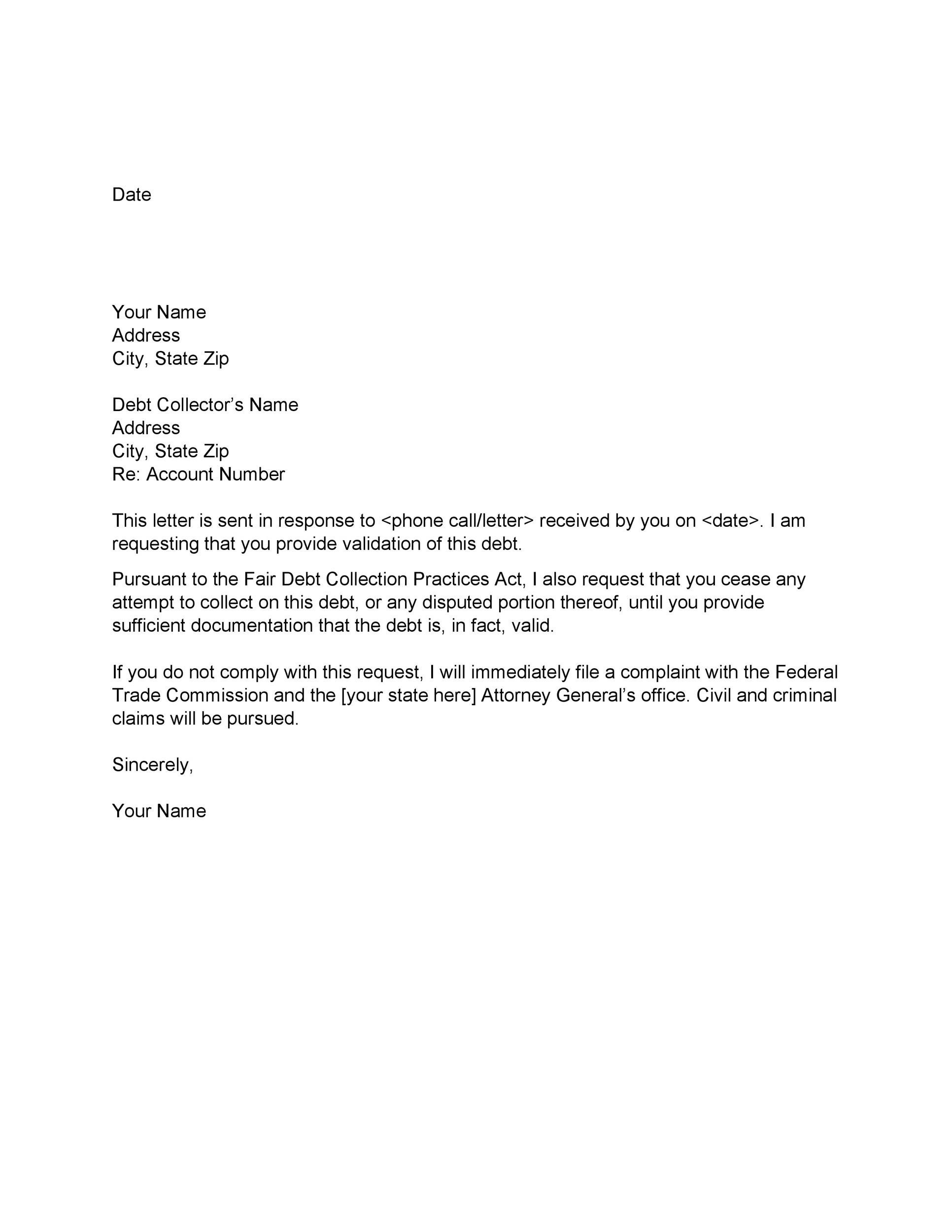

Debt Validation Letter Sample. The fair debt collection practices act (fdcpa) gives you the right to request validation and provides you many other protections against debt collectors. Give a reference to the date of the initial contact. The debt validation request is time sensitive. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. What to do if the debt in question is not yours? When writing a debt validation letter, it is important to ask the following things in the letter: The name of the agency or the creditor seeking payment. You must make your request in writing within 30 days of the debt collector's initial contact with you. The letter below is a sample debt validation letter. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Writing a debt validation letter can keep you from paying a bogus debt collection. The amount that you owe. Sample letters to creditor (when you are unable to pay). For best results, you will need to get familiar with the fdcpa and debt validation if you. The debt collector must send a sample debt validation letter five days from the first contact and it must contain the following details:

Debt Validation Letter Sample, Debt Validation Letters And Verification Letters Are Two Examples.

