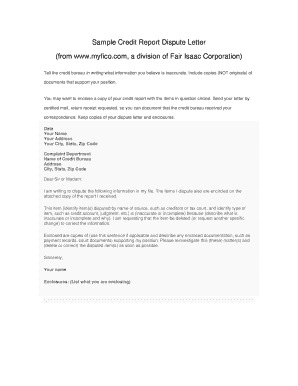

Debt Validation Letter Response. Table of contents should you request for validation of debt letter? Debt validation letters and verification letters are two examples. Sample debt validation letter here is a sample debt validation letter you can use to send to creditors: Debt collectors must send a validation letter giving info about the debt you're being asked to pay. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Debt collectors are required to present debt validation letters to the person who owe the money. Account number dear debt collector: Don't act until you have your validation letter. The letter must be sent within thirty (30) days of receiving notice of the. We've put together some facts to help you get the information you need to validate your debts. Although these two letters have similar names and content, they do have some key differences. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Sample debt validation/verification letters this letter is in response to a (insert how the information was received, for example, a letter or. Based on the fair debt collection practices act, debt collectors must provide you with a debt validation letter which contains information regarding the debt in question. Collectors must provide a debt validation letter to confirm details of the debt, including the amount.

Debt Validation Letter Response. Once I Validate Your Debt Receipts, I.

Sample Debt Validation Letters How To Respond To Debt Claim. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. We've put together some facts to help you get the information you need to validate your debts. Debt collectors must send a validation letter giving info about the debt you're being asked to pay. Don't act until you have your validation letter. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. Based on the fair debt collection practices act, debt collectors must provide you with a debt validation letter which contains information regarding the debt in question. Debt collectors are required to present debt validation letters to the person who owe the money. The letter must be sent within thirty (30) days of receiving notice of the. Account number dear debt collector: Sample debt validation letter here is a sample debt validation letter you can use to send to creditors: Table of contents should you request for validation of debt letter? Sample debt validation/verification letters this letter is in response to a (insert how the information was received, for example, a letter or. Debt validation letters and verification letters are two examples. Although these two letters have similar names and content, they do have some key differences.

Debt validation request letter example, free format and information on making and writing debt i am lisa carter and i am writing this letter in response to the letter you sent to my address with a this letter in no terms means that i am denying any payment to you.

In fact, this is highly advised against. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. In some cases, lawyers try to get this information by filing a lawsuit against the debtor. This letter is sent in response to a letter/phone call i received on date you received the letter/call. My debt is not substantial, a. What to do after sending your letter. Debt validation letters should be concise and professional. Thank you for reviewing these requests and sending through your speedy and clear response. While it may be that you don't receive it for the reasons above. This letter is sent in response to received by you on. Debt collection agencies should reach out to you with a debt validation letter. Be advised, this is not a refusal to pay, but validation is requested. Debt collectors are required to present debt validation letters to the person who owe the money. Debt validation is where you try to find out whether the collection agency (ca) has the legal right to collect on the debt by asking them to provide you with proof. Sample debt validation/verification letters this letter is in response to a (insert how the information was received, for example, a letter or. Debt validation request letter example, free format and information on making and writing debt i am lisa carter and i am writing this letter in response to the letter you sent to my address with a this letter in no terms means that i am denying any payment to you. However, this is not usually upheld in court, and the lender must respond to the debt validation letter before they can get a legal. You can send a simple debt validation letter merely asking for confirmation of the debt, but using a more professional letter could scare off zombie. What does a debt validation letter look like? The debt validation letter and the debt verification letter. Following is a sample debt validation letter that you can use to request the creditor/collection agency verify that the debt is actually yours and you are legally bound to pay that debt. I am reviewing your claim that i owe this debt and require. Debt validation letter sample (1/2). Once you receive one, deal with it with the following steps. I sent a debt validation letter to a collection agency and it's been over 30 days and still i haven't received a response. I am way beyond that point. Just be careful that they might be in the process of suing you. This letter may be headed something like letter before action or notice of pending legal action or even where do you stand if the reply form wasn't sent but a detailed response to the lbc was sent clearly. We've put together some facts to help you get the information you need to validate your debts. The specific structure of the debt validation letter varies, but it should include you have 30 days after you receive a debt validation notice to send a letter disputing it, according to the fdcpa's requirements.

Debt Verification Letter By Stella Marie Lee Issuu: Just Be Careful That They Might Be In The Process Of Suing You.

