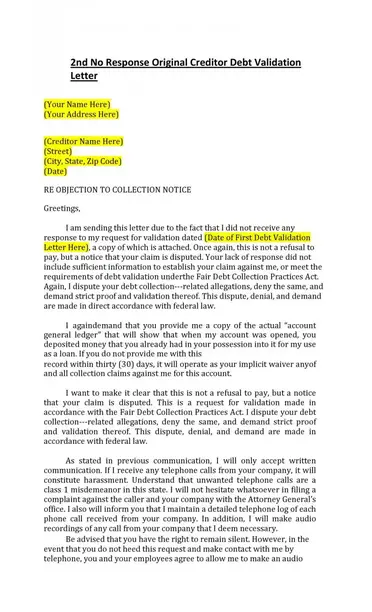

Debt Validation Letter To Dispute Debt. Notice of dispute of debt and request for debt validation. You must make your request in writing within 30 days of the debt collector's initial contact with you. The debt collector must send a sample debt validation letter five days from the first contact and it must contain the following details you only have 30 days if you want to dispute a debt it's required by law that debt collectors should provide you with a debt validation letter template within five days. Use this letter to dispute a debt collection you're unsure of. Writing a debt validation letter can keep you from paying a bogus debt collection. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. A statement that if you write to dispute the debt or request more information within 30 days, the debt collector will verify the debt by mail. The debt validation request is time sensitive. The letter must be sent within thirty (30) days of receiving notice of the. Don't act until you have your validation letter. Debt validation letters and verification letters are two examples. You have just 30 days from the date you receive the validation letter to dispute all or part of the debt. Although these two letters have similar names and content, they do have some key differences.

Debt Validation Letter To Dispute Debt, Debt Validation | If The Debt Collector Has A Bare Account And The Consumer Seeks A Debt A Disputed Debt Could Be:

7 Facts About Writing A Debt Validation Letter Badcredit Org. Use this letter to dispute a debt collection you're unsure of. You must make your request in writing within 30 days of the debt collector's initial contact with you. Notice of dispute of debt and request for debt validation. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Writing a debt validation letter can keep you from paying a bogus debt collection. Debt validation letters and verification letters are two examples. Don't act until you have your validation letter. The debt collector must send a sample debt validation letter five days from the first contact and it must contain the following details you only have 30 days if you want to dispute a debt it's required by law that debt collectors should provide you with a debt validation letter template within five days. Although these two letters have similar names and content, they do have some key differences. A statement that if you write to dispute the debt or request more information within 30 days, the debt collector will verify the debt by mail. You have just 30 days from the date you receive the validation letter to dispute all or part of the debt. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. The debt validation request is time sensitive. The letter must be sent within thirty (30) days of receiving notice of the.

There are two important steps when dealing with agencies attempting to collect repayments:

