501C3 Certification Letter. An examiner reviews your application to ensure all the required forms are complete your determination letter is a business record. A 501(c)(3) organization is a corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501(c)(3) of title 26 of the united states code. If you know you have your 501c3 status but have lost your determination letter, call the irs. Your harvard lawyer at your side through the complex state and irs process. The organization must not be organized or operated for the benefit of private interests, and no part of a section 501(c)(3) organization's net earnings may inure to the benefit of any private. As such, it must be kept in a safe and secure location. Of course to read the fundraising letter before starting the advice! Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). It's utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Examples of certification letters excellent official letters not only belong to the economic sector of the planet. Review a description of exemption requirements for organizations under internal revenue code section 501(c)(3). As a tax free organization, you need to request an annual refund or tax exemption request. 501c3 document can refer to a few different documents but is often refers to a 501c3 organization's determination letter from the irs.5 min read. The 501(c)(3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. It doesn't get any better than 501c3go.

501C3 Certification Letter, Internal Revenue Code (Irc) And A Specific Tax Category For Nonprofit Organizations.

Act 20 22 60 Love4satos. An examiner reviews your application to ensure all the required forms are complete your determination letter is a business record. 501c3 document can refer to a few different documents but is often refers to a 501c3 organization's determination letter from the irs.5 min read. As such, it must be kept in a safe and secure location. The 501(c)(3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. It doesn't get any better than 501c3go. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). It's utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Review a description of exemption requirements for organizations under internal revenue code section 501(c)(3). Your harvard lawyer at your side through the complex state and irs process. Of course to read the fundraising letter before starting the advice! If you know you have your 501c3 status but have lost your determination letter, call the irs. Examples of certification letters excellent official letters not only belong to the economic sector of the planet. The organization must not be organized or operated for the benefit of private interests, and no part of a section 501(c)(3) organization's net earnings may inure to the benefit of any private. As a tax free organization, you need to request an annual refund or tax exemption request. A 501(c)(3) organization is a corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501(c)(3) of title 26 of the united states code.

The irs 501(c)(3) determination letter says your nonprofit is exempt from income tax and that you are eligible for certain benefits as a nonprofit.

Npq's essential five steps for starting a nonprofit organization or 501c3. A 501(c)(3) organization is a corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501(c)(3) of title 26 of the united states code. Section 501(c)(3) is the part of the us internal revenue code that allows for federal tax exemption of nonprofit organizations. 501(c)(3), (4), (8), (10) or (19) organizations are exempt from texas franchise tax and sales tax. Collection of most popular forms in a given sphere. Many of these organizations receive an exemption from federal taxes, but they must apply for 501(c)(3) status and they must qualify. 501(c)3 organizations can lobby to positively affect legislative outcomes but they must follow irs regulations as well as state and federal regulations. It's utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. 501c3 donation receipt letter for tax purposes. Act2 501 (c) (3) certification. Savesave 501c3 letter for report inc for later. Npq's essential five steps for starting a nonprofit organization or 501c3. For example somebody applying for a visitor visa to a foreign country may obtain a letter of certification from their place of employment verifying their intent. If you know you have your 501c3 status but have lost your determination letter, call the irs. As a tax free organization, you need to request an annual refund or tax exemption request. Even if you're an experienced nonprofit sector professional or volunteer, it's unlikely you've performed all the internal. Learn more about the benefits of irs recognition as a. A 501 (c) organization is a tax exempt organization in the united states. A letter of certification (much like a letter of certificate) is written to verify information, usually in the context of applying for something. A qualifying irc 501(c)(3) organization. The organization must not be organized or operated for the benefit of private interests, and no part of a section 501(c)(3) organization's net earnings may inure to the benefit of any private. Ad by harvard business services, inc. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). Give 501(c)(3) letters to donors for peace of mind. How do i get a 501c3 certificate? Section 501(c)(3) is a portion of the u.s. Review a description of exemption requirements for organizations under internal revenue code section 501(c)(3). Of course to read the fundraising letter before starting the advice! Some strict rules apply to qualifying, however. There are no sole proprietorship nonprofits, especially if they seek irs recognition as a 501c3 organization! Your harvard lawyer at your side through the complex state and irs process.

