They can only send a 147c letter to an. Internal revenue service stop 343g cincinnati, oh 45999 attention: We recommend employers download these publications from irs.gov.

Irs Ein Letter- Format A Business Letter And Remember To Get To The Point.

Ein Number For Solo 401k Retirement Trust My Solo 401k Financial. You can close your business account with the irs by writing to internal revenue service, cincinnati, ohio 45999. The irs only issues the ein confirmation letter (cp 575) one time. Internal revenue service stop 343g cincinnati, oh 45999 attention: You can't get this letter again. We recommend employers download these publications from irs.gov. The irs will mail your 147c letter to the mailing address they have on file for your llc. You may need a copy of ein letter from irs on various occasions to confirm your tax id to your bankers, financers, and vendors.3 min read. If you remember your ein the irs can't just give out ein information to anyone. It contains the required information needed by the irs in order to process your request. They can only send a 147c letter to an. The irs sends out a confirmation letter for every ein application it processes. The letter will confirm the employer name and ein connected with the personal security information that you will provide to the irs. Instead, submit a letter to the irs, preferably on your company letterhead. Please complete the application below. If you obtained the ein through harvard business services, our team will be happy to assist you.

The irs is clear and concise in its letters and notifications.

Ein is used to identify a business. The irs sends out a confirmation letter for every ein application it processes. A letter to the internal revenue service (irs) is helpful if you need to make adjustments to your filing or dispute a each letter from the irs will contain specific instructions regarding what you need to do. If you're serious about starting your business, consulting a business lawyer first will save. Please complete the application below. We recommend employers download these publications from irs.gov. The irs will mail your 147c letter to the mailing address they have on file for your llc. You can close your business account with the irs by writing to internal revenue service, cincinnati, ohio 45999. Don't panic too much about the letter, most of these letters come off in a harsh tone but can be resolved through a few steps. An irs penalty response letter is a document used to file a request with the irs that a penalty levied against a taxpayer, either an individual or a business, be reduced or canceled. Include the street address, city, state, and zip code. It contains the required information needed by the irs in order to process your request. If successfully validated, you will be able to view your irs verification of nonfiling letter that can then print it out for submission. If you obtained the ein through harvard business services, our team will be happy to assist you. An irs audit letter is certified mail that will clearly identify your name, taxpayer id. You will be asked some. Ein is used to identify a business. Personal service corporation tax id. Internal revenue service stop 343g cincinnati, oh 45999 attention: They can only send a 147c letter to an. The letter will confirm the employer name and ein connected with the personal security information that you will provide to the irs. Without an official letter from irs with the company's name, address, and ein, it is usually impossible to open a bank account, verify payoneer or paypal business profiles, etc. What is an irs verification of nonfiling letter? Quick guide on how to complete sample letter to irs to cancel tin. The irs is clear and concise in its letters and notifications. A verification of nonfiling letter confirms that the irs has not received a tax return for the student or parent, as applicable. The irs only issues the ein confirmation letter (cp 575) one time. If you remember your ein the irs can't just give out ein information to anyone. The revenue service of the united states is called the internal revenue service or irs. Format a business letter and remember to get to the point. Further, if you owe the irs money, the irs may assign a revenue officer (a human being who looks to collect from you.

Irs Ein Letter Rosenet: Irs Sends A Letter To The Individuals For Different Reasons And You Are Not Required To Respond To Every Letter They.

Irs Ein Form Ss 4 Instructions Fresh Form Ss4 Cool Tax Id Employer Number Application Ss 4 Fax 1023 Models Form Ideas. It contains the required information needed by the irs in order to process your request. We recommend employers download these publications from irs.gov. The letter will confirm the employer name and ein connected with the personal security information that you will provide to the irs. The irs sends out a confirmation letter for every ein application it processes. They can only send a 147c letter to an. The irs will mail your 147c letter to the mailing address they have on file for your llc. If you obtained the ein through harvard business services, our team will be happy to assist you. Internal revenue service stop 343g cincinnati, oh 45999 attention: Instead, submit a letter to the irs, preferably on your company letterhead. You can close your business account with the irs by writing to internal revenue service, cincinnati, ohio 45999. If you remember your ein the irs can't just give out ein information to anyone. You may need a copy of ein letter from irs on various occasions to confirm your tax id to your bankers, financers, and vendors.3 min read. The irs only issues the ein confirmation letter (cp 575) one time. You can't get this letter again. Please complete the application below.

Depending On Your Tax Situation Your Donations To Our Chapter May Be Tax Deductible Ein Verification Letter 2016 Lerner Signed Irs Cover Letters To Conservative Groups Demanding Determination Letterpng Sample Letter To , Irs Sends A Letter To The Individuals For Different Reasons And You Are Not Required To Respond To Every Letter They.

