609 Credit Repair Letters. A 609 dispute letter is often billed as a credit repair secret or legal loophole that forces the credit reporting agencies to remove certain negative information from your credit reports. The federal law loophole that removes all negative accounts every time! A 609 dispute letter claims to be a credit repair secret that you can purchase. And that credit repair loophole is called the 609 dispute letter. Attorney credit repair dispute letter templates. Once the credit reporting agency receives your section 609 letter, it will either respond by sending you the contract with your signature on it that supports once the credit repair agency gathers all the relevant information from you, it will take over the verification requests and dispute process, including. Templates for 609 letters can be found on the internet—often for a fee—but there is no need to spend money on such a product. If the creditor did, in fact, fail to document something correctly, they have no legal choice but to remove that negative item from your credit report. The best way to handle this credit scoring dilemma is to contact the collection agency and explain that you are willing to pay off the collection account under the condition request a letter from the collector that explicitly states their agreement to delete the account upon receipt/clearance of your payment. Section 609 of the fair credit reporting act requires credit reporting agencies to disclose information to consumers who request it about what is in their credit reports. Here's the truth about a 609 letter: They absolutely do work in many cases. All of them reference section 609 of the fcra, but they can all be tailored to fit your unique situation. The easy 609 credit repair secret: The following are examples of letters you can send to credit reporting agencies and bureaus to dispute any negative items or debt on your reports.