Consumer Rights Re Student Loans. When writing a debt validation letter, it is important to ask the following things in the letter: What to do if the debt in question is not yours? Give a reference to the date of the initial contact. Writing a debt validation letter can keep you from paying a bogus debt collection. The debt validation request is time sensitive. The fair debt collection practices act (fdcpa) gives you the right to request validation and provides you many other protections against debt collectors. The letter below is a sample debt validation letter. The name of the agency or the creditor seeking payment. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. The debt collector must send a sample debt validation letter five days from the first contact and it must contain the following details: The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. You must make your request in writing within 30 days of the debt collector's initial contact with you. For best results, you will need to get familiar with the fdcpa and debt validation if you. The amount that you owe. Sample letters to creditor (when you are unable to pay).

4.1 if the collection agency doesn't respond.

4.1 if the collection agency doesn't respond. Due to possible inaccuracies in these credit reporting agency reports, i must demand that the validation i hereby lawfully request be in the form of a notarized statement by a person with original knowledge of the. Find sample debt settlement letters (sample debt negotiation letters) and letters on credit/debt in order to contact creditors, cas and credit bureaus. Debt validation letters and verification letters are two examples. When writing a debt validation letter, it is important to ask the following things in the letter: In some cases, lawyers try to get this information by filing a lawsuit against the debtor. Please understand that this is just a formality and i need to check the authenticity of any such letter which deals with paying of debts. The debt validation request is time sensitive. 4.1 if the collection agency doesn't respond. Do not copy either of the letters verbatim. How to write a job offer letter (with samples). I write this letter to request for any debt validation document you hold to say that i have taken this loan from your company. A debt collection letter is a notification a creditor sends to their debtors to inform them of an as you terminate the letter, it's essential to warn the debtor of the repercussions of not honoring the debt debt validation letter (format and samples). Don't act until you have your validation letter. The name of the agency or the creditor seeking payment. Below you will find an example of a debt validation letter. Documents similar to sample debt validation letter to collection agency. A debt validation letter will be the document to use for this purpose. A debt collector sends a validation letter saying what you owe, while you send a verification letter saying why you don't. If you have an issue with your debt collector, these free templates will. The letter below is a sample debt validation letter. These can be used when dealing with debt collectors. Should your offices provide the proper documentation validating the debt, i will require at least 30 days to investigate this information. You can use this letter as is, simply change the relevant details. There are two versions of the debt validation letter. Sample letters to creditor (when you are unable to pay). 4 debt validation letter responses: Before any money changes hands, collectors must you'll find a sample debt validation letter in our free consumer guide to good credit, along with. The debt validation sample letter below will help you confirm the. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. Craft your letter as a response to the specific information provided in the debt validation letter or from your other contact with the debt collector, according to bruce mcclary.

Free Debt Validation Letter Template Samples Word Pdf Eforms Free Fillable Forms: The Debt Validation Letter Is Sent By A Consumer To Verify A Debt By Providing Evidence Of The Claim.

7 Facts About Writing A Debt Validation Letter Badcredit Org. Writing a debt validation letter can keep you from paying a bogus debt collection. The debt validation request is time sensitive. The amount that you owe. The debt collector must send a sample debt validation letter five days from the first contact and it must contain the following details: The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Give a reference to the date of the initial contact. When writing a debt validation letter, it is important to ask the following things in the letter: The letter below is a sample debt validation letter. The name of the agency or the creditor seeking payment. You must make your request in writing within 30 days of the debt collector's initial contact with you. For best results, you will need to get familiar with the fdcpa and debt validation if you. Sample letters to creditor (when you are unable to pay). What to do if the debt in question is not yours? The fair debt collection practices act (fdcpa) gives you the right to request validation and provides you many other protections against debt collectors.