Response To A Credit Card Lawsuit Answering A Summons. Sample debt validation/verification letters this letter is in response to a (insert how the information was received, for example, a letter or. Although these two letters have similar names and content, they do have some key differences. We've put together some facts to help you get the information you need to validate your debts. Account number dear debt collector: The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. The letter must be sent within thirty (30) days of receiving notice of the. Table of contents should you request for validation of debt letter? Don't act until you have your validation letter. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Based on the fair debt collection practices act, debt collectors must provide you with a debt validation letter which contains information regarding the debt in question. Sample debt validation letter here is a sample debt validation letter you can use to send to creditors: Debt collectors must send a validation letter giving info about the debt you're being asked to pay. Debt validation letters and verification letters are two examples. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. Debt collectors are required to present debt validation letters to the person who owe the money.

Sample Debt Validation Letters How To Respond To Debt Claim - Should Your Offices Provide The Proper Documentation Validating The Debt, I Will Require At Least 30 Days To Investigate This Information.

50 Free Debt Validation Letter Samples Templates Á Templatelab. Although these two letters have similar names and content, they do have some key differences. Debt validation letters and verification letters are two examples. Account number dear debt collector: Don't act until you have your validation letter. Sample debt validation letter here is a sample debt validation letter you can use to send to creditors: We've put together some facts to help you get the information you need to validate your debts. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Debt collectors are required to present debt validation letters to the person who owe the money. Sample debt validation/verification letters this letter is in response to a (insert how the information was received, for example, a letter or. Based on the fair debt collection practices act, debt collectors must provide you with a debt validation letter which contains information regarding the debt in question.

Consumer Rights Re Student Loans . The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim.

Debt Letter Template 7 Free Word Pdf Format Download Free Premium Templates. Debt collectors must send a validation letter giving info about the debt you're being asked to pay. Based on the fair debt collection practices act, debt collectors must provide you with a debt validation letter which contains information regarding the debt in question. Although these two letters have similar names and content, they do have some key differences. Sample debt validation/verification letters this letter is in response to a (insert how the information was received, for example, a letter or. Account number dear debt collector: The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. Table of contents should you request for validation of debt letter? Debt collectors are required to present debt validation letters to the person who owe the money. Debt validation letters and verification letters are two examples. Don't act until you have your validation letter. The letter must be sent within thirty (30) days of receiving notice of the. Sample debt validation letter here is a sample debt validation letter you can use to send to creditors: We've put together some facts to help you get the information you need to validate your debts. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act.

Follow Up Debt Validation No Response To 3 Letter Business Law Justice - I Am Reviewing Your Claim That I Owe This Debt And Require.

Method Of Verification Sample Letter 2020 S Updated Template Guide. Table of contents should you request for validation of debt letter? We've put together some facts to help you get the information you need to validate your debts. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. Sample debt validation letter here is a sample debt validation letter you can use to send to creditors: The letter must be sent within thirty (30) days of receiving notice of the. Don't act until you have your validation letter. Based on the fair debt collection practices act, debt collectors must provide you with a debt validation letter which contains information regarding the debt in question. Although these two letters have similar names and content, they do have some key differences. Debt collectors must send a validation letter giving info about the debt you're being asked to pay. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Debt collectors are required to present debt validation letters to the person who owe the money. Debt validation letters and verification letters are two examples. Account number dear debt collector: Sample debt validation/verification letters this letter is in response to a (insert how the information was received, for example, a letter or.

Sample Debt Validation Letter For Debt Collectors Sample Site F - Debt Validation Letter Sample (1/2).

Do You Still Have To Pay Your Debts If They Re Sold To A Collections Agency Clark Howard. Debt collectors are required to present debt validation letters to the person who owe the money. Table of contents should you request for validation of debt letter? Account number dear debt collector: Don't act until you have your validation letter. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Sample debt validation/verification letters this letter is in response to a (insert how the information was received, for example, a letter or. Debt validation letters and verification letters are two examples. Although these two letters have similar names and content, they do have some key differences. Sample debt validation letter here is a sample debt validation letter you can use to send to creditors: Collectors must provide a debt validation letter to confirm details of the debt, including the amount. Based on the fair debt collection practices act, debt collectors must provide you with a debt validation letter which contains information regarding the debt in question. Debt collectors must send a validation letter giving info about the debt you're being asked to pay. The letter must be sent within thirty (30) days of receiving notice of the. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. We've put together some facts to help you get the information you need to validate your debts.

Debt Verification Letter By Stella Marie Lee Issuu . I Am Requesting That You Provide Verification Of This Debt.