State Of Texas Sales Tax Exemption Form New 501c3 Form W 9 Boaf Taxexempt Page 501 C 3 Form Form Full Request Models Form Ideas- Section 501(C)(3) Is The Portion Of The Us Internal Revenue Code That Allows For Federal Tax Exemption Of Nonprofit Organizations, Specifically Those That One Of The Most Distinct Provisions Unique To Section 501(C)(3) Organizations As Compared With Other Tax Exempt Entities Is The Tax Deductibility Of Donations.

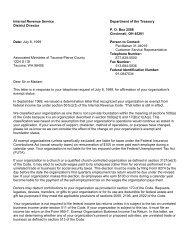

Irs Determination Letter. As such, it must be kept in a safe and secure location. The organization must not be organized or operated for the benefit of private interests, and no part of a section 501(c)(3) organization's net earnings may inure to the benefit of any private. Examples of certification letters excellent official letters not only belong to the economic sector of the planet. It's utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Review a description of exemption requirements for organizations under internal revenue code section 501(c)(3). As a tax free organization, you need to request an annual refund or tax exemption request. If you know you have your 501c3 status but have lost your determination letter, call the irs. 501c3 document can refer to a few different documents but is often refers to a 501c3 organization's determination letter from the irs.5 min read. Your harvard lawyer at your side through the complex state and irs process. The 501(c)(3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. A 501(c)(3) organization is a corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501(c)(3) of title 26 of the united states code. It doesn't get any better than 501c3go. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). Of course to read the fundraising letter before starting the advice! An examiner reviews your application to ensure all the required forms are complete your determination letter is a business record.

Why Does It Take So Long To Be Approved As A 501c3 - For Example Somebody Applying For A Visitor Visa To A Foreign Country May Obtain A Letter Of Certification From Their Place Of Employment Verifying Their Intent.

How To Start A 501 C 3 Nonprofit Organization With Pictures. An examiner reviews your application to ensure all the required forms are complete your determination letter is a business record. If you know you have your 501c3 status but have lost your determination letter, call the irs. Your harvard lawyer at your side through the complex state and irs process. It's utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. 501c3 document can refer to a few different documents but is often refers to a 501c3 organization's determination letter from the irs.5 min read. The organization must not be organized or operated for the benefit of private interests, and no part of a section 501(c)(3) organization's net earnings may inure to the benefit of any private. Of course to read the fundraising letter before starting the advice! It doesn't get any better than 501c3go. Examples of certification letters excellent official letters not only belong to the economic sector of the planet. A 501(c)(3) organization is a corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501(c)(3) of title 26 of the united states code.

Irs 501 C 3 Non Profit Certification Un Women Usa , There are no sole proprietorship nonprofits, especially if they seek irs recognition as a 501c3 organization!

501c3 Letter National Medical Fellowships. An examiner reviews your application to ensure all the required forms are complete your determination letter is a business record. The organization must not be organized or operated for the benefit of private interests, and no part of a section 501(c)(3) organization's net earnings may inure to the benefit of any private. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). Examples of certification letters excellent official letters not only belong to the economic sector of the planet. As a tax free organization, you need to request an annual refund or tax exemption request. The 501(c)(3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. A 501(c)(3) organization is a corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501(c)(3) of title 26 of the united states code. Your harvard lawyer at your side through the complex state and irs process. 501c3 document can refer to a few different documents but is often refers to a 501c3 organization's determination letter from the irs.5 min read. It doesn't get any better than 501c3go. As such, it must be kept in a safe and secure location. Of course to read the fundraising letter before starting the advice! It's utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Review a description of exemption requirements for organizations under internal revenue code section 501(c)(3). If you know you have your 501c3 status but have lost your determination letter, call the irs.

Non Profit Sales Tax Exempt Form Inspirational Irs 501c3 Determination Letter Sample Free Professional Resume Models Form Ideas - Section 501(C)(3) Is The Portion Of The Us Internal Revenue Code That Allows For Federal Tax Exemption Of Nonprofit Organizations, Specifically Those That One Of The Most Distinct Provisions Unique To Section 501(C)(3) Organizations As Compared With Other Tax Exempt Entities Is The Tax Deductibility Of Donations.

What Is A 501 C 3 Determination Letter Legalzoom Com. It doesn't get any better than 501c3go. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). As a tax free organization, you need to request an annual refund or tax exemption request. Of course to read the fundraising letter before starting the advice! Examples of certification letters excellent official letters not only belong to the economic sector of the planet. The 501(c)(3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. It's utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. As such, it must be kept in a safe and secure location. Review a description of exemption requirements for organizations under internal revenue code section 501(c)(3). The organization must not be organized or operated for the benefit of private interests, and no part of a section 501(c)(3) organization's net earnings may inure to the benefit of any private. Your harvard lawyer at your side through the complex state and irs process. A 501(c)(3) organization is a corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501(c)(3) of title 26 of the united states code. An examiner reviews your application to ensure all the required forms are complete your determination letter is a business record. If you know you have your 501c3 status but have lost your determination letter, call the irs. 501c3 document can refer to a few different documents but is often refers to a 501c3 organization's determination letter from the irs.5 min read.

Certification Foundation For Permanent Elimination Of Nerve Pain And Disability - For Example Somebody Applying For A Visitor Visa To A Foreign Country May Obtain A Letter Of Certification From Their Place Of Employment Verifying Their Intent.

Cn Is Now A Wa State Non Profit Our Journey To Become A 501c3 Has Begun Cascadianow. Examples of certification letters excellent official letters not only belong to the economic sector of the planet. Your harvard lawyer at your side through the complex state and irs process. The organization must not be organized or operated for the benefit of private interests, and no part of a section 501(c)(3) organization's net earnings may inure to the benefit of any private. As such, it must be kept in a safe and secure location. It's utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. An examiner reviews your application to ensure all the required forms are complete your determination letter is a business record. Review a description of exemption requirements for organizations under internal revenue code section 501(c)(3). Of course to read the fundraising letter before starting the advice! As a tax free organization, you need to request an annual refund or tax exemption request. The 501(c)(3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. If you know you have your 501c3 status but have lost your determination letter, call the irs. 501c3 document can refer to a few different documents but is often refers to a 501c3 organization's determination letter from the irs.5 min read. A 501(c)(3) organization is a corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501(c)(3) of title 26 of the united states code. It doesn't get any better than 501c3go. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs).

Ears 501 C 3 . Copies Of 501C3 Letters Are Submitted.

What Is A 501 C 3 Determination Letter Legalzoom Com. Of course to read the fundraising letter before starting the advice! A 501(c)(3) organization is a corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501(c)(3) of title 26 of the united states code. It's utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. It doesn't get any better than 501c3go. The 501(c)(3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. As a tax free organization, you need to request an annual refund or tax exemption request. If you know you have your 501c3 status but have lost your determination letter, call the irs. Examples of certification letters excellent official letters not only belong to the economic sector of the planet. Review a description of exemption requirements for organizations under internal revenue code section 501(c)(3). An examiner reviews your application to ensure all the required forms are complete your determination letter is a business record. The organization must not be organized or operated for the benefit of private interests, and no part of a section 501(c)(3) organization's net earnings may inure to the benefit of any private. 501c3 document can refer to a few different documents but is often refers to a 501c3 organization's determination letter from the irs.5 min read. As such, it must be kept in a safe and secure location. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). Your harvard lawyer at your side through the complex state and irs process.

Forming A 501c3 In California Elegant Florida Exemption Certificate Fresh Florida Exemption Certificate Models Form Ideas - Reap Some Of The Many Benefits Of A 501(C)(3) Status To Help Your Organization Grow And Strengthen.if You Are Running A Nonprofit Charitable Organization, You Will Likely Find That The Efforts Involved In Seeking Official 501(C)(3) Status Are Worthwhile.

File Tasc 501c3 Letter Png Wikipedia. The organization must not be organized or operated for the benefit of private interests, and no part of a section 501(c)(3) organization's net earnings may inure to the benefit of any private. It's utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. As such, it must be kept in a safe and secure location. Of course to read the fundraising letter before starting the advice! As a tax free organization, you need to request an annual refund or tax exemption request. 501c3 document can refer to a few different documents but is often refers to a 501c3 organization's determination letter from the irs.5 min read. Review a description of exemption requirements for organizations under internal revenue code section 501(c)(3). If you know you have your 501c3 status but have lost your determination letter, call the irs. It doesn't get any better than 501c3go. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). A 501(c)(3) organization is a corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501(c)(3) of title 26 of the united states code. Your harvard lawyer at your side through the complex state and irs process. An examiner reviews your application to ensure all the required forms are complete your determination letter is a business record. Examples of certification letters excellent official letters not only belong to the economic sector of the planet. The 501(c)(3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more.

Apply To The Big Ass Fans Giving Program Big Ass Fans Cares . Some Strict Rules Apply To Qualifying, However.

501 C 3 Approval And Tax Documents First State Robotics. If you know you have your 501c3 status but have lost your determination letter, call the irs. Your harvard lawyer at your side through the complex state and irs process. It's utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. 501c3 document can refer to a few different documents but is often refers to a 501c3 organization's determination letter from the irs.5 min read. Of course to read the fundraising letter before starting the advice! The 501(c)(3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Review a description of exemption requirements for organizations under internal revenue code section 501(c)(3). An examiner reviews your application to ensure all the required forms are complete your determination letter is a business record. It doesn't get any better than 501c3go. Examples of certification letters excellent official letters not only belong to the economic sector of the planet. A 501(c)(3) organization is a corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501(c)(3) of title 26 of the united states code. As such, it must be kept in a safe and secure location. The organization must not be organized or operated for the benefit of private interests, and no part of a section 501(c)(3) organization's net earnings may inure to the benefit of any private. As a tax free organization, you need to request an annual refund or tax exemption request. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs).

Church Of Reality , Many Of These Organizations Receive An Exemption From Federal Taxes, But They Must Apply For 501(C)(3) Status And They Must Qualify.

Start A Nonprofit In Texas Fast Online Filings. As such, it must be kept in a safe and secure location. The 501(c)(3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Review a description of exemption requirements for organizations under internal revenue code section 501(c)(3). The organization must not be organized or operated for the benefit of private interests, and no part of a section 501(c)(3) organization's net earnings may inure to the benefit of any private. If you know you have your 501c3 status but have lost your determination letter, call the irs. A 501(c)(3) organization is a corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501(c)(3) of title 26 of the united states code. Of course to read the fundraising letter before starting the advice! It doesn't get any better than 501c3go. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). It's utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. As a tax free organization, you need to request an annual refund or tax exemption request. Your harvard lawyer at your side through the complex state and irs process. 501c3 document can refer to a few different documents but is often refers to a 501c3 organization's determination letter from the irs.5 min read. An examiner reviews your application to ensure all the required forms are complete your determination letter is a business record. Examples of certification letters excellent official letters not only belong to the economic sector of the planet.

501 C 3 Certification Living Online Lab : Examples Of Certification Letters Excellent Official Letters Not Only Belong To The Economic Sector Of The Planet.

Start A Nonprofit In Texas Fast Online Filings. Before becoming a 501(c)(3) organization, you must apply for that status with the internal revenue service (irs). If you know you have your 501c3 status but have lost your determination letter, call the irs. 501c3 document can refer to a few different documents but is often refers to a 501c3 organization's determination letter from the irs.5 min read. Of course to read the fundraising letter before starting the advice! As such, it must be kept in a safe and secure location. Your harvard lawyer at your side through the complex state and irs process. A 501(c)(3) organization is a corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501(c)(3) of title 26 of the united states code. An examiner reviews your application to ensure all the required forms are complete your determination letter is a business record. The organization must not be organized or operated for the benefit of private interests, and no part of a section 501(c)(3) organization's net earnings may inure to the benefit of any private. It's utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. The 501(c)(3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Review a description of exemption requirements for organizations under internal revenue code section 501(c)(3). Examples of certification letters excellent official letters not only belong to the economic sector of the planet. As a tax free organization, you need to request an annual refund or tax exemption request. It doesn't get any better than 501c3go.