Debt Validation Letter Why It Could Land You In Hot Water . In Some Cases, Lawyers Try To Get This Information By Filing A Lawsuit Against The Debtor.

Writing A Good Debt Validation Letter By Stella Marie Lee Issuu. Give a reference to the date of the initial contact. The amount that you owe. The fair debt collection practices act (fdcpa) gives you the right to request validation and provides you many other protections against debt collectors. Writing a debt validation letter can keep you from paying a bogus debt collection. The debt validation request is time sensitive. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Sample letters to creditor (when you are unable to pay). The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. When writing a debt validation letter, it is important to ask the following things in the letter: What to do if the debt in question is not yours?

Sample Debt Validation Letter 2020 S Updated Template Guide , Collectors must provide a debt validation letter to confirm details of the debt, including the amount.

50 Free Debt Validation Letter Samples Templates Á Templatelab. The debt collector must send a sample debt validation letter five days from the first contact and it must contain the following details: The name of the agency or the creditor seeking payment. You must make your request in writing within 30 days of the debt collector's initial contact with you. Sample letters to creditor (when you are unable to pay). The letter below is a sample debt validation letter. The amount that you owe. What to do if the debt in question is not yours? The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Give a reference to the date of the initial contact. The debt validation request is time sensitive. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. The fair debt collection practices act (fdcpa) gives you the right to request validation and provides you many other protections against debt collectors. Writing a debt validation letter can keep you from paying a bogus debt collection. When writing a debt validation letter, it is important to ask the following things in the letter: For best results, you will need to get familiar with the fdcpa and debt validation if you.

Demand Letter How To Write 20 Sample Letters Examples : Get A Sample Debt Validation Letter To Send To Debt Collectors, In Accordance With The Fair Debt Collection Practices Act (Fdcpa) And Exercise Your Consumer Rights.

Debt Validation Letter Why It Could Land You In Hot Water. The debt validation request is time sensitive. Sample letters to creditor (when you are unable to pay). The fair debt collection practices act (fdcpa) gives you the right to request validation and provides you many other protections against debt collectors. For best results, you will need to get familiar with the fdcpa and debt validation if you. What to do if the debt in question is not yours? The name of the agency or the creditor seeking payment. Writing a debt validation letter can keep you from paying a bogus debt collection. You must make your request in writing within 30 days of the debt collector's initial contact with you. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Give a reference to the date of the initial contact. When writing a debt validation letter, it is important to ask the following things in the letter: The letter below is a sample debt validation letter. The debt collector must send a sample debt validation letter five days from the first contact and it must contain the following details: The amount that you owe. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act.

Debt Validation Letter How To Write Samples Templates - There Are Two Versions Of The Debt Validation Letter.

Debt Validation Programs How To Fight A Debt And Win. What to do if the debt in question is not yours? You must make your request in writing within 30 days of the debt collector's initial contact with you. The fair debt collection practices act (fdcpa) gives you the right to request validation and provides you many other protections against debt collectors. The debt validation request is time sensitive. Writing a debt validation letter can keep you from paying a bogus debt collection. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. The amount that you owe. The letter below is a sample debt validation letter. When writing a debt validation letter, it is important to ask the following things in the letter: The debt collector must send a sample debt validation letter five days from the first contact and it must contain the following details: Give a reference to the date of the initial contact. The name of the agency or the creditor seeking payment. Sample letters to creditor (when you are unable to pay). For best results, you will need to get familiar with the fdcpa and debt validation if you.

Sample Student Loan Debt Validation Letter : A Debt Validation Letter Is A Written Request Sent To The Creditor Or Collection Agency By The Consumer Requesting That They Prove They Can Legally Collect On The Debt.

Pay For Delete Sample Letter 2020 Updated Tips Template Guide. The debt collector must send a sample debt validation letter five days from the first contact and it must contain the following details: What to do if the debt in question is not yours? For best results, you will need to get familiar with the fdcpa and debt validation if you. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. The amount that you owe. The fair debt collection practices act (fdcpa) gives you the right to request validation and provides you many other protections against debt collectors. The letter below is a sample debt validation letter. The name of the agency or the creditor seeking payment. Give a reference to the date of the initial contact. Sample letters to creditor (when you are unable to pay). When writing a debt validation letter, it is important to ask the following things in the letter: Writing a debt validation letter can keep you from paying a bogus debt collection. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. The debt validation request is time sensitive. You must make your request in writing within 30 days of the debt collector's initial contact with you.

