Dispute Validity Of Debt Letter. In the meantime, you can dispute the validity of the debt with the collection agency.5 x trustworthy source us consumer financial protection bureau u.s. Debt validation letters and verification letters are two examples. The debt validation request is time sensitive. You must make your request in writing within 30 days of the debt collector's initial contact with you. Once you send a request for proof, also called a debt validation letter, the collector must stop. Government agency for the notice should disclose the correct address to which you should send your letter disputing the validity of the debt. Use this letter to dispute a debt collection you're unsure of. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. A statement that the debt is assumed valid by the collector unless you dispute it within 30 days of the first contact. Don't act until you have your validation letter. Sample debt dispute/debt validation letter. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. The debt collector must send a sample debt validation letter five days from the first contact and it must contain the following details a statement saying that the debt collector assumes the validity of the debt unless you send a written dispute within 30 days from the first contact. If you receive a phone call or letter from a collector and you are not sure whether you really owe the debt or the amount they say you owe is correct, you have the right to send the collector a debt dispute/debt validation letter. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act.

Dispute Validity Of Debt Letter. Within Five Days Of Its First Communication To You, The Debt Collector Is Responsible For Sending You A Debt Validation Notice.

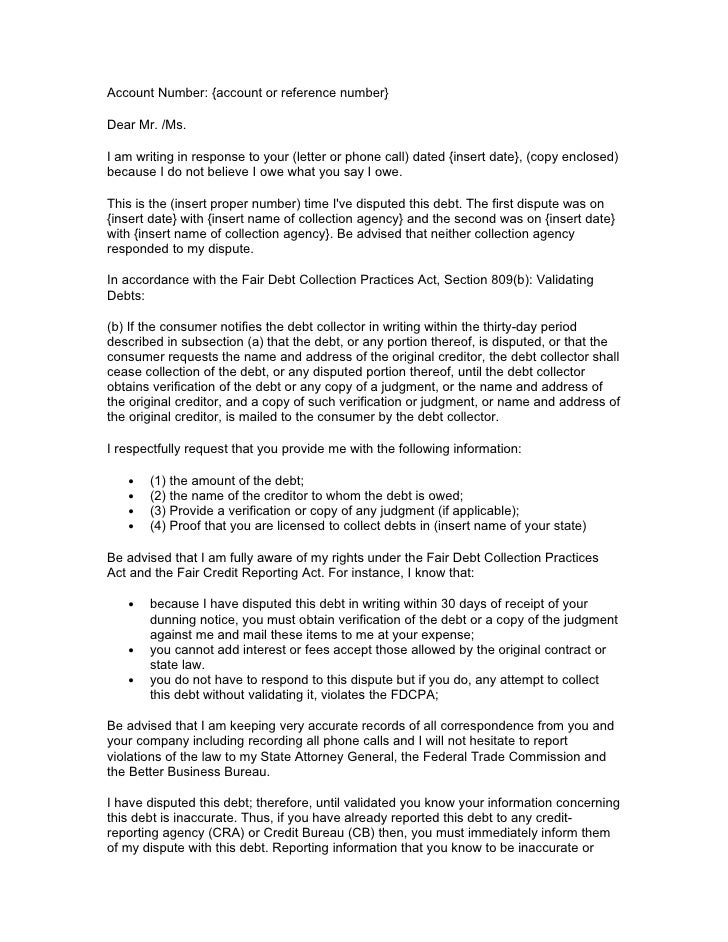

Sample Debt Validation Letter For Debt Collectors. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. If you receive a phone call or letter from a collector and you are not sure whether you really owe the debt or the amount they say you owe is correct, you have the right to send the collector a debt dispute/debt validation letter. You must make your request in writing within 30 days of the debt collector's initial contact with you. Sample debt dispute/debt validation letter. Don't act until you have your validation letter. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. Use this letter to dispute a debt collection you're unsure of. The debt validation request is time sensitive. Once you send a request for proof, also called a debt validation letter, the collector must stop. Debt validation letters and verification letters are two examples. The debt collector must send a sample debt validation letter five days from the first contact and it must contain the following details a statement saying that the debt collector assumes the validity of the debt unless you send a written dispute within 30 days from the first contact. Government agency for the notice should disclose the correct address to which you should send your letter disputing the validity of the debt. In the meantime, you can dispute the validity of the debt with the collection agency.5 x trustworthy source us consumer financial protection bureau u.s. A statement that the debt is assumed valid by the collector unless you dispute it within 30 days of the first contact.

809 (b) that your claim is disputed and validation is requested.