A debt validation program offers qualified applicants an affordable monthly payment to deal with all of their. If the debt does not belong to you. Within the five days of first contacting you, a debt collector is required to send you a written debt validation letter incorporating the following information Once the debt collector has made contact, they have only five days to provide a debt validation letter. Send debt validation letter to the debt collector if you believe you don't owe the debt and thus, the debt collector has to provide the proof. A debt verification letter is less effective than a debt validation letter, but it still serves a purpose. The debt validation letter and the debt verification letter. If you dispute the debt within 30 days, the debt collector must cease attempts to collect until they've mailed you verification of the debt or a copy how to send a request for validation of debt letter. Choose from the list of debt negotiation letters, debt collection letters, and credit report dispute. Use this letter to dispute a debt collection you're unsure of. I am also requesting that you validate this debt you claim i owe by. People often confuse this validation request as a debt debt verification letters are particularly important to use if you have an overly aggressive debt collector. The term debt validation letter refers to a letter that an individual sends to their creditor or collection agency requesting proof that the debt in question is valid and not outside the statute if you feel there is an item on your credit report that is inaccurate, you should contact experian to dispute the item. Debt validation letter sample (1/2). Notice of dispute of debt and request for debt validation. The debt validation request is time sensitive. Once you receive one, deal with it with the following steps. The right to dispute the debt and receive validation are part of the consumer's rights under the united states federal fair debt collection practices act. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. In your reply, specifically address each disputed item and. A debt validation program offers qualified applicants an affordable monthly payment to deal with all of their. A debt collector sends a validation letter saying what you owe, while you send a verification letter saying why you don't. Was validation of a debt achieved if the lender simply acknowledged an account was present or did it require documentation of all transactions in the you don't need to write a fancy letter, just write a letter saying you dispute the validity of the debt and you would like the collector to provide the. The debt collector must send a sample debt validation letter five days from the first contact and it must contain the following details you only have 30 days if you want to dispute a debt it's required by law that debt collectors should provide you with a debt validation letter template within five days. How to dispute a collector's claim and stop collection activity. Use this sample letter to make them prove it's your debt. Debt validation is your right, and it can be useful, but that doesn't mean it's a tactic that should be used in every debt collection situation. Please reinvestigate these disputed item(s) and send your resolution to my inquiry at the address provided above. Validation of debt can help you stop harassment by debt collectors. Here is a template of a debt validation letter to help you get started: Don't act until you have your validation letter.

Sample Debt Validation Letters How To Respond To Debt Claim: Validation Of Debt Can Help You Stop Harassment By Debt Collectors.

Sample Debt Validation Letters How To Respond To Debt Claim. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. The debt collector must send a sample debt validation letter five days from the first contact and it must contain the following details you only have 30 days if you want to dispute a debt it's required by law that debt collectors should provide you with a debt validation letter template within five days. Writing a debt validation letter can keep you from paying a bogus debt collection. Debt validation letters and verification letters are two examples. You must make your request in writing within 30 days of the debt collector's initial contact with you. A statement that if you write to dispute the debt or request more information within 30 days, the debt collector will verify the debt by mail. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. The debt validation request is time sensitive. Notice of dispute of debt and request for debt validation. The letter must be sent within thirty (30) days of receiving notice of the. You have just 30 days from the date you receive the validation letter to dispute all or part of the debt. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. Don't act until you have your validation letter. Although these two letters have similar names and content, they do have some key differences. Use this letter to dispute a debt collection you're unsure of.

Write An Esi Debt Validation Letter By Ajlegal - Notice Of Dispute Of Debt And Request For Debt Validation.

Sample Debt Validation Letters How To Respond To Debt Claim. The debt collector must send a sample debt validation letter five days from the first contact and it must contain the following details you only have 30 days if you want to dispute a debt it's required by law that debt collectors should provide you with a debt validation letter template within five days. Use this letter to dispute a debt collection you're unsure of. A statement that if you write to dispute the debt or request more information within 30 days, the debt collector will verify the debt by mail. You must make your request in writing within 30 days of the debt collector's initial contact with you. Debt validation letters and verification letters are two examples. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. The debt validation request is time sensitive. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. Don't act until you have your validation letter.

How To Dispute And Ask A Debt Collector To Validate A Debt : What to do if the debt in question is not yours?

Debt Validation Letter. Although these two letters have similar names and content, they do have some key differences. A statement that if you write to dispute the debt or request more information within 30 days, the debt collector will verify the debt by mail. The letter must be sent within thirty (30) days of receiving notice of the. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. The debt collector must send a sample debt validation letter five days from the first contact and it must contain the following details you only have 30 days if you want to dispute a debt it's required by law that debt collectors should provide you with a debt validation letter template within five days. The debt validation request is time sensitive. Use this letter to dispute a debt collection you're unsure of. Don't act until you have your validation letter. Debt validation letters and verification letters are two examples. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. Notice of dispute of debt and request for debt validation. You must make your request in writing within 30 days of the debt collector's initial contact with you. Writing a debt validation letter can keep you from paying a bogus debt collection. You have just 30 days from the date you receive the validation letter to dispute all or part of the debt.

