Debt Negotiation Letter. Find sample debt settlement letters (sample debt negotiation letters) and letters on credit/debt in order to contact creditors, cas and credit bureaus. There are 16 references cited in this article, which can be found at the bottom of the page. 21 sample letters to negotiate your debt for reduced settlements and alternate repayment plans. Print or download sample debt validation, debt verification, cease and desist, wage garnishment revokation, and pay for delete settlement letter for. A debt negotiation letter is a good way to start the discussions between you and the creditor and hopefully make financial arrangements you can live with. If you owe a creditor more money than you can afford to pay right now, writing a debt negotiation letter is the first step in attempting to pay down your debt in a way that. This section contains sample letters you can use to negotiate reduced settlements or alternate payment arrangements with your unsecured creditors and debt collectors, as well as letters to send. When writing a debt negotiating letter, a person should tally up what is owed, come up with a reasonable amount that can be afforded, and be specific on. This article has been viewed 41,722 times. Debtors may think that they already know the debt amount but should remember that other charges. Should you end up in court, you can prove that you tried to settle the debt and let the creditor know. The funds that i am eager. Fax and mail a copy of that letter to the collection agency, along with your debt hardship letter, budget included with this letter is a settlement offer that i am willing to pay today to resolve this debt in one lump sum payment. This letter is important for many aspects. A debt settlement negotiation letter is not a difficult thing to set out, and the content will depend on the true amount of the debt should be obtained before trying to start any debt settlement negotiations.

Debt Negotiation Letter- The Feeling Of Debt Relief Could Quickly Give Way To Disappointment, Especially If You Learn That The Derogatory Information From That Collection Account Is.

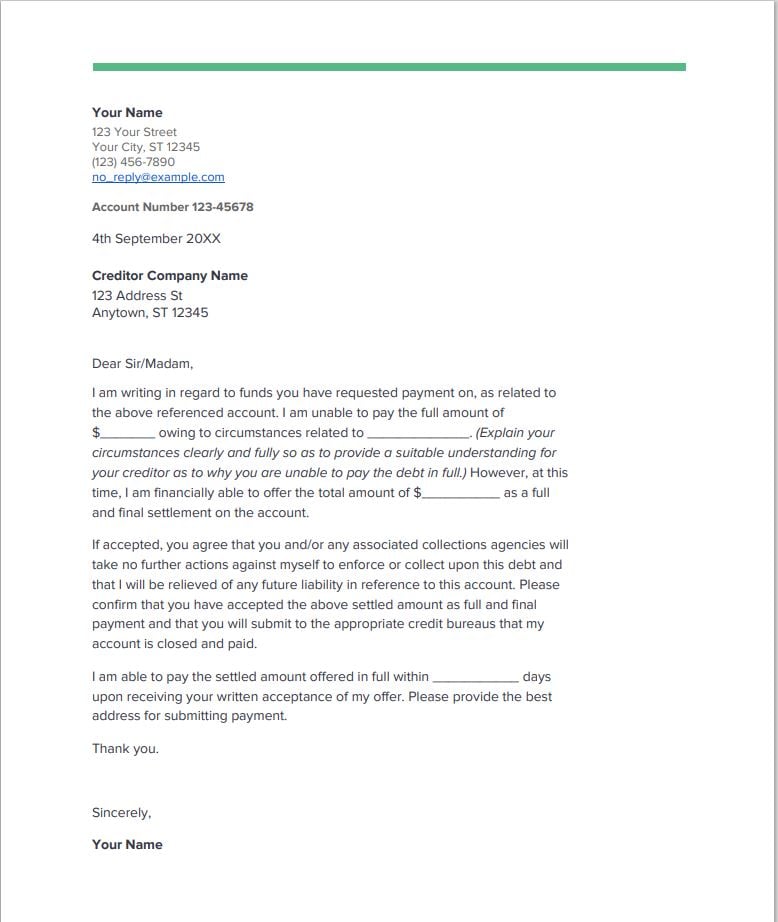

Debt Settlement Offer Letter Samples Templates Word Pdf. This section contains sample letters you can use to negotiate reduced settlements or alternate payment arrangements with your unsecured creditors and debt collectors, as well as letters to send. When writing a debt negotiating letter, a person should tally up what is owed, come up with a reasonable amount that can be afforded, and be specific on. There are 16 references cited in this article, which can be found at the bottom of the page. If you owe a creditor more money than you can afford to pay right now, writing a debt negotiation letter is the first step in attempting to pay down your debt in a way that. The funds that i am eager. A debt negotiation letter is a good way to start the discussions between you and the creditor and hopefully make financial arrangements you can live with. Find sample debt settlement letters (sample debt negotiation letters) and letters on credit/debt in order to contact creditors, cas and credit bureaus. Should you end up in court, you can prove that you tried to settle the debt and let the creditor know. This letter is important for many aspects. 21 sample letters to negotiate your debt for reduced settlements and alternate repayment plans. This article has been viewed 41,722 times. A debt settlement negotiation letter is not a difficult thing to set out, and the content will depend on the true amount of the debt should be obtained before trying to start any debt settlement negotiations. Fax and mail a copy of that letter to the collection agency, along with your debt hardship letter, budget included with this letter is a settlement offer that i am willing to pay today to resolve this debt in one lump sum payment. Print or download sample debt validation, debt verification, cease and desist, wage garnishment revokation, and pay for delete settlement letter for. Debtors may think that they already know the debt amount but should remember that other charges.

Home » sample letters » sample acceptance letter after negotiation.

There are 16 references cited in this article, which can be found at the bottom of the page. Before you contact the creditor or collector, figure out your goals. Each year thousands of debts are settled with these letters confirming terms. This is a template letter to your creditors requesting that they forgive your debt and write it off for compassionate reasons. Appearing professional in the letter can help those with whom you are negotiating to take you more seriously. Debt negotiation letter on mainkeys. These programs should not be confused with credit counseling or debt management plans (dmps). This letter is important for many aspects. Wikihow.com,mortgage rates credit cards refinance home cd rates by bankrate.com,debt relief steps are important, and lots of options are out there, get free help with comprehensive reviews of debt solutions so you can choose the right one for you. In addition, some creditors will ask for 80% of thebalance but this is just a starting. Find sample debt settlement letters (sample debt negotiation letters) and letters on credit/debt in order to contact creditors, cas and credit bureaus. Writing a debt settlement letter is a professional way of negotiating with creditors when you are having difficulty meeting your financial obligations. A debt negotiation letter is a good way to start the discussions between you and the creditor and hopefully make financial arrangements you can live with. Draft your negotiation letter with care; Use these tips to boost your confidence to negotiate payments. This process is often called debt settlement or debt negotiation. for example, you might settle a debt by getting the creditor to accept a lower amount or perhaps you can negotiate lower payments, either temporarily or permanently. Negotiating a debt settlement on your own is not easy, but it. The negotiation process might take a little back and forth. Negotiating debt and paying the new agreement requires a settlement letter. A negotiation letter is a letter which is used in negotiations over a business matter such as the terms of a job offer, a salary, or a debt. But salaries are not all that are negotiated during our struggle to bag the job we have always wanted. Writing a good debt settlement letter is essential for a favorable outcome when negotiating with your creditors. …to begin the debt settlement process, you must send out an initial settlement offer. Here's how diy debt settlement negotiations work, how it here is a list of our partners. Verbal communication with creditors and debt collectors are a necessary part of the debt negotiation process. A pay for delete letter is a negotiation tool. No letter, no deal, no exceptions, ever! It is a good idea to type the in this letter, you will propose that you pay a smaller amount of money than the original balance. Debt negotiation programs (dnps) are the last resort for those struggling to manage their debt. Whether it is overwhelming credit card debt or an inability to make your loan payments, financial delinquency is very stressful and can really hurt your credit score. In the course of negotiating settlements, you will sometimes run into lazy or misinformed debt collectors who refuse to grant a proper letter.

Settlement Letter With Capital One Client Saved 80, Debt Negotiation Programs (Dnps) Are The Last Resort For Those Struggling To Manage Their Debt.

Sample Letters Settlement Offer Letter Debbie Debtor 123 Debt Street Debtsville Ca Pdf Free Download. Fax and mail a copy of that letter to the collection agency, along with your debt hardship letter, budget included with this letter is a settlement offer that i am willing to pay today to resolve this debt in one lump sum payment. This article has been viewed 41,722 times. When writing a debt negotiating letter, a person should tally up what is owed, come up with a reasonable amount that can be afforded, and be specific on. This letter is important for many aspects. This section contains sample letters you can use to negotiate reduced settlements or alternate payment arrangements with your unsecured creditors and debt collectors, as well as letters to send. Find sample debt settlement letters (sample debt negotiation letters) and letters on credit/debt in order to contact creditors, cas and credit bureaus. The funds that i am eager. 21 sample letters to negotiate your debt for reduced settlements and alternate repayment plans. If you owe a creditor more money than you can afford to pay right now, writing a debt negotiation letter is the first step in attempting to pay down your debt in a way that. A debt negotiation letter is a good way to start the discussions between you and the creditor and hopefully make financial arrangements you can live with. Should you end up in court, you can prove that you tried to settle the debt and let the creditor know. Print or download sample debt validation, debt verification, cease and desist, wage garnishment revokation, and pay for delete settlement letter for. A debt settlement negotiation letter is not a difficult thing to set out, and the content will depend on the true amount of the debt should be obtained before trying to start any debt settlement negotiations. Debtors may think that they already know the debt amount but should remember that other charges. There are 16 references cited in this article, which can be found at the bottom of the page.

Should I Write A Debt Settlement Offer Letter : This Is Also Called An Unsolicited Offer.

Judgement Settlement Letter Example Fill Online Printable Fillable Blank Pdffiller. Find sample debt settlement letters (sample debt negotiation letters) and letters on credit/debt in order to contact creditors, cas and credit bureaus. This section contains sample letters you can use to negotiate reduced settlements or alternate payment arrangements with your unsecured creditors and debt collectors, as well as letters to send. There are 16 references cited in this article, which can be found at the bottom of the page. Should you end up in court, you can prove that you tried to settle the debt and let the creditor know. If you owe a creditor more money than you can afford to pay right now, writing a debt negotiation letter is the first step in attempting to pay down your debt in a way that. Fax and mail a copy of that letter to the collection agency, along with your debt hardship letter, budget included with this letter is a settlement offer that i am willing to pay today to resolve this debt in one lump sum payment. 21 sample letters to negotiate your debt for reduced settlements and alternate repayment plans. When writing a debt negotiating letter, a person should tally up what is owed, come up with a reasonable amount that can be afforded, and be specific on. A debt settlement negotiation letter is not a difficult thing to set out, and the content will depend on the true amount of the debt should be obtained before trying to start any debt settlement negotiations. This letter is important for many aspects.

How To Negotiate Credit Card Debt Settle On Your Own W 4 Easy Steps . A letter of demand serves as a finally warning to a recalcitrant debtor if you send a letter of demand you've drafted yourself and you don't get a response, you can consider having a solicitor or debt collection agency.

Debt Dispute Letter Template Addictionary. Debtors may think that they already know the debt amount but should remember that other charges. The funds that i am eager. If you owe a creditor more money than you can afford to pay right now, writing a debt negotiation letter is the first step in attempting to pay down your debt in a way that. This letter is important for many aspects. Fax and mail a copy of that letter to the collection agency, along with your debt hardship letter, budget included with this letter is a settlement offer that i am willing to pay today to resolve this debt in one lump sum payment. A debt negotiation letter is a good way to start the discussions between you and the creditor and hopefully make financial arrangements you can live with. This article has been viewed 41,722 times. Should you end up in court, you can prove that you tried to settle the debt and let the creditor know. A debt settlement negotiation letter is not a difficult thing to set out, and the content will depend on the true amount of the debt should be obtained before trying to start any debt settlement negotiations. 21 sample letters to negotiate your debt for reduced settlements and alternate repayment plans. Find sample debt settlement letters (sample debt negotiation letters) and letters on credit/debt in order to contact creditors, cas and credit bureaus. This section contains sample letters you can use to negotiate reduced settlements or alternate payment arrangements with your unsecured creditors and debt collectors, as well as letters to send. Print or download sample debt validation, debt verification, cease and desist, wage garnishment revokation, and pay for delete settlement letter for. When writing a debt negotiating letter, a person should tally up what is owed, come up with a reasonable amount that can be afforded, and be specific on. There are 16 references cited in this article, which can be found at the bottom of the page.

Settlement Letters From Pnc Bank Consumer Debt Help Association . The Negotiation Process Might Take A Little Back And Forth.

How To Write A Debt Settlement Proposal Letter United Settlement. A debt negotiation letter is a good way to start the discussions between you and the creditor and hopefully make financial arrangements you can live with. There are 16 references cited in this article, which can be found at the bottom of the page. If you owe a creditor more money than you can afford to pay right now, writing a debt negotiation letter is the first step in attempting to pay down your debt in a way that. Should you end up in court, you can prove that you tried to settle the debt and let the creditor know. A debt settlement negotiation letter is not a difficult thing to set out, and the content will depend on the true amount of the debt should be obtained before trying to start any debt settlement negotiations. Debtors may think that they already know the debt amount but should remember that other charges. Find sample debt settlement letters (sample debt negotiation letters) and letters on credit/debt in order to contact creditors, cas and credit bureaus. The funds that i am eager. Print or download sample debt validation, debt verification, cease and desist, wage garnishment revokation, and pay for delete settlement letter for. When writing a debt negotiating letter, a person should tally up what is owed, come up with a reasonable amount that can be afforded, and be specific on. This letter is important for many aspects. This section contains sample letters you can use to negotiate reduced settlements or alternate payment arrangements with your unsecured creditors and debt collectors, as well as letters to send. Fax and mail a copy of that letter to the collection agency, along with your debt hardship letter, budget included with this letter is a settlement offer that i am willing to pay today to resolve this debt in one lump sum payment. This article has been viewed 41,722 times. 21 sample letters to negotiate your debt for reduced settlements and alternate repayment plans.

How The Debt Collection Agency Business Works , American Express Debt Negotiation Letter$1,360.71 Paid On Balance Of $6,803.53.

How To Negotiate A Federal Student Loan Settlement Sample Letter. This article has been viewed 41,722 times. Fax and mail a copy of that letter to the collection agency, along with your debt hardship letter, budget included with this letter is a settlement offer that i am willing to pay today to resolve this debt in one lump sum payment. 21 sample letters to negotiate your debt for reduced settlements and alternate repayment plans. This section contains sample letters you can use to negotiate reduced settlements or alternate payment arrangements with your unsecured creditors and debt collectors, as well as letters to send. The funds that i am eager. Debtors may think that they already know the debt amount but should remember that other charges. Find sample debt settlement letters (sample debt negotiation letters) and letters on credit/debt in order to contact creditors, cas and credit bureaus. Print or download sample debt validation, debt verification, cease and desist, wage garnishment revokation, and pay for delete settlement letter for. Should you end up in court, you can prove that you tried to settle the debt and let the creditor know. When writing a debt negotiating letter, a person should tally up what is owed, come up with a reasonable amount that can be afforded, and be specific on. A debt negotiation letter is a good way to start the discussions between you and the creditor and hopefully make financial arrangements you can live with. There are 16 references cited in this article, which can be found at the bottom of the page. This letter is important for many aspects. If you owe a creditor more money than you can afford to pay right now, writing a debt negotiation letter is the first step in attempting to pay down your debt in a way that. A debt settlement negotiation letter is not a difficult thing to set out, and the content will depend on the true amount of the debt should be obtained before trying to start any debt settlement negotiations.

Unique Sample Letter Of Settlement Agreement Letter Models Form Ideas : Although Some Dnps Are Legitimate And May Provide Significant Benefits To Some Debtors, Many Dnps Can.