The validation letter will also have a number of statements of your rights, including the following information: Dontgetrippedoff dedicated to helping those in financial trouble, here you will find information to help you with debt collection if you are writing to the credit bureaus, simply state: Collectors must provide a debt validation letter to confirm details of the debt, including the amount. If you cannot produce such proof after i have put you on notice then i. The debt collector must send a sample debt validation letter five days from the first contact and it must contain the following details a statement saying that the debt collector assumes the validity of the debt unless you send a written dispute within 30 days from the first contact. Assuming a debt is valid but expired it's up to you to decide whether or not to pay it. Sample debt dispute/debt validation letter. Debt validation, settlement & dispute example letters, provided by golden financial services. Copyright according to the fdcpa you must validate a debt to a debtor if the debtor responds to your primary notice within a matter of days. How to write a debt validation letter in the letter, reference the date of the initial contact and the method, for example, a phone call received from your. If a debt cannot be validated, the debt collection company must cease. After disputing the debt, your creditor must validate and prove its validity. If you receive a phone call or letter from a collector and you are not sure whether you really owe the debt or the amount they say you owe is correct, you have the right to send the collector a debt dispute/debt validation letter. Here is a sample letter letter to send to a debt collector within 30 days of receiving the initial communication. Furthermore, i formally dispute the validity of this debt. Following is a sample debt validation letter that you can use to request the creditor/collection agency verify that the debt is actually yours and you. Generally, the advice on sending a debt validation letter on a valid debt is premised on making sure that the collection entity who is attempting to collect from you is legitimate. Sample letters to creditor (when you are unable to pay). Within five days of its first communication to you, the debt collector is responsible for sending you a debt validation notice. How to dispute the validity of a debt letter. Debt collectors must send you a debt validation letter when they initiate contact with you. It shall constitute an unfair or deceptive act or practice for a creditor to fail to provide to a debtor or an attorney for a debtor the following, within five business days after the initial communication with a debtor in connection with the collection of a debt, unless the following. Once you send a request for proof, also called a debt validation letter, the collector must stop. Example credit dispute letter (2/2). The validation letter will also have a number of statements of your rights, including the following information: Please provide me with documentation that supports why you believe this debt belongs to me, and why you believe i owe this. There are two versions of the debt validation letter. Government agency for the notice should disclose the correct address to which you should send your letter disputing the validity of the debt. The right to dispute the debt and receive validation are part of the consumer's rights under the united states federal fair debt collection practices act. Debt validation letters and verification letters are two examples. As the debtor, you have a 30.

50 Free Debt Validation Letter Samples Templates Á Templatelab, Sample Debt Dispute/Debt Validation Letter.

7 Facts About Writing A Debt Validation Letter Badcredit Org. If you receive a phone call or letter from a collector and you are not sure whether you really owe the debt or the amount they say you owe is correct, you have the right to send the collector a debt dispute/debt validation letter. The debt validation request is time sensitive. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. Sample debt dispute/debt validation letter. Use this letter to dispute a debt collection you're unsure of. Debt validation letters and verification letters are two examples. In the meantime, you can dispute the validity of the debt with the collection agency.5 x trustworthy source us consumer financial protection bureau u.s. A statement that the debt is assumed valid by the collector unless you dispute it within 30 days of the first contact. Don't act until you have your validation letter. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Once you send a request for proof, also called a debt validation letter, the collector must stop. The debt collector must send a sample debt validation letter five days from the first contact and it must contain the following details a statement saying that the debt collector assumes the validity of the debt unless you send a written dispute within 30 days from the first contact. You must make your request in writing within 30 days of the debt collector's initial contact with you. Government agency for the notice should disclose the correct address to which you should send your letter disputing the validity of the debt.

Sample Debt Validation Letters How To Respond To Debt Claim - In Accordance With The Fair Debt Collection Practices Act (Fdcpa), You Can Challenge The Validity Of A Debt.

Sample Debt Validation Letters How To Respond To Debt Claim. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Government agency for the notice should disclose the correct address to which you should send your letter disputing the validity of the debt. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. You must make your request in writing within 30 days of the debt collector's initial contact with you. The debt collector must send a sample debt validation letter five days from the first contact and it must contain the following details a statement saying that the debt collector assumes the validity of the debt unless you send a written dispute within 30 days from the first contact. Once you send a request for proof, also called a debt validation letter, the collector must stop. The debt validation request is time sensitive. Sample debt dispute/debt validation letter. Use this letter to dispute a debt collection you're unsure of.

Sample Debt Validation Letters How To Respond To Debt Claim . Collectors must provide a debt validation letter to confirm details of the debt, including the amount.