Lesson 24 The Debt Validation Process Credit Warriors - Collectors Must Provide A Debt Validation Letter To Confirm Details Of The Debt, Including The Amount.

Sample Debt Validation Letter To Collection Agency Credit History Government Information. The debt validation request is time sensitive. Don't act until you have your validation letter. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Use this letter to dispute a debt collection you're unsure of. The debt collector must send a sample debt validation letter five days from the first contact and it must contain the following details you only have 30 days if you want to dispute a debt it's required by law that debt collectors should provide you with a debt validation letter template within five days. You have just 30 days from the date you receive the validation letter to dispute all or part of the debt. A statement that if you write to dispute the debt or request more information within 30 days, the debt collector will verify the debt by mail. Debt validation letters and verification letters are two examples. Writing a debt validation letter can keep you from paying a bogus debt collection. Notice of dispute of debt and request for debt validation. Although these two letters have similar names and content, they do have some key differences. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. You must make your request in writing within 30 days of the debt collector's initial contact with you. The letter must be sent within thirty (30) days of receiving notice of the. Collectors must provide a debt validation letter to confirm details of the debt, including the amount.

Debt Validation Discover The Secret Debt Validation Letter That Wil - Before Any Money Changes Hands, Collectors Must Prove That Their Debts Are Legitimate.

Writing A Good Debt Validation Letter By Stella Marie Lee Issuu. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. You have just 30 days from the date you receive the validation letter to dispute all or part of the debt. Debt validation letters and verification letters are two examples. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Writing a debt validation letter can keep you from paying a bogus debt collection. You must make your request in writing within 30 days of the debt collector's initial contact with you. A statement that if you write to dispute the debt or request more information within 30 days, the debt collector will verify the debt by mail. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. The debt validation request is time sensitive. Use this letter to dispute a debt collection you're unsure of. The letter must be sent within thirty (30) days of receiving notice of the. Although these two letters have similar names and content, they do have some key differences. The debt collector must send a sample debt validation letter five days from the first contact and it must contain the following details you only have 30 days if you want to dispute a debt it's required by law that debt collectors should provide you with a debt validation letter template within five days. Don't act until you have your validation letter. Notice of dispute of debt and request for debt validation.

Sample Pay For Delete Letter For Credit Report Cleanup . Within The Five Days Of First Contacting You, A Debt Collector Is Required To Send You A Written Debt Validation Letter Incorporating The Following Information

Free Debt Validation Letter Template Samples Word Pdf Eforms Free Fillable Forms. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. The debt validation request is time sensitive. You must make your request in writing within 30 days of the debt collector's initial contact with you. Writing a debt validation letter can keep you from paying a bogus debt collection. The letter must be sent within thirty (30) days of receiving notice of the. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Don't act until you have your validation letter. A statement that if you write to dispute the debt or request more information within 30 days, the debt collector will verify the debt by mail. Debt validation letters and verification letters are two examples. Use this letter to dispute a debt collection you're unsure of. Although these two letters have similar names and content, they do have some key differences. You have just 30 days from the date you receive the validation letter to dispute all or part of the debt. Notice of dispute of debt and request for debt validation. The debt collector must send a sample debt validation letter five days from the first contact and it must contain the following details you only have 30 days if you want to dispute a debt it's required by law that debt collectors should provide you with a debt validation letter template within five days.

Sample Debt Validation Letters How To Respond To Debt Claim - Debt Collection Agencies Should Reach Out To You With A Debt Validation Letter.