Ein Number What Is An Ein Truic. Instead, submit a letter to the irs, preferably on your company letterhead. The irs will mail your 147c letter to the mailing address they have on file for your llc. Please complete the application below. You can't get this letter again. They can only send a 147c letter to an. We recommend employers download these publications from irs.gov. You may need a copy of ein letter from irs on various occasions to confirm your tax id to your bankers, financers, and vendors.3 min read. The letter will confirm the employer name and ein connected with the personal security information that you will provide to the irs. Internal revenue service stop 343g cincinnati, oh 45999 attention: It contains the required information needed by the irs in order to process your request.

Ein Comprehensive Guide Freshbooks - Internal revenue service stop 343g cincinnati, oh 45999 attention:

32 3 2 Letter Rulings Internal Revenue Service. You can't get this letter again. It contains the required information needed by the irs in order to process your request. The letter will confirm the employer name and ein connected with the personal security information that you will provide to the irs. We recommend employers download these publications from irs.gov. The irs sends out a confirmation letter for every ein application it processes. You can close your business account with the irs by writing to internal revenue service, cincinnati, ohio 45999. If you obtained the ein through harvard business services, our team will be happy to assist you. They can only send a 147c letter to an. The irs only issues the ein confirmation letter (cp 575) one time. If you remember your ein the irs can't just give out ein information to anyone. You may need a copy of ein letter from irs on various occasions to confirm your tax id to your bankers, financers, and vendors.3 min read. Internal revenue service stop 343g cincinnati, oh 45999 attention: Please complete the application below. The irs will mail your 147c letter to the mailing address they have on file for your llc. Instead, submit a letter to the irs, preferably on your company letterhead.

How To Apply For An Estate Ein Or Tin Online 9 Step Guide , They Will Either Mail It To You Or Fax It To You.

32 3 2 Letter Rulings Internal Revenue Service. It contains the required information needed by the irs in order to process your request. If you remember your ein the irs can't just give out ein information to anyone. We recommend employers download these publications from irs.gov. The irs only issues the ein confirmation letter (cp 575) one time. Please complete the application below. Internal revenue service stop 343g cincinnati, oh 45999 attention: Instead, submit a letter to the irs, preferably on your company letterhead. The letter will confirm the employer name and ein connected with the personal security information that you will provide to the irs. If you obtained the ein through harvard business services, our team will be happy to assist you. You may need a copy of ein letter from irs on various occasions to confirm your tax id to your bankers, financers, and vendors.3 min read. They can only send a 147c letter to an. The irs sends out a confirmation letter for every ein application it processes. The irs will mail your 147c letter to the mailing address they have on file for your llc. You can close your business account with the irs by writing to internal revenue service, cincinnati, ohio 45999. You can't get this letter again.

Ss4 Ein Registration Letter Asap Help Center : Ein Is Used To Identify A Business.

How To Apply For An Estate Ein Or Tin Online 9 Step Guide. The irs only issues the ein confirmation letter (cp 575) one time. You can't get this letter again. Internal revenue service stop 343g cincinnati, oh 45999 attention: You may need a copy of ein letter from irs on various occasions to confirm your tax id to your bankers, financers, and vendors.3 min read. Please complete the application below. You can close your business account with the irs by writing to internal revenue service, cincinnati, ohio 45999. Instead, submit a letter to the irs, preferably on your company letterhead. The irs will mail your 147c letter to the mailing address they have on file for your llc. If you obtained the ein through harvard business services, our team will be happy to assist you. The irs sends out a confirmation letter for every ein application it processes. They can only send a 147c letter to an. If you remember your ein the irs can't just give out ein information to anyone. It contains the required information needed by the irs in order to process your request. The letter will confirm the employer name and ein connected with the personal security information that you will provide to the irs. We recommend employers download these publications from irs.gov.

Get An Irs Ein Number The Definitive Step By Step Guide : Format A Business Letter And Remember To Get To The Point.

The Irs Aca Audit Has Begun What To Do To Avoid Penalties The Aca Times. We recommend employers download these publications from irs.gov. Instead, submit a letter to the irs, preferably on your company letterhead. You can close your business account with the irs by writing to internal revenue service, cincinnati, ohio 45999. It contains the required information needed by the irs in order to process your request. You may need a copy of ein letter from irs on various occasions to confirm your tax id to your bankers, financers, and vendors.3 min read. The irs only issues the ein confirmation letter (cp 575) one time. The irs sends out a confirmation letter for every ein application it processes. Please complete the application below. The irs will mail your 147c letter to the mailing address they have on file for your llc. If you obtained the ein through harvard business services, our team will be happy to assist you. If you remember your ein the irs can't just give out ein information to anyone. They can only send a 147c letter to an. You can't get this letter again. Internal revenue service stop 343g cincinnati, oh 45999 attention: The letter will confirm the employer name and ein connected with the personal security information that you will provide to the irs.