Disputing And Verifying A Debt Dealing With Debt Collectors Dealing With Debt Collectors Alaska. Sample debt dispute/debt validation letter. In the meantime, you can dispute the validity of the debt with the collection agency.5 x trustworthy source us consumer financial protection bureau u.s. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. The debt validation request is time sensitive. Once you send a request for proof, also called a debt validation letter, the collector must stop. A statement that the debt is assumed valid by the collector unless you dispute it within 30 days of the first contact. Debt validation letters and verification letters are two examples. Use this letter to dispute a debt collection you're unsure of. Government agency for the notice should disclose the correct address to which you should send your letter disputing the validity of the debt. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Don't act until you have your validation letter. If you receive a phone call or letter from a collector and you are not sure whether you really owe the debt or the amount they say you owe is correct, you have the right to send the collector a debt dispute/debt validation letter. The debt collector must send a sample debt validation letter five days from the first contact and it must contain the following details a statement saying that the debt collector assumes the validity of the debt unless you send a written dispute within 30 days from the first contact. You must make your request in writing within 30 days of the debt collector's initial contact with you.

How To Dispute And Ask A Debt Collector To Validate A Debt - The Debt Validation Letter Is Sent By A Consumer To Verify A Debt By Providing Evidence Of The Claim.

Most Effective Credit Bureau Dispute Letter 2020 Free Copy. Once you send a request for proof, also called a debt validation letter, the collector must stop. Use this letter to dispute a debt collection you're unsure of. Debt validation letters and verification letters are two examples. A statement that the debt is assumed valid by the collector unless you dispute it within 30 days of the first contact. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. If you receive a phone call or letter from a collector and you are not sure whether you really owe the debt or the amount they say you owe is correct, you have the right to send the collector a debt dispute/debt validation letter. In the meantime, you can dispute the validity of the debt with the collection agency.5 x trustworthy source us consumer financial protection bureau u.s. Don't act until you have your validation letter. The debt validation request is time sensitive. The debt collector must send a sample debt validation letter five days from the first contact and it must contain the following details a statement saying that the debt collector assumes the validity of the debt unless you send a written dispute within 30 days from the first contact. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. Government agency for the notice should disclose the correct address to which you should send your letter disputing the validity of the debt. You must make your request in writing within 30 days of the debt collector's initial contact with you. Sample debt dispute/debt validation letter. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim.

Free Debt Validation Letter Template Samples Word Pdf Eforms Free Fillable Forms : The Debt Collector Must Send A Sample Debt Validation Letter Five Days From The First Contact And It Must Contain The Following Details A Statement Saying That The Debt Collector Assumes The Validity Of The Debt Unless You Send A Written Dispute Within 30 Days From The First Contact.

How To Dispute The Validity Of A Debt Letter 15 Steps. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. Government agency for the notice should disclose the correct address to which you should send your letter disputing the validity of the debt. In the meantime, you can dispute the validity of the debt with the collection agency.5 x trustworthy source us consumer financial protection bureau u.s. A statement that the debt is assumed valid by the collector unless you dispute it within 30 days of the first contact. The debt collector must send a sample debt validation letter five days from the first contact and it must contain the following details a statement saying that the debt collector assumes the validity of the debt unless you send a written dispute within 30 days from the first contact. Once you send a request for proof, also called a debt validation letter, the collector must stop. Use this letter to dispute a debt collection you're unsure of. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Debt validation letters and verification letters are two examples. If you receive a phone call or letter from a collector and you are not sure whether you really owe the debt or the amount they say you owe is correct, you have the right to send the collector a debt dispute/debt validation letter. You must make your request in writing within 30 days of the debt collector's initial contact with you. Don't act until you have your validation letter. The debt validation request is time sensitive. Sample debt dispute/debt validation letter. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act.

How To Respond To A Debt Collection Letter And What To Include In A Debt Validation Letter Toughnickel Money , Per The Fair Credit Reporting Act I Am Requesting Validation Of This Debt.

7 Facts About Writing A Debt Validation Letter Badcredit Org. Don't act until you have your validation letter. In the meantime, you can dispute the validity of the debt with the collection agency.5 x trustworthy source us consumer financial protection bureau u.s. Sample debt dispute/debt validation letter. Government agency for the notice should disclose the correct address to which you should send your letter disputing the validity of the debt. If you receive a phone call or letter from a collector and you are not sure whether you really owe the debt or the amount they say you owe is correct, you have the right to send the collector a debt dispute/debt validation letter. Use this letter to dispute a debt collection you're unsure of. Once you send a request for proof, also called a debt validation letter, the collector must stop. A statement that the debt is assumed valid by the collector unless you dispute it within 30 days of the first contact. The debt collector must send a sample debt validation letter five days from the first contact and it must contain the following details a statement saying that the debt collector assumes the validity of the debt unless you send a written dispute within 30 days from the first contact. Debt validation letters and verification letters are two examples. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. You must make your request in writing within 30 days of the debt collector's initial contact with you. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. The debt validation request is time sensitive.

If You Can T Write What Rights Do You Really Have Literacy And The Exercising Of Personal Rights Linguistic Pulse - Under The Fdcpa, You Have The Right To Ask For Validity Of The Debt That The Collection.

How To Dispute The Validity Of A Debt Letter 15 Steps. You must make your request in writing within 30 days of the debt collector's initial contact with you. A statement that the debt is assumed valid by the collector unless you dispute it within 30 days of the first contact. The debt collector must send a sample debt validation letter five days from the first contact and it must contain the following details a statement saying that the debt collector assumes the validity of the debt unless you send a written dispute within 30 days from the first contact. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. Don't act until you have your validation letter. If you receive a phone call or letter from a collector and you are not sure whether you really owe the debt or the amount they say you owe is correct, you have the right to send the collector a debt dispute/debt validation letter. The debt validation request is time sensitive. Debt validation letters and verification letters are two examples. Once you send a request for proof, also called a debt validation letter, the collector must stop. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Sample debt dispute/debt validation letter. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Government agency for the notice should disclose the correct address to which you should send your letter disputing the validity of the debt. In the meantime, you can dispute the validity of the debt with the collection agency.5 x trustworthy source us consumer financial protection bureau u.s. Use this letter to dispute a debt collection you're unsure of.

How To Write A Letter To Dispute A Hospital Bill , You Must Make Your Request In Writing Within 30 Days Of The Debt Collector's Initial Contact With You.

Resolve That Shoeing Dispute With A Demand Letter American Farriers Journal. Government agency for the notice should disclose the correct address to which you should send your letter disputing the validity of the debt. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. In the meantime, you can dispute the validity of the debt with the collection agency.5 x trustworthy source us consumer financial protection bureau u.s. The debt validation request is time sensitive. Once you send a request for proof, also called a debt validation letter, the collector must stop. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. The debt collector must send a sample debt validation letter five days from the first contact and it must contain the following details a statement saying that the debt collector assumes the validity of the debt unless you send a written dispute within 30 days from the first contact. Sample debt dispute/debt validation letter. If you receive a phone call or letter from a collector and you are not sure whether you really owe the debt or the amount they say you owe is correct, you have the right to send the collector a debt dispute/debt validation letter. Don't act until you have your validation letter. You must make your request in writing within 30 days of the debt collector's initial contact with you. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. A statement that the debt is assumed valid by the collector unless you dispute it within 30 days of the first contact. Debt validation letters and verification letters are two examples. Use this letter to dispute a debt collection you're unsure of.

Debt Defense America Brings Us More Debt Dispute Foolishness . Generally, The Advice On Sending A Debt Validation Letter On A Valid Debt Is Premised On Making Sure That The Collection Entity Who Is Attempting To Collect From You Is Legitimate.

How To Respond To A Debt Collection Letter And What To Include In A Debt Validation Letter Toughnickel Money. Sample debt dispute/debt validation letter. Don't act until you have your validation letter. The debt validation request is time sensitive. A statement that the debt is assumed valid by the collector unless you dispute it within 30 days of the first contact. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. Government agency for the notice should disclose the correct address to which you should send your letter disputing the validity of the debt. The debt collector must send a sample debt validation letter five days from the first contact and it must contain the following details a statement saying that the debt collector assumes the validity of the debt unless you send a written dispute within 30 days from the first contact. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Debt validation letters and verification letters are two examples. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. In the meantime, you can dispute the validity of the debt with the collection agency.5 x trustworthy source us consumer financial protection bureau u.s. You must make your request in writing within 30 days of the debt collector's initial contact with you. Use this letter to dispute a debt collection you're unsure of. Once you send a request for proof, also called a debt validation letter, the collector must stop. If you receive a phone call or letter from a collector and you are not sure whether you really owe the debt or the amount they say you owe is correct, you have the right to send the collector a debt dispute/debt validation letter.

Credit Dispute Letters : Debt Validation, Settlement & Dispute Example Letters, Provided By Golden Financial Services.

Debt Dispute Letter How To Use It To Make Collectors Validate Debt. You must make your request in writing within 30 days of the debt collector's initial contact with you. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Sample debt dispute/debt validation letter. In the meantime, you can dispute the validity of the debt with the collection agency.5 x trustworthy source us consumer financial protection bureau u.s. Use this letter to dispute a debt collection you're unsure of. Once you send a request for proof, also called a debt validation letter, the collector must stop. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Don't act until you have your validation letter. Debt validation letters and verification letters are two examples. A statement that the debt is assumed valid by the collector unless you dispute it within 30 days of the first contact. The debt validation request is time sensitive. The debt collector must send a sample debt validation letter five days from the first contact and it must contain the following details a statement saying that the debt collector assumes the validity of the debt unless you send a written dispute within 30 days from the first contact. Government agency for the notice should disclose the correct address to which you should send your letter disputing the validity of the debt. If you receive a phone call or letter from a collector and you are not sure whether you really owe the debt or the amount they say you owe is correct, you have the right to send the collector a debt dispute/debt validation letter.