Sample Debt Validation Letter Qfinance - You Must Make Your Request In Writing Within 30 Days Of The Debt Collector's Initial Contact With You.

Debt Validation Programs How To Fight A Debt And Win. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. The amount that you owe. Sample letters to creditor (when you are unable to pay). Writing a debt validation letter can keep you from paying a bogus debt collection. The name of the agency or the creditor seeking payment. What to do if the debt in question is not yours? The fair debt collection practices act (fdcpa) gives you the right to request validation and provides you many other protections against debt collectors. When writing a debt validation letter, it is important to ask the following things in the letter: The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. The letter below is a sample debt validation letter. You must make your request in writing within 30 days of the debt collector's initial contact with you. Give a reference to the date of the initial contact. For best results, you will need to get familiar with the fdcpa and debt validation if you. The debt collector must send a sample debt validation letter five days from the first contact and it must contain the following details: The debt validation request is time sensitive.

Sample Debt Validation Letter To Collection Agency - Use Our Sample Debt Validation Letter As A Template For Your Validation Letter.

Free 6 Debt Validation Letters In Pdf Ms Word. Writing a debt validation letter can keep you from paying a bogus debt collection. When writing a debt validation letter, it is important to ask the following things in the letter: The amount that you owe. The name of the agency or the creditor seeking payment. The letter below is a sample debt validation letter. The fair debt collection practices act (fdcpa) gives you the right to request validation and provides you many other protections against debt collectors. The debt validation request is time sensitive. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. For best results, you will need to get familiar with the fdcpa and debt validation if you. Give a reference to the date of the initial contact. You must make your request in writing within 30 days of the debt collector's initial contact with you. What to do if the debt in question is not yours? The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Sample letters to creditor (when you are unable to pay). The debt collector must send a sample debt validation letter five days from the first contact and it must contain the following details:

Debt Validation Letter Why It Could Land You In Hot Water , Debt Validation Letters Are Essential In Getting The Correct Information From A Creditor, Or Eliminating Bad Information From Your Credit File.

12 Debt Validation Letter Samples Editable Download Word Pdf. The fair debt collection practices act (fdcpa) gives you the right to request validation and provides you many other protections against debt collectors. The amount that you owe. Sample letters to creditor (when you are unable to pay). The debt collector must send a sample debt validation letter five days from the first contact and it must contain the following details: What to do if the debt in question is not yours? When writing a debt validation letter, it is important to ask the following things in the letter: The debt validation request is time sensitive. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. For best results, you will need to get familiar with the fdcpa and debt validation if you. The letter below is a sample debt validation letter. You must make your request in writing within 30 days of the debt collector's initial contact with you. Writing a debt validation letter can keep you from paying a bogus debt collection. Give a reference to the date of the initial contact. The name of the agency or the creditor seeking payment.

Sample Debt Validation Letter Collection Agency Government Information . However, This Is Not Usually Upheld In Court, And The Lender Must Respond To The Debt Validation Letter Before They Can Get A Legal.

Free Debt Validation Letter Templates Customize Print Pdf Templateroller. For best results, you will need to get familiar with the fdcpa and debt validation if you. Sample letters to creditor (when you are unable to pay). Give a reference to the date of the initial contact. What to do if the debt in question is not yours? The amount that you owe. Writing a debt validation letter can keep you from paying a bogus debt collection. The name of the agency or the creditor seeking payment. The debt collector must send a sample debt validation letter five days from the first contact and it must contain the following details: You must make your request in writing within 30 days of the debt collector's initial contact with you. When writing a debt validation letter, it is important to ask the following things in the letter: The fair debt collection practices act (fdcpa) gives you the right to request validation and provides you many other protections against debt collectors. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. The letter below is a sample debt validation letter. The debt validation request is time sensitive. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim.