Debt Collection Dispute Letter. The debt validation request is time sensitive. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. According to the fair debt collection practices act (fdcpa) you you have. Mention the consequences of late payment and close the letter on a. Collection letters are usually written in a series. Debt collection letter is a special letter that is drafted by a lender to request a legal claim owing to the breach of contract by a recipient of a loan. Send an initial dispute letter to stop calls. The first letter is just a simple reminder and the tone changes to a more direct and demanding one with include the amount of debt the customer must pay and indicate the next deadline. Pursuant to the fair debt collection practices act, section 809(b), validating debts: Use this letter to dispute a debt collection you're unsure of. You must make your request in writing within 30 days of the debt collector's initial contact with you. All you have to do is send an initial dispute letter to stop calls, at least until the debt is fully validated. Are collectors calling and demanding money for a debt that may not be yours? The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. If the consumer notifies the debt collector in writing within the finally, if you do not own this debt, i demand that you immediately send a copy of this dispute letter to the original creditor so they are also aware that i.

Debt Collection Dispute Letter- Free Credit Dispute Letters Available From Credit Infocenter.

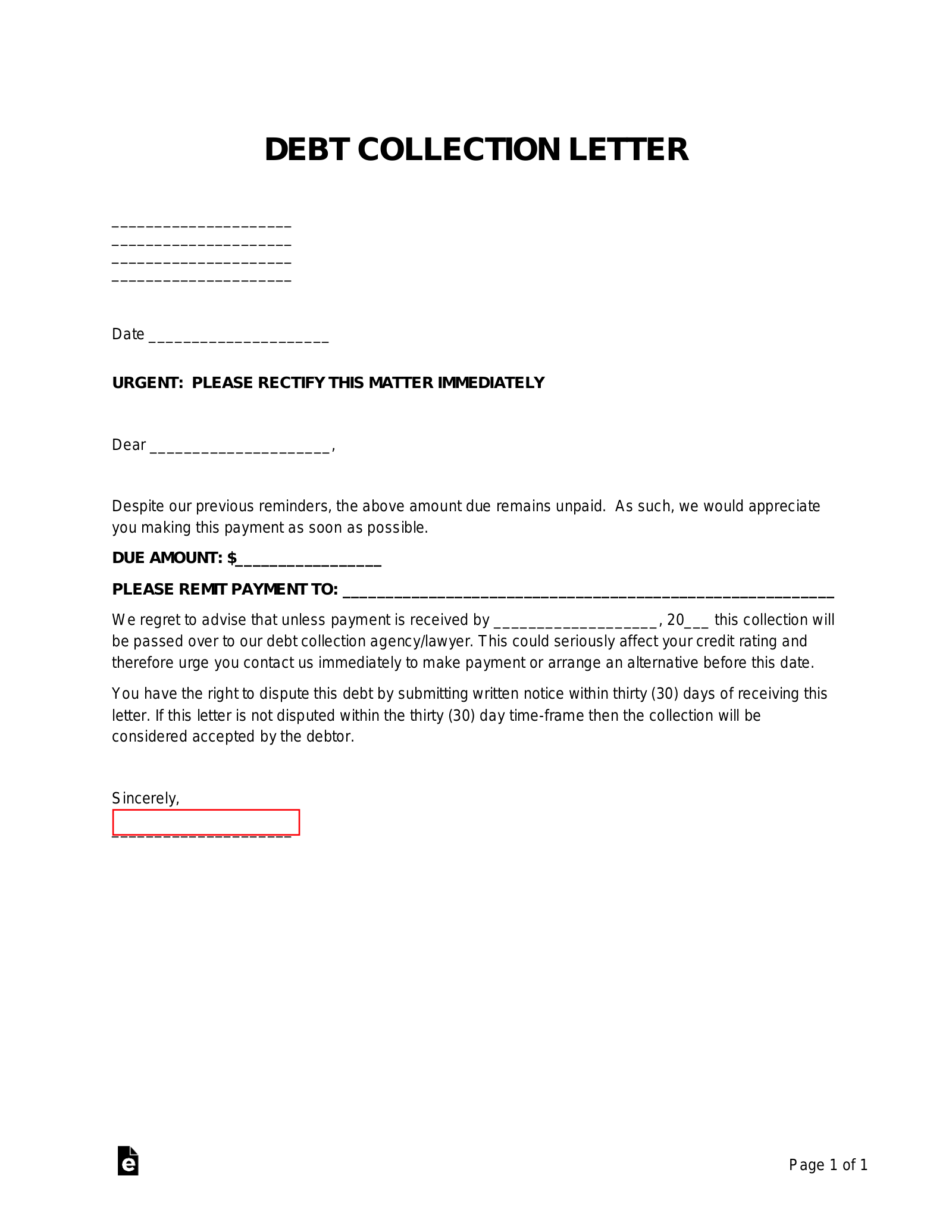

50 Free Debt Validation Letter Samples Templates Á Templatelab. Mention the consequences of late payment and close the letter on a. According to the fair debt collection practices act (fdcpa) you you have. You must make your request in writing within 30 days of the debt collector's initial contact with you. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Are collectors calling and demanding money for a debt that may not be yours? The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Collection letters are usually written in a series. Debt collection letter is a special letter that is drafted by a lender to request a legal claim owing to the breach of contract by a recipient of a loan. The first letter is just a simple reminder and the tone changes to a more direct and demanding one with include the amount of debt the customer must pay and indicate the next deadline. If the consumer notifies the debt collector in writing within the finally, if you do not own this debt, i demand that you immediately send a copy of this dispute letter to the original creditor so they are also aware that i. All you have to do is send an initial dispute letter to stop calls, at least until the debt is fully validated. Send an initial dispute letter to stop calls. The debt validation request is time sensitive. Pursuant to the fair debt collection practices act, section 809(b), validating debts: Use this letter to dispute a debt collection you're unsure of.

Choose from the list of debt negotiation letters, debt collection letters, and credit report dispute.

