Fake Irs Letter Template. The internal revenue service is in the thick of correspondence season, reported tax lawyer kelly phillips erb for forbes. Our experts review the top fake irs letter scams and phishing phone calls you may experience this tax season. Tax penalties are assessed for many reasons and, similarly, there are many reasons in place for a penalty that is unjust. When a taxpayer owes back taxes, or there are any other issues that need to be sorted out, the irs usually initiates contact. What are fake irs letters? Did you receive an irs notice or letter? Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. Fake irs letters can look a lot like the real thing, but we'll explain how to tell the difference between fake irs letter scammers and the real thing. Never trust a letter just because it says 'irs'. Many tax scammers will design a notice to exactly like it came from the irs in if you think that the irs letter is a mistake or contains erroneous information, outline your explanation clearly and concisely, with a tone of respect. Another fake irs letter that has been circulated is similar to this always report fake letters to the irs. Beware of fake irs letters. That means that the internal revenue service (irs) is sending out bills and notices to taxpayers. An irs penalty response letter is a document used to file a request with the irs that a penalty levied against a taxpayer, either an individual or a business, be reduced or canceled. This helps the irs identify scams that are in circulation among taxpayers.

Fake Irs Letter Template- The Irs Said That The Letter Will Provide Information On How The Payment Was Made And How To Report Any Failure To Receive The Payment.

Irs Stimulus Payment Recipients Lash Out Against Trump S Vanity Letter The Washington Post. Beware of fake irs letters. Another fake irs letter that has been circulated is similar to this always report fake letters to the irs. Many tax scammers will design a notice to exactly like it came from the irs in if you think that the irs letter is a mistake or contains erroneous information, outline your explanation clearly and concisely, with a tone of respect. When a taxpayer owes back taxes, or there are any other issues that need to be sorted out, the irs usually initiates contact. Did you receive an irs notice or letter? Our experts review the top fake irs letter scams and phishing phone calls you may experience this tax season. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. That means that the internal revenue service (irs) is sending out bills and notices to taxpayers. The internal revenue service is in the thick of correspondence season, reported tax lawyer kelly phillips erb for forbes. This helps the irs identify scams that are in circulation among taxpayers. Never trust a letter just because it says 'irs'. Tax penalties are assessed for many reasons and, similarly, there are many reasons in place for a penalty that is unjust. Fake irs letters can look a lot like the real thing, but we'll explain how to tell the difference between fake irs letter scammers and the real thing. What are fake irs letters? An irs penalty response letter is a document used to file a request with the irs that a penalty levied against a taxpayer, either an individual or a business, be reduced or canceled.

You may have gotten a robo or live telephone call warning you that the irs has issued a warrant for your arrest.

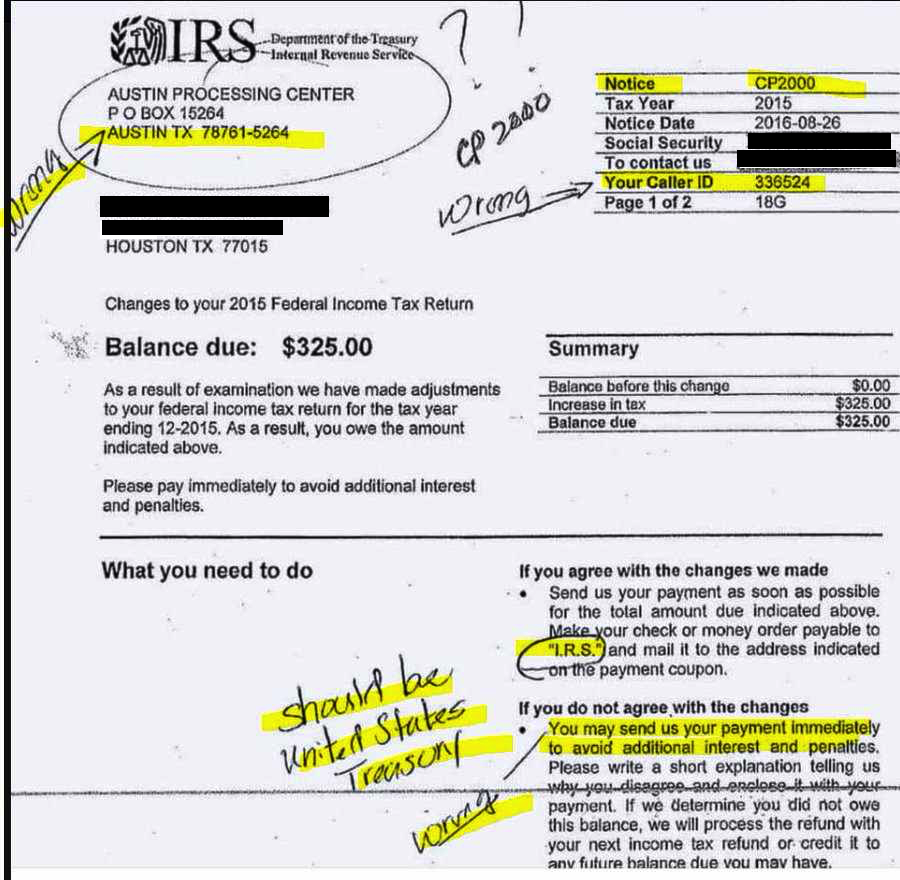

Fake irs letters can look a lot like the real thing, but we'll explain how to tell the difference between fake irs letter scammers and the real thing. That means that the internal revenue service (irs) is sending out bills and notices to taxpayers. However, if you want to improve your chances of your request being accepted, you should work with a. The irs said that the letter will provide information on how the payment was made and how to report any failure to receive the payment. We prepared 40+ awesome personal reference letter samples and templates which you may download for free. Format a business letter and remember to get to the point. > irs letter real or fake? Irs sample letter use irs sample letter 1 to seek debt cancellation of passive income. If you receive a call from someone supposedly from the irs out of the blue, just hang up. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. And it has worked because the scammers are so intimidating. What does the letter say? The irs does send notices like this through the mail, asking for payments or other updated information that needs to be verified, but the problem is that scammers have made it almost impossible for consumers to tell the difference between a real irs letter and a fake one. Call the irs customer service number and ask them. Learn how to protect your valuable data with a letter on irs letterhead that requests all payments be remitted to the united states treasury. Never trust a letter just because it says 'irs'. An irs penalty response letter is a document used to file a request with the irs that a penalty levied against a taxpayer, either an individual or a business, be reduced or canceled. So many people are staying hardly in front of. We promise original letters, we don't use any template. Tax penalties are assessed for many reasons and, similarly, there are many reasons in place for a penalty that is unjust. They know that the irs will not call you until they have sent you exhaustive correspondence. Victims often receive a letter from the fake agency claiming that they have a tax lien or tax levy and that they had better pay the bureau of tax enforcement or else. Our experts review the top fake irs letter scams and phishing phone calls you may experience this tax season. However, you have nothing to fear when you need to write them a letter. Street address city, state, zip code tax period: An example of an irs request or sample letter for irs penalty abatement. Crooks using fake letters from irs to scam victims]. According to the irs, a letter about the economic impact payment to will be sent to taxpayers' last known address within 15 days after the payment is paid. If the letter tells that the irs has made some changes in your tax return, you need to compare those changes with your we guarantee customer satisfaction. Us taxpayers who have received letters from the irs should check the correspondence carefully before they proceed to part with their crypto earnings to pay. (1) the irs will never call you to initiate an examination or audit.

4 19 10 Examination General Overview Internal Revenue Service: Tax Protest Letter Template Collection | Letter Cover.