7 381 Debt Negotiation Savings Bank Of America Credit Iq. Print or download sample debt validation, debt verification, cease and desist, wage garnishment revokation, and pay for delete settlement letter for. Find sample debt settlement letters (sample debt negotiation letters) and letters on credit/debt in order to contact creditors, cas and credit bureaus. This section contains sample letters you can use to negotiate reduced settlements or alternate payment arrangements with your unsecured creditors and debt collectors, as well as letters to send. This letter is important for many aspects. If you owe a creditor more money than you can afford to pay right now, writing a debt negotiation letter is the first step in attempting to pay down your debt in a way that. Debtors may think that they already know the debt amount but should remember that other charges. 21 sample letters to negotiate your debt for reduced settlements and alternate repayment plans. Should you end up in court, you can prove that you tried to settle the debt and let the creditor know. There are 16 references cited in this article, which can be found at the bottom of the page. Fax and mail a copy of that letter to the collection agency, along with your debt hardship letter, budget included with this letter is a settlement offer that i am willing to pay today to resolve this debt in one lump sum payment. This article has been viewed 41,722 times. A debt settlement negotiation letter is not a difficult thing to set out, and the content will depend on the true amount of the debt should be obtained before trying to start any debt settlement negotiations. The funds that i am eager. A debt negotiation letter is a good way to start the discussions between you and the creditor and hopefully make financial arrangements you can live with. When writing a debt negotiating letter, a person should tally up what is owed, come up with a reasonable amount that can be afforded, and be specific on.

13 789 Debt Negotiation Savings First National Bank Of Omaha Credit Iq , Here Is A Sample Debt Settlement Letter That You Can Use As A Model To Write Your F Irst Letter.your Name:your Address:address Of The Creditor Or The By Doing This, You Will Know Where To Start With Your Negotiations.

Settlement Letter With Usaa Savings Bank Client Saved 66. If you owe a creditor more money than you can afford to pay right now, writing a debt negotiation letter is the first step in attempting to pay down your debt in a way that. This article has been viewed 41,722 times. This section contains sample letters you can use to negotiate reduced settlements or alternate payment arrangements with your unsecured creditors and debt collectors, as well as letters to send. Find sample debt settlement letters (sample debt negotiation letters) and letters on credit/debt in order to contact creditors, cas and credit bureaus. Debtors may think that they already know the debt amount but should remember that other charges. Print or download sample debt validation, debt verification, cease and desist, wage garnishment revokation, and pay for delete settlement letter for. This letter is important for many aspects. A debt settlement negotiation letter is not a difficult thing to set out, and the content will depend on the true amount of the debt should be obtained before trying to start any debt settlement negotiations. When writing a debt negotiating letter, a person should tally up what is owed, come up with a reasonable amount that can be afforded, and be specific on. 21 sample letters to negotiate your debt for reduced settlements and alternate repayment plans. Fax and mail a copy of that letter to the collection agency, along with your debt hardship letter, budget included with this letter is a settlement offer that i am willing to pay today to resolve this debt in one lump sum payment. The funds that i am eager. There are 16 references cited in this article, which can be found at the bottom of the page. Should you end up in court, you can prove that you tried to settle the debt and let the creditor know. A debt negotiation letter is a good way to start the discussions between you and the creditor and hopefully make financial arrangements you can live with.

Illinois Laws And Legal Materials Ovlg : American Express Debt Negotiation Letter$1,360.71 Paid On Balance Of $6,803.53.