609 Credit Repair Letters, Remove All Negative Accounts In 30 Days Using A Federal Law Loophole That Works.

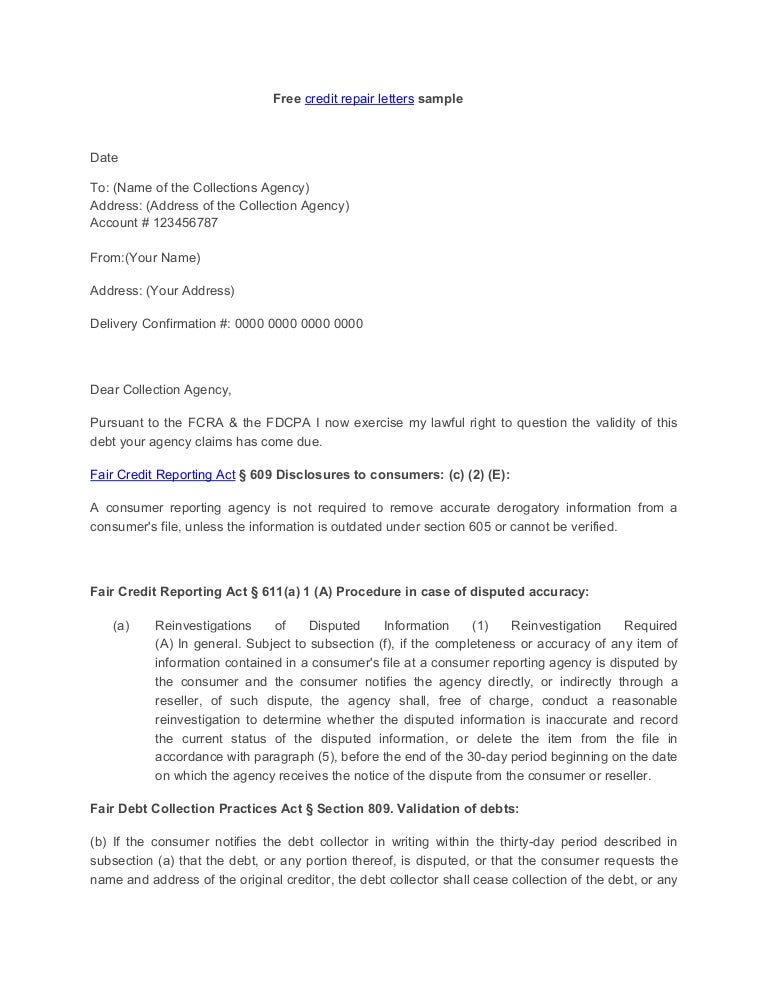

609 Credit Repair Letters. The best way to handle this credit scoring dilemma is to contact the collection agency and explain that you are willing to pay off the collection account under the condition request a letter from the collector that explicitly states their agreement to delete the account upon receipt/clearance of your payment. If the creditor did, in fact, fail to document something correctly, they have no legal choice but to remove that negative item from your credit report. The following are examples of letters you can send to credit reporting agencies and bureaus to dispute any negative items or debt on your reports. The federal law loophole that removes all negative accounts every time! And that credit repair loophole is called the 609 dispute letter. They absolutely do work in many cases. Attorney credit repair dispute letter templates. The easy 609 credit repair secret: Templates for 609 letters can be found on the internet—often for a fee—but there is no need to spend money on such a product. A 609 dispute letter claims to be a credit repair secret that you can purchase. All of them reference section 609 of the fcra, but they can all be tailored to fit your unique situation. A 609 dispute letter is often billed as a credit repair secret or legal loophole that forces the credit reporting agencies to remove certain negative information from your credit reports. Once the credit reporting agency receives your section 609 letter, it will either respond by sending you the contract with your signature on it that supports once the credit repair agency gathers all the relevant information from you, it will take over the verification requests and dispute process, including. Here's the truth about a 609 letter: Section 609 of the fair credit reporting act requires credit reporting agencies to disclose information to consumers who request it about what is in their credit reports.

The attached section 609 attorney credit repair letter is the correct information.

Credit reporting errors should never be ignored, but what exactly can or should you do when mistakes happen? 🤫credit repair companies secret behind the 609 letter.🤔 подробнее. 8vh the section 609 credit repair letter for experian, equifax or transunion and simply copy the negative information from your corresponding credit. You will need to change it to your circumstances as well as modifying for an email. Let us know what's wrong with this preview of 609 credit repair series by bradley caulfield. 609 credit repair letters that work. Remove all negative accounts in 30 days using a federal law loophole that works. These are just the highlights commonly used in the 609 credit repair strategy. This single credit bureau dispute letter has helped delete thousands of negative accounts trying to repair your credit yourself can get overwhelming and confusing: 609 credit repair letters that work. Templates for 609 letters can be found on the internet—often for a fee—but there is no need to spend money on such a product. Dont let the simplicity of this letter fool you. Remove all negative accounts in 30 days using a federal… by brandon weaver paperback $14.86. The fair credit reporting act (fcra) gives credit bureaus strict legal guidelines about what they can and cannot do. The following is a sample dispute letter to a credit bureau. Depending upon who you ask, you'll probably receive different advice. Agencies, credit card companies and other folks the moment mending your. 609 credit repair series book. Unfortunately, 609 letters are not the 'magic bullet' many online articles was your letter intended for repairing your credit rejected by the credit bureau? Repair your credit like the pros: A 609 dispute letter claims to be a credit repair secret that you can purchase. Attorney credit repair dispute letter templates. Section 609 of the fair credit reporting act requires credit reporting agencies to disclose information to consumers who request it about what is in their credit reports. The federal law loophole that removes all negative accounts every time! Download pdf ebook the easy section 609 credit repair secret : It's another effective strategy to add to your overall credit improvement strategy. The following are examples of letters you can send to credit reporting agencies and bureaus to dispute any negative items or debt on your reports. Go to creditrepairletter.info and find out today how to get your life back. And that credit repair loophole is called the 609 dispute letter. The attached section 609 attorney credit repair letter is the correct information. New to this, from reading around i hear section 609 dispute letter is basically an outdated trick/useless as it just asks for verifying the negative items.

Fcra Background Check Authorization Form Elegant Letter To Collection Agency Unique Fcra Section 609 Credit Repair Models Form Ideas. Credit Reporting Errors Should Never Be Ignored, But What Exactly Can Or Should You Do When Mistakes Happen?