The Finest April Fools Prank The Fake Irs Audit Letter With Free Downloads Funny April Fools Pranks April Fools Pranks April Fools Joke. Tax penalties are assessed for many reasons and, similarly, there are many reasons in place for a penalty that is unjust. The internal revenue service is in the thick of correspondence season, reported tax lawyer kelly phillips erb for forbes. Did you receive an irs notice or letter? An irs penalty response letter is a document used to file a request with the irs that a penalty levied against a taxpayer, either an individual or a business, be reduced or canceled. Fake irs letters can look a lot like the real thing, but we'll explain how to tell the difference between fake irs letter scammers and the real thing. Another fake irs letter that has been circulated is similar to this always report fake letters to the irs. Beware of fake irs letters. That means that the internal revenue service (irs) is sending out bills and notices to taxpayers. When a taxpayer owes back taxes, or there are any other issues that need to be sorted out, the irs usually initiates contact. What are fake irs letters? Our experts review the top fake irs letter scams and phishing phone calls you may experience this tax season. Never trust a letter just because it says 'irs'. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. This helps the irs identify scams that are in circulation among taxpayers. Many tax scammers will design a notice to exactly like it came from the irs in if you think that the irs letter is a mistake or contains erroneous information, outline your explanation clearly and concisely, with a tone of respect.

Fake Irs Letter What To Look Out For When You Receive An Irs Letter . What Are Fake Irs Letters?

Fill Free Fillable Irs Pdf Forms. Fake irs letters can look a lot like the real thing, but we'll explain how to tell the difference between fake irs letter scammers and the real thing. Tax penalties are assessed for many reasons and, similarly, there are many reasons in place for a penalty that is unjust. An irs penalty response letter is a document used to file a request with the irs that a penalty levied against a taxpayer, either an individual or a business, be reduced or canceled. What are fake irs letters? Did you receive an irs notice or letter? Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. Never trust a letter just because it says 'irs'. When a taxpayer owes back taxes, or there are any other issues that need to be sorted out, the irs usually initiates contact. That means that the internal revenue service (irs) is sending out bills and notices to taxpayers. Our experts review the top fake irs letter scams and phishing phone calls you may experience this tax season.

Brian S Column My Ctc Frivolous Adventure Begins Thecoffeecoaster Com : They know that the irs will not call you until they have sent you exhaustive correspondence.

Irs Audit Letter What An Irs Letter Looks Like How To Respond. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. Another fake irs letter that has been circulated is similar to this always report fake letters to the irs. Tax penalties are assessed for many reasons and, similarly, there are many reasons in place for a penalty that is unjust. When a taxpayer owes back taxes, or there are any other issues that need to be sorted out, the irs usually initiates contact. Our experts review the top fake irs letter scams and phishing phone calls you may experience this tax season. Never trust a letter just because it says 'irs'. This helps the irs identify scams that are in circulation among taxpayers. Beware of fake irs letters. Many tax scammers will design a notice to exactly like it came from the irs in if you think that the irs letter is a mistake or contains erroneous information, outline your explanation clearly and concisely, with a tone of respect. That means that the internal revenue service (irs) is sending out bills and notices to taxpayers. An irs penalty response letter is a document used to file a request with the irs that a penalty levied against a taxpayer, either an individual or a business, be reduced or canceled. Did you receive an irs notice or letter? What are fake irs letters? Fake irs letters can look a lot like the real thing, but we'll explain how to tell the difference between fake irs letter scammers and the real thing. The internal revenue service is in the thick of correspondence season, reported tax lawyer kelly phillips erb for forbes.

How Can We Tell If An Irs Letter It S Toll Free Number Is From The Irs Tmi Message Board : If The Letter Tells That The Irs Has Made Some Changes In Your Tax Return, You Need To Compare Those Changes With Your We Guarantee Customer Satisfaction.

Irs Audit Letter Cp3219a Sample 1. Never trust a letter just because it says 'irs'. This helps the irs identify scams that are in circulation among taxpayers. Tax penalties are assessed for many reasons and, similarly, there are many reasons in place for a penalty that is unjust. Beware of fake irs letters. Our experts review the top fake irs letter scams and phishing phone calls you may experience this tax season. When a taxpayer owes back taxes, or there are any other issues that need to be sorted out, the irs usually initiates contact. That means that the internal revenue service (irs) is sending out bills and notices to taxpayers. Many tax scammers will design a notice to exactly like it came from the irs in if you think that the irs letter is a mistake or contains erroneous information, outline your explanation clearly and concisely, with a tone of respect. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. Fake irs letters can look a lot like the real thing, but we'll explain how to tell the difference between fake irs letter scammers and the real thing. An irs penalty response letter is a document used to file a request with the irs that a penalty levied against a taxpayer, either an individual or a business, be reduced or canceled. Did you receive an irs notice or letter? What are fake irs letters? The internal revenue service is in the thick of correspondence season, reported tax lawyer kelly phillips erb for forbes. Another fake irs letter that has been circulated is similar to this always report fake letters to the irs.