50 Free Debt Validation Letter Samples Templates Á Templatelab. Notice of dispute of debt and request for debt validation. Writing a debt validation letter can keep you from paying a bogus debt collection. The debt validation request is time sensitive. You must make your request in writing within 30 days of the debt collector's initial contact with you. Although these two letters have similar names and content, they do have some key differences. A statement that if you write to dispute the debt or request more information within 30 days, the debt collector will verify the debt by mail. Don't act until you have your validation letter. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Debt validation letters and verification letters are two examples. The debt collector must send a sample debt validation letter five days from the first contact and it must contain the following details you only have 30 days if you want to dispute a debt it's required by law that debt collectors should provide you with a debt validation letter template within five days. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. The letter must be sent within thirty (30) days of receiving notice of the. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Use this letter to dispute a debt collection you're unsure of. You have just 30 days from the date you receive the validation letter to dispute all or part of the debt.

Debt Validation Letter Why It Could Land You In Hot Water - Validation Of Debt Can Help You Stop Harassment By Debt Collectors.

12 Debt Validation Letter Samples Editable Download Word Pdf. The debt validation request is time sensitive. Notice of dispute of debt and request for debt validation. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. Although these two letters have similar names and content, they do have some key differences. You must make your request in writing within 30 days of the debt collector's initial contact with you. The debt collector must send a sample debt validation letter five days from the first contact and it must contain the following details you only have 30 days if you want to dispute a debt it's required by law that debt collectors should provide you with a debt validation letter template within five days. Debt validation letters and verification letters are two examples. You have just 30 days from the date you receive the validation letter to dispute all or part of the debt. Writing a debt validation letter can keep you from paying a bogus debt collection. The letter must be sent within thirty (30) days of receiving notice of the. Use this letter to dispute a debt collection you're unsure of. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. A statement that if you write to dispute the debt or request more information within 30 days, the debt collector will verify the debt by mail. Don't act until you have your validation letter.

Credit Repair Letters The Best Repair Sample Letters By Vanessa Chen Issuu : Please Reinvestigate These Disputed Item(S) And Send Your Resolution To My Inquiry At The Address Provided Above.

Request For Creditor Follow Up Dispute Letters That Work. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. You must make your request in writing within 30 days of the debt collector's initial contact with you. The debt collector must send a sample debt validation letter five days from the first contact and it must contain the following details you only have 30 days if you want to dispute a debt it's required by law that debt collectors should provide you with a debt validation letter template within five days. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Although these two letters have similar names and content, they do have some key differences. The debt validation request is time sensitive. A statement that if you write to dispute the debt or request more information within 30 days, the debt collector will verify the debt by mail. Use this letter to dispute a debt collection you're unsure of. Writing a debt validation letter can keep you from paying a bogus debt collection. You have just 30 days from the date you receive the validation letter to dispute all or part of the debt. Don't act until you have your validation letter. The letter must be sent within thirty (30) days of receiving notice of the. Notice of dispute of debt and request for debt validation. Debt validation letters and verification letters are two examples.

Lesson 24 The Debt Validation Process Credit Warriors : Please Reinvestigate These Disputed Item(S) And Send Your Resolution To My Inquiry At The Address Provided Above.

Free 6 Debt Validation Letters In Pdf Ms Word. The letter must be sent within thirty (30) days of receiving notice of the. Notice of dispute of debt and request for debt validation. Debt validation letters and verification letters are two examples. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. A statement that if you write to dispute the debt or request more information within 30 days, the debt collector will verify the debt by mail. Although these two letters have similar names and content, they do have some key differences. You have just 30 days from the date you receive the validation letter to dispute all or part of the debt. Writing a debt validation letter can keep you from paying a bogus debt collection. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Use this letter to dispute a debt collection you're unsure of. The debt validation request is time sensitive. Don't act until you have your validation letter. You must make your request in writing within 30 days of the debt collector's initial contact with you. The debt collector must send a sample debt validation letter five days from the first contact and it must contain the following details you only have 30 days if you want to dispute a debt it's required by law that debt collectors should provide you with a debt validation letter template within five days.