Her Likes This Card Credit Debt Negotiation Settlement. This article has been viewed 41,722 times. 21 sample letters to negotiate your debt for reduced settlements and alternate repayment plans. When writing a debt negotiating letter, a person should tally up what is owed, come up with a reasonable amount that can be afforded, and be specific on. This letter is important for many aspects. Should you end up in court, you can prove that you tried to settle the debt and let the creditor know. This section contains sample letters you can use to negotiate reduced settlements or alternate payment arrangements with your unsecured creditors and debt collectors, as well as letters to send. Find sample debt settlement letters (sample debt negotiation letters) and letters on credit/debt in order to contact creditors, cas and credit bureaus. A debt negotiation letter is a good way to start the discussions between you and the creditor and hopefully make financial arrangements you can live with. Debtors may think that they already know the debt amount but should remember that other charges. The funds that i am eager. There are 16 references cited in this article, which can be found at the bottom of the page. Print or download sample debt validation, debt verification, cease and desist, wage garnishment revokation, and pay for delete settlement letter for. A debt settlement negotiation letter is not a difficult thing to set out, and the content will depend on the true amount of the debt should be obtained before trying to start any debt settlement negotiations. If you owe a creditor more money than you can afford to pay right now, writing a debt negotiation letter is the first step in attempting to pay down your debt in a way that. Fax and mail a copy of that letter to the collection agency, along with your debt hardship letter, budget included with this letter is a settlement offer that i am willing to pay today to resolve this debt in one lump sum payment.

Debt Negotiation Program Live Your Life Without Debt , Debtors May Think That They Already Know The Debt Amount But Should Remember That Other Charges.

Debt Settlement Letters. Debtors may think that they already know the debt amount but should remember that other charges. A debt negotiation letter is a good way to start the discussions between you and the creditor and hopefully make financial arrangements you can live with. 21 sample letters to negotiate your debt for reduced settlements and alternate repayment plans. There are 16 references cited in this article, which can be found at the bottom of the page. This letter is important for many aspects. If you owe a creditor more money than you can afford to pay right now, writing a debt negotiation letter is the first step in attempting to pay down your debt in a way that. Find sample debt settlement letters (sample debt negotiation letters) and letters on credit/debt in order to contact creditors, cas and credit bureaus. Should you end up in court, you can prove that you tried to settle the debt and let the creditor know. This article has been viewed 41,722 times. When writing a debt negotiating letter, a person should tally up what is owed, come up with a reasonable amount that can be afforded, and be specific on. A debt settlement negotiation letter is not a difficult thing to set out, and the content will depend on the true amount of the debt should be obtained before trying to start any debt settlement negotiations. Fax and mail a copy of that letter to the collection agency, along with your debt hardship letter, budget included with this letter is a settlement offer that i am willing to pay today to resolve this debt in one lump sum payment. Print or download sample debt validation, debt verification, cease and desist, wage garnishment revokation, and pay for delete settlement letter for. The funds that i am eager. This section contains sample letters you can use to negotiate reduced settlements or alternate payment arrangements with your unsecured creditors and debt collectors, as well as letters to send.

Debt Settlement How It Works Faqs And More Magnifymoney : Negotiating A Debt Settlement With A Creditor On Your Own Can Save You Time And Money.

Collection Letter Sample Letter Templates Collection Letter Letter Example. The funds that i am eager. If you owe a creditor more money than you can afford to pay right now, writing a debt negotiation letter is the first step in attempting to pay down your debt in a way that. A debt settlement negotiation letter is not a difficult thing to set out, and the content will depend on the true amount of the debt should be obtained before trying to start any debt settlement negotiations. This article has been viewed 41,722 times. Fax and mail a copy of that letter to the collection agency, along with your debt hardship letter, budget included with this letter is a settlement offer that i am willing to pay today to resolve this debt in one lump sum payment. 21 sample letters to negotiate your debt for reduced settlements and alternate repayment plans. There are 16 references cited in this article, which can be found at the bottom of the page. This section contains sample letters you can use to negotiate reduced settlements or alternate payment arrangements with your unsecured creditors and debt collectors, as well as letters to send. This letter is important for many aspects. Should you end up in court, you can prove that you tried to settle the debt and let the creditor know. Print or download sample debt validation, debt verification, cease and desist, wage garnishment revokation, and pay for delete settlement letter for. Find sample debt settlement letters (sample debt negotiation letters) and letters on credit/debt in order to contact creditors, cas and credit bureaus. Debtors may think that they already know the debt amount but should remember that other charges. A debt negotiation letter is a good way to start the discussions between you and the creditor and hopefully make financial arrangements you can live with. When writing a debt negotiating letter, a person should tally up what is owed, come up with a reasonable amount that can be afforded, and be specific on.