That does not mean you cannot dispute the. Collection letters are usually written in a series. I am also requesting that you validate this debt you claim i owe by providing the documentation and information requested below. If you receive a collections notice from a debt collection agency and do not believe the debt to be yours or the amount to be inaccurate, you may dispute the debt with the collection agency by writing a letter formally declaring that you contest the debt. The debt validation request is time sensitive. According to the fair debt collection practices act (fdcpa) you you have. Many states have their own debt collection laws that are different from the federal fair debt collection practices act. 2nd debt collection dispute (new collector). The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. If the consumer notifies the debt collector in writing within the finally, if you do not own this debt, i demand that you immediately send a copy of this dispute letter to the original creditor so they are also aware that i. The first letter is just a simple reminder and the tone changes to a more direct and demanding one with include the amount of debt the customer must pay and indicate the next deadline. Debt is still invalid (collector attempted to verify the debt). You can choose this prior to filing a lawsuit. A debt collection letter is a notification a creditor sends to their debtors to inform them of an impending debt and consequences of not repaying the debt in time. Debt collection letter is a special letter that is drafted by a lender to request a legal claim owing to the breach of contract by a recipient of a loan. Our sample letters can help if you Choose from the list of debt negotiation letters, debt collection letters, and credit report dispute. There are other options in dealing with a collection agency. All you have to do is send an initial dispute letter to stop calls, at least until the debt is fully validated. Send an initial dispute letter to stop calls. Dispute the collection using the advanced dispute method. The sample debt settlement letters and validation letters on this page will help you negotiate and validate your debts and understand how to deal with creditors or collection agencies (ca) in writing. Credit report dispute letter — use this credit dispute letter to send to all three credit reporting agencies when disputing inaccurate, incorrect, or. A letter to a debt collector disputing a debt is a letter that denies the existence of a debt or disapproves the amount due. Mention the consequences of late payment and close the letter on a. Use this letter to dispute a debt and to tell a collector to stop contacting you. But for your clarification, i have submitted my installment amount on 3rd december 2011. To collect your debt, it is a good idea to write a first response debt dispute letter to make the debt collector verify your debt. Debt collectors must send a validation letter giving info about the debt you're being asked to pay. Free credit dispute letters available from credit infocenter. Debt collection issues can be challenging.

Stop Enhanced Recovery Company Erc Collections And Remove From Credit Report: Send An Initial Dispute Letter To Stop Calls.

Free Sample Debt Dispute Letter. If the consumer notifies the debt collector in writing within the finally, if you do not own this debt, i demand that you immediately send a copy of this dispute letter to the original creditor so they are also aware that i. You must make your request in writing within 30 days of the debt collector's initial contact with you. Mention the consequences of late payment and close the letter on a. The first letter is just a simple reminder and the tone changes to a more direct and demanding one with include the amount of debt the customer must pay and indicate the next deadline. Send an initial dispute letter to stop calls. Pursuant to the fair debt collection practices act, section 809(b), validating debts: Debt collection letter is a special letter that is drafted by a lender to request a legal claim owing to the breach of contract by a recipient of a loan. Are collectors calling and demanding money for a debt that may not be yours? All you have to do is send an initial dispute letter to stop calls, at least until the debt is fully validated. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Collection letters are usually written in a series. The debt validation request is time sensitive. According to the fair debt collection practices act (fdcpa) you you have. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Use this letter to dispute a debt collection you're unsure of.

Creditors Letters Diy Disputes , Debt Validation Letters And Verification Letters Are Two Examples.

Debt Dispute Letter How To Use It To Make Collectors Validate Debt. Debt collection letter is a special letter that is drafted by a lender to request a legal claim owing to the breach of contract by a recipient of a loan. Send an initial dispute letter to stop calls. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Use this letter to dispute a debt collection you're unsure of. Mention the consequences of late payment and close the letter on a. The debt validation request is time sensitive. According to the fair debt collection practices act (fdcpa) you you have. If the consumer notifies the debt collector in writing within the finally, if you do not own this debt, i demand that you immediately send a copy of this dispute letter to the original creditor so they are also aware that i. Pursuant to the fair debt collection practices act, section 809(b), validating debts: The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act.

Dispute Debt Collection Business Law Common Law : Your name your street address city, state zip code.

Good G Notice. You must make your request in writing within 30 days of the debt collector's initial contact with you. Pursuant to the fair debt collection practices act, section 809(b), validating debts: The first letter is just a simple reminder and the tone changes to a more direct and demanding one with include the amount of debt the customer must pay and indicate the next deadline. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Use this letter to dispute a debt collection you're unsure of. All you have to do is send an initial dispute letter to stop calls, at least until the debt is fully validated. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. The debt validation request is time sensitive. According to the fair debt collection practices act (fdcpa) you you have. Send an initial dispute letter to stop calls. If the consumer notifies the debt collector in writing within the finally, if you do not own this debt, i demand that you immediately send a copy of this dispute letter to the original creditor so they are also aware that i. Are collectors calling and demanding money for a debt that may not be yours? Collection letters are usually written in a series. Debt collection letter is a special letter that is drafted by a lender to request a legal claim owing to the breach of contract by a recipient of a loan. Mention the consequences of late payment and close the letter on a.

Stop Enhanced Recovery Company Erc Collections And Remove From Credit Report - Understand How Debt Collection Works, What Your Rights Are, Common Issues With Debt Collection, And How To Work With Debt Collectors.

Credit And Debt Dispute Letters. Mention the consequences of late payment and close the letter on a. All you have to do is send an initial dispute letter to stop calls, at least until the debt is fully validated. Debt collection letter is a special letter that is drafted by a lender to request a legal claim owing to the breach of contract by a recipient of a loan. Are collectors calling and demanding money for a debt that may not be yours? If the consumer notifies the debt collector in writing within the finally, if you do not own this debt, i demand that you immediately send a copy of this dispute letter to the original creditor so they are also aware that i. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. The first letter is just a simple reminder and the tone changes to a more direct and demanding one with include the amount of debt the customer must pay and indicate the next deadline. According to the fair debt collection practices act (fdcpa) you you have. You must make your request in writing within 30 days of the debt collector's initial contact with you. The debt validation request is time sensitive. Use this letter to dispute a debt collection you're unsure of. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Collection letters are usually written in a series. Pursuant to the fair debt collection practices act, section 809(b), validating debts: Send an initial dispute letter to stop calls.

Writing A Letter To Creditors Sample : Pursuant To The Fair Debt Collection Practices Act, Section 809(B), Validating Debts:

50 Free Debt Validation Letter Samples Templates Á Templatelab. All you have to do is send an initial dispute letter to stop calls, at least until the debt is fully validated. Mention the consequences of late payment and close the letter on a. According to the fair debt collection practices act (fdcpa) you you have. Send an initial dispute letter to stop calls. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Use this letter to dispute a debt collection you're unsure of. The debt validation request is time sensitive. The first letter is just a simple reminder and the tone changes to a more direct and demanding one with include the amount of debt the customer must pay and indicate the next deadline. If the consumer notifies the debt collector in writing within the finally, if you do not own this debt, i demand that you immediately send a copy of this dispute letter to the original creditor so they are also aware that i. Pursuant to the fair debt collection practices act, section 809(b), validating debts: The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Collection letters are usually written in a series. Debt collection letter is a special letter that is drafted by a lender to request a legal claim owing to the breach of contract by a recipient of a loan. You must make your request in writing within 30 days of the debt collector's initial contact with you. Are collectors calling and demanding money for a debt that may not be yours?

Collection Account Deleted Verification Fail Scoreology - Although These Two Letters Have Similar Names And Content, They Do Have Some Key A Common Misconception About Disputing Debt With A Collection Agency Is That The Debt Will Be Removed From Your Credit Reports If Disputed.

Disputing And Verifying A Debt Dealing With Debt Collectors Dealing With Debt Collectors Alaska. Are collectors calling and demanding money for a debt that may not be yours? Debt collection letter is a special letter that is drafted by a lender to request a legal claim owing to the breach of contract by a recipient of a loan. The first letter is just a simple reminder and the tone changes to a more direct and demanding one with include the amount of debt the customer must pay and indicate the next deadline. You must make your request in writing within 30 days of the debt collector's initial contact with you. All you have to do is send an initial dispute letter to stop calls, at least until the debt is fully validated. The debt validation request is time sensitive. Mention the consequences of late payment and close the letter on a. Use this letter to dispute a debt collection you're unsure of. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Pursuant to the fair debt collection practices act, section 809(b), validating debts: According to the fair debt collection practices act (fdcpa) you you have. Send an initial dispute letter to stop calls. If the consumer notifies the debt collector in writing within the finally, if you do not own this debt, i demand that you immediately send a copy of this dispute letter to the original creditor so they are also aware that i. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Collection letters are usually written in a series.

Writing A Letter To Creditors Sample : The First Letter Is Just A Simple Reminder And The Tone Changes To A More Direct And Demanding One With Include The Amount Of Debt The Customer Must Pay And Indicate The Next Deadline.

Collection Letter Example And Tips To Make It Mous Syusa. Pursuant to the fair debt collection practices act, section 809(b), validating debts: Debt collection letter is a special letter that is drafted by a lender to request a legal claim owing to the breach of contract by a recipient of a loan. According to the fair debt collection practices act (fdcpa) you you have. Mention the consequences of late payment and close the letter on a. Collection letters are usually written in a series. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. All you have to do is send an initial dispute letter to stop calls, at least until the debt is fully validated. The first letter is just a simple reminder and the tone changes to a more direct and demanding one with include the amount of debt the customer must pay and indicate the next deadline. If the consumer notifies the debt collector in writing within the finally, if you do not own this debt, i demand that you immediately send a copy of this dispute letter to the original creditor so they are also aware that i. The debt validation request is time sensitive. You must make your request in writing within 30 days of the debt collector's initial contact with you. Use this letter to dispute a debt collection you're unsure of. Send an initial dispute letter to stop calls. Are collectors calling and demanding money for a debt that may not be yours?

Custom Write Collection Dispute Letters By Rivalconsultant - Diy Credit Repair Letters Can Be Sent To Credit Bureaus, Collection Agencies, And Creditors.

Debt Collection Cease And Desist Letter Template. The first letter is just a simple reminder and the tone changes to a more direct and demanding one with include the amount of debt the customer must pay and indicate the next deadline. Send an initial dispute letter to stop calls. Mention the consequences of late payment and close the letter on a. According to the fair debt collection practices act (fdcpa) you you have. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. All you have to do is send an initial dispute letter to stop calls, at least until the debt is fully validated. Collection letters are usually written in a series. The debt validation request is time sensitive. If the consumer notifies the debt collector in writing within the finally, if you do not own this debt, i demand that you immediately send a copy of this dispute letter to the original creditor so they are also aware that i. Are collectors calling and demanding money for a debt that may not be yours? Debt collection letter is a special letter that is drafted by a lender to request a legal claim owing to the breach of contract by a recipient of a loan. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Use this letter to dispute a debt collection you're unsure of. You must make your request in writing within 30 days of the debt collector's initial contact with you. Pursuant to the fair debt collection practices act, section 809(b), validating debts:

Debt Validation Letter Pdf Debt : If You're Facing An Aggressive Debt Collector:

Pay For Delete Sample Letter 2020 Updated Tips Template Guide. Pursuant to the fair debt collection practices act, section 809(b), validating debts: Are collectors calling and demanding money for a debt that may not be yours? Use this letter to dispute a debt collection you're unsure of. Collection letters are usually written in a series. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Mention the consequences of late payment and close the letter on a. The debt validation request is time sensitive. According to the fair debt collection practices act (fdcpa) you you have. The first letter is just a simple reminder and the tone changes to a more direct and demanding one with include the amount of debt the customer must pay and indicate the next deadline. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. If the consumer notifies the debt collector in writing within the finally, if you do not own this debt, i demand that you immediately send a copy of this dispute letter to the original creditor so they are also aware that i. You must make your request in writing within 30 days of the debt collector's initial contact with you. Send an initial dispute letter to stop calls. All you have to do is send an initial dispute letter to stop calls, at least until the debt is fully validated. Debt collection letter is a special letter that is drafted by a lender to request a legal claim owing to the breach of contract by a recipient of a loan.

Template Dispute Letter To Collection Agency Tenak - Based On The Fair Debt Collection Practices Act, Debt Collectors Must Provide You With A Debt Validation Letter Which Contains Information Regarding The A Statement Saying That The Debt Collector Assumes The Validity Of The Debt Unless You Send A Written Dispute Within 30 Days From The First Contact.

Collection Letter Example And Tips To Make It Mous Syusa. The debt validation request is time sensitive. All you have to do is send an initial dispute letter to stop calls, at least until the debt is fully validated. The first letter is just a simple reminder and the tone changes to a more direct and demanding one with include the amount of debt the customer must pay and indicate the next deadline. Use this letter to dispute a debt collection you're unsure of. If the consumer notifies the debt collector in writing within the finally, if you do not own this debt, i demand that you immediately send a copy of this dispute letter to the original creditor so they are also aware that i. Mention the consequences of late payment and close the letter on a. Are collectors calling and demanding money for a debt that may not be yours? Pursuant to the fair debt collection practices act, section 809(b), validating debts: Collection letters are usually written in a series. Debt collection letter is a special letter that is drafted by a lender to request a legal claim owing to the breach of contract by a recipient of a loan. You must make your request in writing within 30 days of the debt collector's initial contact with you. According to the fair debt collection practices act (fdcpa) you you have. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. The debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. Send an initial dispute letter to stop calls.