12 Debt Validation Letter Samples Editable Download Word Pdf. The letter must be sent within thirty (30) days of receiving notice of the. Account number dear debt collector: Debt validation letters and verification letters are two examples. Although these two letters have similar names and content, they do have some key differences. Debt collectors are required to present debt validation letters to the person who owe the money. Don't act until you have your validation letter. Debt collectors must send a validation letter giving info about the debt you're being asked to pay. Sample debt validation/verification letters this letter is in response to a (insert how the information was received, for example, a letter or. Based on the fair debt collection practices act, debt collectors must provide you with a debt validation letter which contains information regarding the debt in question. We've put together some facts to help you get the information you need to validate your debts. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Table of contents should you request for validation of debt letter? Sample debt validation letter here is a sample debt validation letter you can use to send to creditors: Collectors must provide a debt validation letter to confirm details of the debt, including the amount.

Debt Validation Letter Credit Repair Secrets Exposed Here Credit Repair Credit Repair Letters Check Credit Score . The Term Debt Validation Letter Refers To A Letter That An Individual Sends To Their Creditor Or Collection Agency Requesting Proof That The Debt In Question Is Valid And Not Outside.

New Debt Validation Letter Sample Download Https Letterbuis Com New Debt Validation Letter Sample Download Lettering Letter Sample Letter Templates. The letter must be sent within thirty (30) days of receiving notice of the. Debt collectors must send a validation letter giving info about the debt you're being asked to pay. Sample debt validation/verification letters this letter is in response to a (insert how the information was received, for example, a letter or. Based on the fair debt collection practices act, debt collectors must provide you with a debt validation letter which contains information regarding the debt in question. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Account number dear debt collector: Although these two letters have similar names and content, they do have some key differences. Debt validation letters and verification letters are two examples. Table of contents should you request for validation of debt letter? The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Sample debt validation letter here is a sample debt validation letter you can use to send to creditors: Debt collectors are required to present debt validation letters to the person who owe the money. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. We've put together some facts to help you get the information you need to validate your debts. Don't act until you have your validation letter.

Free 6 Debt Letter Templates In Ms Word Pdf , I Am Reviewing Your Claim That I Owe This Debt And Require.

50 Free Debt Validation Letter Samples Templates Á Templatelab. The letter must be sent within thirty (30) days of receiving notice of the. Don't act until you have your validation letter. Sample debt validation letter here is a sample debt validation letter you can use to send to creditors: Table of contents should you request for validation of debt letter? Account number dear debt collector: Debt collectors are required to present debt validation letters to the person who owe the money. We've put together some facts to help you get the information you need to validate your debts. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Debt validation letters and verification letters are two examples. Debt collectors must send a validation letter giving info about the debt you're being asked to pay. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Based on the fair debt collection practices act, debt collectors must provide you with a debt validation letter which contains information regarding the debt in question. Although these two letters have similar names and content, they do have some key differences. Collectors must provide a debt validation letter to confirm details of the debt, including the amount. Sample debt validation/verification letters this letter is in response to a (insert how the information was received, for example, a letter or.

Disputing A Collection Letter In Greenwood Since 2015 - Debt Validation Letters And Verification Letters Are Two Examples.

12 Debt Validation Letter Samples Editable Download Word Pdf. Don't act until you have your validation letter. Sample debt validation letter here is a sample debt validation letter you can use to send to creditors: Collectors must provide a debt validation letter to confirm details of the debt, including the amount. The letter must be sent within thirty (30) days of receiving notice of the. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Account number dear debt collector: Table of contents should you request for validation of debt letter? Sample debt validation/verification letters this letter is in response to a (insert how the information was received, for example, a letter or. Debt validation letters and verification letters are two examples. Debt collectors must send a validation letter giving info about the debt you're being asked to pay. Based on the fair debt collection practices act, debt collectors must provide you with a debt validation letter which contains information regarding the debt in question. Debt collectors are required to present debt validation letters to the person who owe the money. We've put together some facts to help you get the information you need to validate your debts. Although these two letters have similar names and content, they do have some key differences.

50 Free Debt Validation Letter Samples Templates Á Templatelab , I Am Reviewing Your Claim That I Owe This Debt And Require.

Debt Validation Letter Why It Could Land You In Hot Water. Sample debt validation/verification letters this letter is in response to a (insert how the information was received, for example, a letter or. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. The letter must be sent within thirty (30) days of receiving notice of the. Based on the fair debt collection practices act, debt collectors must provide you with a debt validation letter which contains information regarding the debt in question. Although these two letters have similar names and content, they do have some key differences. Table of contents should you request for validation of debt letter? Debt collectors are required to present debt validation letters to the person who owe the money. Debt validation letters and verification letters are two examples. Account number dear debt collector: We've put together some facts to help you get the information you need to validate your debts. Debt collectors must send a validation letter giving info about the debt you're being asked to pay. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Don't act until you have your validation letter. Sample debt validation letter here is a sample debt validation letter you can use to send to creditors: Collectors must provide a debt validation letter to confirm details of the debt, including the amount.