Using Irs Documentation As Reference When Entering Business Name And Tax Id Number Tin For Us Based Businesses Stripe Help Support - The Good News Is That You.

Ein Verification Letter 147c For Your Llc Llc University. Please complete the application below. The irs will mail your 147c letter to the mailing address they have on file for your llc. If you remember your ein the irs can't just give out ein information to anyone. You can't get this letter again. It contains the required information needed by the irs in order to process your request. Instead, submit a letter to the irs, preferably on your company letterhead. The irs only issues the ein confirmation letter (cp 575) one time. We recommend employers download these publications from irs.gov. The letter will confirm the employer name and ein connected with the personal security information that you will provide to the irs. You may need a copy of ein letter from irs on various occasions to confirm your tax id to your bankers, financers, and vendors.3 min read. They can only send a 147c letter to an. The irs sends out a confirmation letter for every ein application it processes. If you obtained the ein through harvard business services, our team will be happy to assist you. Internal revenue service stop 343g cincinnati, oh 45999 attention: You can close your business account with the irs by writing to internal revenue service, cincinnati, ohio 45999.

How To Get A Copy Of Your Form Ss 4 Letter Excel Capital - Further, If You Owe The Irs Money, The Irs May Assign A Revenue Officer (A Human Being Who Looks To Collect From You.

Using Irs Documentation As Reference When Entering Business Name And Tax Id Number Tin For Us Based Businesses Stripe Help Support. Please complete the application below. The irs sends out a confirmation letter for every ein application it processes. You can close your business account with the irs by writing to internal revenue service, cincinnati, ohio 45999. You may need a copy of ein letter from irs on various occasions to confirm your tax id to your bankers, financers, and vendors.3 min read. Instead, submit a letter to the irs, preferably on your company letterhead. The letter will confirm the employer name and ein connected with the personal security information that you will provide to the irs. If you remember your ein the irs can't just give out ein information to anyone. It contains the required information needed by the irs in order to process your request. The irs only issues the ein confirmation letter (cp 575) one time. They can only send a 147c letter to an. The irs will mail your 147c letter to the mailing address they have on file for your llc. Internal revenue service stop 343g cincinnati, oh 45999 attention: If you obtained the ein through harvard business services, our team will be happy to assist you. You can't get this letter again. We recommend employers download these publications from irs.gov.

Get You Your Ein And The Confirmation Letter From The Irs By Islamayoub 94 : The Revenue Service Of The United States Is Called The Internal Revenue Service Or Irs.

Ein Verification Letter 147c For Your Llc Llc University. The irs sends out a confirmation letter for every ein application it processes. They can only send a 147c letter to an. You can't get this letter again. The irs will mail your 147c letter to the mailing address they have on file for your llc. The letter will confirm the employer name and ein connected with the personal security information that you will provide to the irs. If you remember your ein the irs can't just give out ein information to anyone. It contains the required information needed by the irs in order to process your request. Please complete the application below. You may need a copy of ein letter from irs on various occasions to confirm your tax id to your bankers, financers, and vendors.3 min read. The irs only issues the ein confirmation letter (cp 575) one time. Internal revenue service stop 343g cincinnati, oh 45999 attention: You can close your business account with the irs by writing to internal revenue service, cincinnati, ohio 45999. Instead, submit a letter to the irs, preferably on your company letterhead. We recommend employers download these publications from irs.gov. If you obtained the ein through harvard business services, our team will be happy to assist you.

Using Irs Documentation As Reference When Entering Business Name And Tax Id Number Tin For Us Based Businesses Stripe Help Support , Further, If You Owe The Irs Money, The Irs May Assign A Revenue Officer (A Human Being Who Looks To Collect From You.

Flexport Help Center Article What Is An Irs Notice. You can close your business account with the irs by writing to internal revenue service, cincinnati, ohio 45999. We recommend employers download these publications from irs.gov. Internal revenue service stop 343g cincinnati, oh 45999 attention: They can only send a 147c letter to an. The irs sends out a confirmation letter for every ein application it processes. It contains the required information needed by the irs in order to process your request. The irs will mail your 147c letter to the mailing address they have on file for your llc. You can't get this letter again. The letter will confirm the employer name and ein connected with the personal security information that you will provide to the irs. You may need a copy of ein letter from irs on various occasions to confirm your tax id to your bankers, financers, and vendors.3 min read. If you remember your ein the irs can't just give out ein information to anyone. Instead, submit a letter to the irs, preferably on your company letterhead. The irs only issues the ein confirmation letter (cp 575) one time. If you obtained the ein through harvard business services, our team will be happy to assist you. Please complete the application below.