The Amazing Credit Repair Letter Section 609 Dispute Sample Throughout 609 Dispu Amazing Credit Disp In 2020 Credit Dispute Credit Repair Letters Letter Templates. The easy 609 credit repair secret: The following are examples of letters you can send to credit reporting agencies and bureaus to dispute any negative items or debt on your reports. And that credit repair loophole is called the 609 dispute letter. A 609 dispute letter claims to be a credit repair secret that you can purchase. The federal law loophole that removes all negative accounts every time! Templates for 609 letters can be found on the internet—often for a fee—but there is no need to spend money on such a product. They absolutely do work in many cases. If the creditor did, in fact, fail to document something correctly, they have no legal choice but to remove that negative item from your credit report. Attorney credit repair dispute letter templates. Section 609 of the fair credit reporting act requires credit reporting agencies to disclose information to consumers who request it about what is in their credit reports. The best way to handle this credit scoring dilemma is to contact the collection agency and explain that you are willing to pay off the collection account under the condition request a letter from the collector that explicitly states their agreement to delete the account upon receipt/clearance of your payment. Once the credit reporting agency receives your section 609 letter, it will either respond by sending you the contract with your signature on it that supports once the credit repair agency gathers all the relevant information from you, it will take over the verification requests and dispute process, including. All of them reference section 609 of the fcra, but they can all be tailored to fit your unique situation. A 609 dispute letter is often billed as a credit repair secret or legal loophole that forces the credit reporting agencies to remove certain negative information from your credit reports. Here's the truth about a 609 letter:

The Section 609 Credit Dispute Do It Yourself Letter Package Pdf Free Download - Attorney Credit Repair Dispute Letter Templates.

What Is A 609 Dispute Letter And Does It Work Lexington Law. Section 609 of the fair credit reporting act requires credit reporting agencies to disclose information to consumers who request it about what is in their credit reports. The best way to handle this credit scoring dilemma is to contact the collection agency and explain that you are willing to pay off the collection account under the condition request a letter from the collector that explicitly states their agreement to delete the account upon receipt/clearance of your payment. All of them reference section 609 of the fcra, but they can all be tailored to fit your unique situation. A 609 dispute letter is often billed as a credit repair secret or legal loophole that forces the credit reporting agencies to remove certain negative information from your credit reports. Attorney credit repair dispute letter templates. The following are examples of letters you can send to credit reporting agencies and bureaus to dispute any negative items or debt on your reports. They absolutely do work in many cases. A 609 dispute letter claims to be a credit repair secret that you can purchase. And that credit repair loophole is called the 609 dispute letter. The federal law loophole that removes all negative accounts every time!

609 Credit Repair Letter System : A 609 dispute letter claims to be a credit repair secret that you can purchase.

Free Sample Dispute Credit Letter. They absolutely do work in many cases. A 609 dispute letter claims to be a credit repair secret that you can purchase. Attorney credit repair dispute letter templates. Here's the truth about a 609 letter: The federal law loophole that removes all negative accounts every time! Once the credit reporting agency receives your section 609 letter, it will either respond by sending you the contract with your signature on it that supports once the credit repair agency gathers all the relevant information from you, it will take over the verification requests and dispute process, including. Section 609 of the fair credit reporting act requires credit reporting agencies to disclose information to consumers who request it about what is in their credit reports. The easy 609 credit repair secret: If the creditor did, in fact, fail to document something correctly, they have no legal choice but to remove that negative item from your credit report. The following are examples of letters you can send to credit reporting agencies and bureaus to dispute any negative items or debt on your reports. A 609 dispute letter is often billed as a credit repair secret or legal loophole that forces the credit reporting agencies to remove certain negative information from your credit reports. All of them reference section 609 of the fcra, but they can all be tailored to fit your unique situation. The best way to handle this credit scoring dilemma is to contact the collection agency and explain that you are willing to pay off the collection account under the condition request a letter from the collector that explicitly states their agreement to delete the account upon receipt/clearance of your payment. And that credit repair loophole is called the 609 dispute letter. Templates for 609 letters can be found on the internet—often for a fee—but there is no need to spend money on such a product.

The Section 609 Credit Dispute Do It Yourself Letter Package Pdf Free Download . The Following Are Examples Of Letters You Can Send To Credit Reporting Agencies And Bureaus To Dispute Any Negative Items Or Debt On Your Reports.

609 Letter Template Free Of Free Section 609 Credit Dispute Letter Template In 2020 Credit Repair Business Credit Repair Letters Credit Repair. Once the credit reporting agency receives your section 609 letter, it will either respond by sending you the contract with your signature on it that supports once the credit repair agency gathers all the relevant information from you, it will take over the verification requests and dispute process, including. The best way to handle this credit scoring dilemma is to contact the collection agency and explain that you are willing to pay off the collection account under the condition request a letter from the collector that explicitly states their agreement to delete the account upon receipt/clearance of your payment. Here's the truth about a 609 letter: A 609 dispute letter claims to be a credit repair secret that you can purchase. All of them reference section 609 of the fcra, but they can all be tailored to fit your unique situation. And that credit repair loophole is called the 609 dispute letter. The following are examples of letters you can send to credit reporting agencies and bureaus to dispute any negative items or debt on your reports. Templates for 609 letters can be found on the internet—often for a fee—but there is no need to spend money on such a product. A 609 dispute letter is often billed as a credit repair secret or legal loophole that forces the credit reporting agencies to remove certain negative information from your credit reports. Section 609 of the fair credit reporting act requires credit reporting agencies to disclose information to consumers who request it about what is in their credit reports. Attorney credit repair dispute letter templates. They absolutely do work in many cases. The easy 609 credit repair secret: If the creditor did, in fact, fail to document something correctly, they have no legal choice but to remove that negative item from your credit report. The federal law loophole that removes all negative accounts every time!

Crcllc Section 609 Wizcreditguru Credit History Credit Bureau . Go To Creditrepairletter.info And Find Out Today How To Get Your Life Back.

Dispute Letter Template Fresh Free Credit Repair Letters Templates 609 Carlynstudio Us. Templates for 609 letters can be found on the internet—often for a fee—but there is no need to spend money on such a product. Section 609 of the fair credit reporting act requires credit reporting agencies to disclose information to consumers who request it about what is in their credit reports. They absolutely do work in many cases. Attorney credit repair dispute letter templates. The federal law loophole that removes all negative accounts every time! And that credit repair loophole is called the 609 dispute letter. The following are examples of letters you can send to credit reporting agencies and bureaus to dispute any negative items or debt on your reports. Here's the truth about a 609 letter: If the creditor did, in fact, fail to document something correctly, they have no legal choice but to remove that negative item from your credit report. The best way to handle this credit scoring dilemma is to contact the collection agency and explain that you are willing to pay off the collection account under the condition request a letter from the collector that explicitly states their agreement to delete the account upon receipt/clearance of your payment. A 609 dispute letter claims to be a credit repair secret that you can purchase. Once the credit reporting agency receives your section 609 letter, it will either respond by sending you the contract with your signature on it that supports once the credit repair agency gathers all the relevant information from you, it will take over the verification requests and dispute process, including. All of them reference section 609 of the fcra, but they can all be tailored to fit your unique situation. A 609 dispute letter is often billed as a credit repair secret or legal loophole that forces the credit reporting agencies to remove certain negative information from your credit reports. The easy 609 credit repair secret:

Free 609 Credit Verification Letters The Pickled Ginger , Go To Creditrepairletter.info And Find Out Today How To Get Your Life Back.

Section 609 Credit Repair Letter Template Inviletter Co Free Carlynstudio Us. Here's the truth about a 609 letter: The following are examples of letters you can send to credit reporting agencies and bureaus to dispute any negative items or debt on your reports. And that credit repair loophole is called the 609 dispute letter. The best way to handle this credit scoring dilemma is to contact the collection agency and explain that you are willing to pay off the collection account under the condition request a letter from the collector that explicitly states their agreement to delete the account upon receipt/clearance of your payment. A 609 dispute letter claims to be a credit repair secret that you can purchase. Templates for 609 letters can be found on the internet—often for a fee—but there is no need to spend money on such a product. The federal law loophole that removes all negative accounts every time! All of them reference section 609 of the fcra, but they can all be tailored to fit your unique situation. If the creditor did, in fact, fail to document something correctly, they have no legal choice but to remove that negative item from your credit report. Attorney credit repair dispute letter templates. The easy 609 credit repair secret: They absolutely do work in many cases. A 609 dispute letter is often billed as a credit repair secret or legal loophole that forces the credit reporting agencies to remove certain negative information from your credit reports. Once the credit reporting agency receives your section 609 letter, it will either respond by sending you the contract with your signature on it that supports once the credit repair agency gathers all the relevant information from you, it will take over the verification requests and dispute process, including. Section 609 of the fair credit reporting act requires credit reporting agencies to disclose information to consumers who request it about what is in their credit reports.

Amazon Com The Easy Section 609 Credit Repair Secret Remove All Negative Accounts In 30 Days Using A Federal Law Loophole That Works Every Time 9781973444657 Weaver Brandon Books . How Credit Attorneys And Certified Consultants Legally Delete Bad… By Carolyn Warren Paperback $14.24.

609 Credit Repair Letters. They absolutely do work in many cases. Here's the truth about a 609 letter: All of them reference section 609 of the fcra, but they can all be tailored to fit your unique situation. The easy 609 credit repair secret: The federal law loophole that removes all negative accounts every time! Once the credit reporting agency receives your section 609 letter, it will either respond by sending you the contract with your signature on it that supports once the credit repair agency gathers all the relevant information from you, it will take over the verification requests and dispute process, including. Attorney credit repair dispute letter templates. A 609 dispute letter is often billed as a credit repair secret or legal loophole that forces the credit reporting agencies to remove certain negative information from your credit reports. And that credit repair loophole is called the 609 dispute letter. Section 609 of the fair credit reporting act requires credit reporting agencies to disclose information to consumers who request it about what is in their credit reports. The best way to handle this credit scoring dilemma is to contact the collection agency and explain that you are willing to pay off the collection account under the condition request a letter from the collector that explicitly states their agreement to delete the account upon receipt/clearance of your payment. Templates for 609 letters can be found on the internet—often for a fee—but there is no need to spend money on such a product. A 609 dispute letter claims to be a credit repair secret that you can purchase. If the creditor did, in fact, fail to document something correctly, they have no legal choice but to remove that negative item from your credit report. The following are examples of letters you can send to credit reporting agencies and bureaus to dispute any negative items or debt on your reports.

Section 609 Credit Repair Letter Template Inviletter Co Free Carlynstudio Us : How Credit Attorneys And Certified Consultants Legally Delete Bad… By Carolyn Warren Paperback $14.24.

The Section 609 Credit Repair Solution How To Remove All Negative Items From Your Credit Report Fast Cunningham Pat 9781520950761 Amazon Com Books. If the creditor did, in fact, fail to document something correctly, they have no legal choice but to remove that negative item from your credit report. They absolutely do work in many cases. A 609 dispute letter is often billed as a credit repair secret or legal loophole that forces the credit reporting agencies to remove certain negative information from your credit reports. Templates for 609 letters can be found on the internet—often for a fee—but there is no need to spend money on such a product. All of them reference section 609 of the fcra, but they can all be tailored to fit your unique situation. Attorney credit repair dispute letter templates. The following are examples of letters you can send to credit reporting agencies and bureaus to dispute any negative items or debt on your reports. Once the credit reporting agency receives your section 609 letter, it will either respond by sending you the contract with your signature on it that supports once the credit repair agency gathers all the relevant information from you, it will take over the verification requests and dispute process, including. The federal law loophole that removes all negative accounts every time! The easy 609 credit repair secret: The best way to handle this credit scoring dilemma is to contact the collection agency and explain that you are willing to pay off the collection account under the condition request a letter from the collector that explicitly states their agreement to delete the account upon receipt/clearance of your payment. Section 609 of the fair credit reporting act requires credit reporting agencies to disclose information to consumers who request it about what is in their credit reports. Here's the truth about a 609 letter: And that credit repair loophole is called the 609 dispute letter. A 609 dispute letter claims to be a credit repair secret that you can purchase.

Free Section 609 Credit Dispute Letters Samples Templates Pdfs , Once The Credit Reporting Agency Receives Your Section 609 Letter, It Will Either Respond By Sending You The Contract With Your Signature On It That Supports Once The Credit Repair Agency Gathers All The Relevant Information From You, It Will Take Over The Verification Requests And Dispute Process, Including.

Amazon Com 609 Letter Templates Credit Repair Secrets Fix Your Credit Score Fast And Legally 609 Credit Repair Book 1 Ebook Caulfield Bradley Kindle Store. The federal law loophole that removes all negative accounts every time! Templates for 609 letters can be found on the internet—often for a fee—but there is no need to spend money on such a product. A 609 dispute letter is often billed as a credit repair secret or legal loophole that forces the credit reporting agencies to remove certain negative information from your credit reports. The easy 609 credit repair secret: They absolutely do work in many cases. Section 609 of the fair credit reporting act requires credit reporting agencies to disclose information to consumers who request it about what is in their credit reports. If the creditor did, in fact, fail to document something correctly, they have no legal choice but to remove that negative item from your credit report. The best way to handle this credit scoring dilemma is to contact the collection agency and explain that you are willing to pay off the collection account under the condition request a letter from the collector that explicitly states their agreement to delete the account upon receipt/clearance of your payment. Here's the truth about a 609 letter: The following are examples of letters you can send to credit reporting agencies and bureaus to dispute any negative items or debt on your reports. And that credit repair loophole is called the 609 dispute letter. A 609 dispute letter claims to be a credit repair secret that you can purchase. Once the credit reporting agency receives your section 609 letter, it will either respond by sending you the contract with your signature on it that supports once the credit repair agency gathers all the relevant information from you, it will take over the verification requests and dispute process, including. Attorney credit repair dispute letter templates. All of them reference section 609 of the fcra, but they can all be tailored to fit your unique situation.

The Section 609 Credit Dispute Do It Yourself Letter Package Pdf Free Download : Dont Let The Simplicity Of This Letter Fool You.

The Section 609 Credit Repair Solution How To Remove All Negative Items From Your Credit Report Fast Cunningham Pat 9781520950761 Amazon Com Books. The federal law loophole that removes all negative accounts every time! The easy 609 credit repair secret: If the creditor did, in fact, fail to document something correctly, they have no legal choice but to remove that negative item from your credit report. Templates for 609 letters can be found on the internet—often for a fee—but there is no need to spend money on such a product. The following are examples of letters you can send to credit reporting agencies and bureaus to dispute any negative items or debt on your reports. A 609 dispute letter claims to be a credit repair secret that you can purchase. Once the credit reporting agency receives your section 609 letter, it will either respond by sending you the contract with your signature on it that supports once the credit repair agency gathers all the relevant information from you, it will take over the verification requests and dispute process, including. Attorney credit repair dispute letter templates. A 609 dispute letter is often billed as a credit repair secret or legal loophole that forces the credit reporting agencies to remove certain negative information from your credit reports. And that credit repair loophole is called the 609 dispute letter. The best way to handle this credit scoring dilemma is to contact the collection agency and explain that you are willing to pay off the collection account under the condition request a letter from the collector that explicitly states their agreement to delete the account upon receipt/clearance of your payment. Section 609 of the fair credit reporting act requires credit reporting agencies to disclose information to consumers who request it about what is in their credit reports. All of them reference section 609 of the fcra, but they can all be tailored to fit your unique situation. Here's the truth about a 609 letter: They absolutely do work in many cases.