Current Newsletter Holsinger : Call The Irs Customer Service Number And Ask Them.

Irs Audit Letter What An Irs Letter Looks Like How To Respond. An irs penalty response letter is a document used to file a request with the irs that a penalty levied against a taxpayer, either an individual or a business, be reduced or canceled. Beware of fake irs letters. What are fake irs letters? This helps the irs identify scams that are in circulation among taxpayers. Our experts review the top fake irs letter scams and phishing phone calls you may experience this tax season. The internal revenue service is in the thick of correspondence season, reported tax lawyer kelly phillips erb for forbes. Another fake irs letter that has been circulated is similar to this always report fake letters to the irs. That means that the internal revenue service (irs) is sending out bills and notices to taxpayers. Never trust a letter just because it says 'irs'. When a taxpayer owes back taxes, or there are any other issues that need to be sorted out, the irs usually initiates contact. Many tax scammers will design a notice to exactly like it came from the irs in if you think that the irs letter is a mistake or contains erroneous information, outline your explanation clearly and concisely, with a tone of respect. Fake irs letters can look a lot like the real thing, but we'll explain how to tell the difference between fake irs letter scammers and the real thing. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. Tax penalties are assessed for many reasons and, similarly, there are many reasons in place for a penalty that is unjust. Did you receive an irs notice or letter?

Form 1040 Wikipedia , When A Taxpayer Owes Back Taxes, Or There Are Any Other Issues That Need To Be Sorted Out, The Irs Usually Initiates Contact.

How To Write A Letter Of Explanation To The Irs With Template Success Tax Relief. Never trust a letter just because it says 'irs'. Our experts review the top fake irs letter scams and phishing phone calls you may experience this tax season. The internal revenue service is in the thick of correspondence season, reported tax lawyer kelly phillips erb for forbes. That means that the internal revenue service (irs) is sending out bills and notices to taxpayers. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. This helps the irs identify scams that are in circulation among taxpayers. Beware of fake irs letters. Did you receive an irs notice or letter? Many tax scammers will design a notice to exactly like it came from the irs in if you think that the irs letter is a mistake or contains erroneous information, outline your explanation clearly and concisely, with a tone of respect. An irs penalty response letter is a document used to file a request with the irs that a penalty levied against a taxpayer, either an individual or a business, be reduced or canceled. Tax penalties are assessed for many reasons and, similarly, there are many reasons in place for a penalty that is unjust. When a taxpayer owes back taxes, or there are any other issues that need to be sorted out, the irs usually initiates contact. What are fake irs letters? Fake irs letters can look a lot like the real thing, but we'll explain how to tell the difference between fake irs letter scammers and the real thing. Another fake irs letter that has been circulated is similar to this always report fake letters to the irs.

3 42 10 Authorized Irs E File Providers Internal Revenue Service , However, If You Want To Improve Your Chances Of Your Request Being Accepted, You Should Work With A.

Irs Penalty Response Letter Template Word Pdf. This helps the irs identify scams that are in circulation among taxpayers. Tax penalties are assessed for many reasons and, similarly, there are many reasons in place for a penalty that is unjust. Fake irs letters can look a lot like the real thing, but we'll explain how to tell the difference between fake irs letter scammers and the real thing. What are fake irs letters? Never trust a letter just because it says 'irs'. Our experts review the top fake irs letter scams and phishing phone calls you may experience this tax season. An irs penalty response letter is a document used to file a request with the irs that a penalty levied against a taxpayer, either an individual or a business, be reduced or canceled. Many tax scammers will design a notice to exactly like it came from the irs in if you think that the irs letter is a mistake or contains erroneous information, outline your explanation clearly and concisely, with a tone of respect. When a taxpayer owes back taxes, or there are any other issues that need to be sorted out, the irs usually initiates contact. That means that the internal revenue service (irs) is sending out bills and notices to taxpayers. Another fake irs letter that has been circulated is similar to this always report fake letters to the irs. Beware of fake irs letters. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. The internal revenue service is in the thick of correspondence season, reported tax lawyer kelly phillips erb for forbes. Did you receive an irs notice or letter?

Beware The Latest Fake Irs Letter Taxmama : Most People Are Not Falling For That Scam Anymore.

Fake Irs Letters Being Sent To Taxpayers Irs Problem Solvers. An irs penalty response letter is a document used to file a request with the irs that a penalty levied against a taxpayer, either an individual or a business, be reduced or canceled. That means that the internal revenue service (irs) is sending out bills and notices to taxpayers. Another fake irs letter that has been circulated is similar to this always report fake letters to the irs. Our experts review the top fake irs letter scams and phishing phone calls you may experience this tax season. Beware of fake irs letters. Never trust a letter just because it says 'irs'. What are fake irs letters? Tax penalties are assessed for many reasons and, similarly, there are many reasons in place for a penalty that is unjust. The internal revenue service is in the thick of correspondence season, reported tax lawyer kelly phillips erb for forbes. Fake irs letters can look a lot like the real thing, but we'll explain how to tell the difference between fake irs letter scammers and the real thing. Many tax scammers will design a notice to exactly like it came from the irs in if you think that the irs letter is a mistake or contains erroneous information, outline your explanation clearly and concisely, with a tone of respect. When a taxpayer owes back taxes, or there are any other issues that need to be sorted out, the irs usually initiates contact. This helps the irs identify scams that are in circulation among taxpayers. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. Did you receive an irs notice or letter?

Fake Address For Letter : To Whom It May Concern:

Pin On Letter Template. Did you receive an irs notice or letter? What are fake irs letters? Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. Tax penalties are assessed for many reasons and, similarly, there are many reasons in place for a penalty that is unjust. An irs penalty response letter is a document used to file a request with the irs that a penalty levied against a taxpayer, either an individual or a business, be reduced or canceled. When a taxpayer owes back taxes, or there are any other issues that need to be sorted out, the irs usually initiates contact. Many tax scammers will design a notice to exactly like it came from the irs in if you think that the irs letter is a mistake or contains erroneous information, outline your explanation clearly and concisely, with a tone of respect. Another fake irs letter that has been circulated is similar to this always report fake letters to the irs. The internal revenue service is in the thick of correspondence season, reported tax lawyer kelly phillips erb for forbes. Beware of fake irs letters. Never trust a letter just because it says 'irs'. This helps the irs identify scams that are in circulation among taxpayers. That means that the internal revenue service (irs) is sending out bills and notices to taxpayers. Our experts review the top fake irs letter scams and phishing phone calls you may experience this tax season. Fake irs letters can look a lot like the real thing, but we'll explain how to tell the difference between fake irs letter scammers and the real thing.

Brian S Column My Ctc Frivolous Adventure Begins Thecoffeecoaster Com - This Helps The Irs Identify Scams That Are In Circulation Among Taxpayers.

4 19 10 Examination General Overview Internal Revenue Service. Tax penalties are assessed for many reasons and, similarly, there are many reasons in place for a penalty that is unjust. The internal revenue service is in the thick of correspondence season, reported tax lawyer kelly phillips erb for forbes. Many tax scammers will design a notice to exactly like it came from the irs in if you think that the irs letter is a mistake or contains erroneous information, outline your explanation clearly and concisely, with a tone of respect. Another fake irs letter that has been circulated is similar to this always report fake letters to the irs. Our experts review the top fake irs letter scams and phishing phone calls you may experience this tax season. What are fake irs letters? Fake irs letters can look a lot like the real thing, but we'll explain how to tell the difference between fake irs letter scammers and the real thing. Beware of fake irs letters. Never trust a letter just because it says 'irs'. Did you receive an irs notice or letter? This helps the irs identify scams that are in circulation among taxpayers. An irs penalty response letter is a document used to file a request with the irs that a penalty levied against a taxpayer, either an individual or a business, be reduced or canceled. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. That means that the internal revenue service (irs) is sending out bills and notices to taxpayers. When a taxpayer owes back taxes, or there are any other issues that need to be sorted out, the irs usually initiates contact.